Investment Opportunities in the Technology Sector Westwood Holdings Group

Post on: 1 Август, 2015 No Comment

Investment Opportunities in the Technology Sector

As fundamental investors, Westwood is always looking to identify sustainable industry trends that lead to high levels of revenue and earnings visibility. When we identify such trends, we evaluate the firms that are best positioned to benefit from them, and then conduct additional analysis on those with the strongest fundamental characteristics—the goal being to identify suitable companies for potential inclusion in our portfolio. Such companies generally exhibit powerful free cash flow generation, high returns on capital, and strong balance sheets.

This investment approach works particularly well in sectors where the dynamics are rapidly evolving and new players can gain market share without gaining broad recognition by the investment community. We believe the Technology sector meets this criterion today.

Two Attractive Technology Trends

While there are a number of trends that may drive future earnings in the Technology sector, we believe two of the most attractive are Mobility and the Internet of Things (IoT) . Both established, legacy technology companies as well as smaller, lesser-known firms are benefiting from these trends.

TREND 1: Mobility

Smartphone Growth Off the Hook: Steve Jobs changed the technology landscape significantly when he introduced Apple’s iPhone in 2007 and brought exceptional ease of use and functionality to the cell phone. Today, the trend continues with the increasing use of smartphones and tablets. As businesses expand globally, international travel grows, and employees seek more flexible working conditions, the demand for mobile technology applications will continue to expand. Smartphones have been growing rapidly since 2007 and accounted for 54% of all handsets shipped in 2013, up from 39% in 2012. We believe this growth will continue.

Emerging Markets will Push Future Growth: Over the next few years, the emerging markets are expected to play a larger role in the growth of smartphones and tablets, as evident in the projections in Figure 1. For instance, in China, close to half of all cellphones still employ very basic technology, e.g. 2 nd generation wireless technology, whereas many U.S. users are now on 4 th generation technology. As the Chinese consumer upgrades to more advanced smartphones with faster wireless standards such as 4G LTE, there is expected to be a large market opportunity for manufacturers of wireless semiconductor chips. Wireless standards such as 4G use a greater amount of semiconductor content versus less complex standards such as 2G. The shift to 4G standards, therefore, will allow radio-frequency semiconductor chip companies to benefit from a multi-year “content-increase” trend.

Figure 1: Smartphone Production Forecast

Source: Gartner, Inc. (April 2014)

Moving into the Fast Lane: Another exciting opportunity for greater mobile applications involves the greater functionality of technology in the automobile. For years, the automobile was relatively unchanged in terms of electronic content—but with the increasing demand for features such as navigation and cruise control, and even newer features such as adaptive cruise control and Wifi, the landscape is changing. We believe this rising demand should increase the average amount consumers spend on vehicle technology for the next three to five years. If this is the case, the potential growth within the technology sector may provide a significant opportunity for investors.

TREND 2: Internet of Things

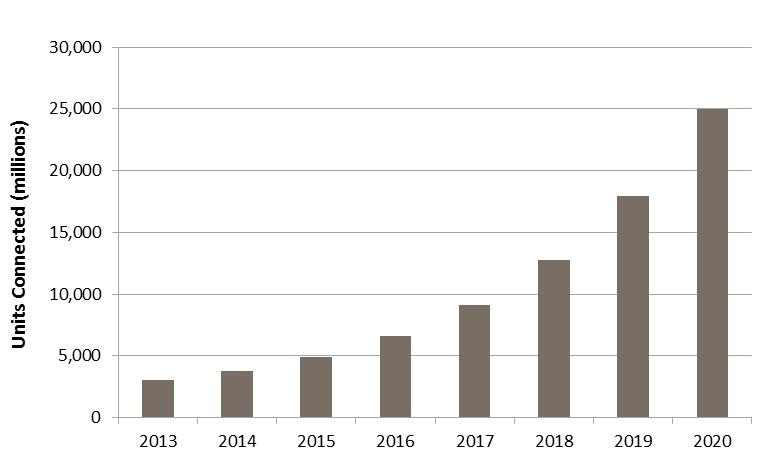

A Proliferation of Connected Devices: Another technology trend that is sparking a lot of interest, and for good reason, is the proliferation of connected devices in our everyday surroundings. This trend is often referred to as IoT, and it denotes the growth in devices that are connected and controlled via the Internet, e.g. thermostats, home security systems, and home entertainment systems. Smartphones are the key to the acceleration in the penetration of these devices, as smartphone owners now have a portable hub to aggregate and interact with the connected devices around them. As more appliances are combined onto a central platform, the number of connected devices is expected to rise at an expedient rate to meet the growing demand from consumers, as shown in Figure 2.

Figure 2: Internet of Things

Source: Gartner, Inc.

Innovation Behind the Wheel: The automobile industry is expected to be the fastest growing category within the IoT trend. The number of connected devices in cars on the roads today is still in its infancy. However, high-end car manufacturers are rapidly increasing the number of devices capable of communicating with the outside world on newer vehicle platforms. For example, data that can be collected from optical and gyroscopic sensors installed in cars are facilitating many of the newest features such as tire pressure sensors and accident avoidance systems.

Home gets Connected Too: While the automotive segment is expected to grow the fastest, more than half of the installed base of internet-connected devices is projected to be household and consumer products. At home, many of the chores that were once done manually will be automated for added convenience and/or energy savings. Automated thermostats and lights, home surveillance systems, and robotic vacuums are just a few of the many connected devices that will populate the modern home. For wearable devices, adoption of technology has been driven by the health and fitness segment. This will continue going forward as the value proposition to consumers of wearing a device becomes greater as functionality, user interaction, and style increase.

Which Companies will Benefit from these Trends?

The types of companies that we expect to benefit from the growth in Mobility and IoT demand include:

- Handset makers,

- Specialty semiconductor firms,

- Device manufacturers, and

- Certain telecom equipment companies

Because these types of firms generally have cyclical revenue streams, it is important to identify those companies that don’t have a high degree of leverage, either financial or operating, as well as those with a Research and Development (R&D) edge. Moreover, a thorough understanding of capital expenditures and primary end markets is necessary to ascertain the reliability of revenue projections. Lastly, it is also important to understand the potential for increased application. For example, semiconductor dollar content is increasing in handsets from under US$1 for 2G devices to US$12-US$14 for premium LTE devices.

Making the Most of the Trends

The Technology sector has spawned many winners and losers and tends to evoke a lot of emotion from investors given the growth potential that many tech companies seem to possess. As a result, prudent fundamental analysis becomes even more critical, as the “consensus” expectations for companies can be significantly misguided. At Westwood, our fundamental research, and long-term track record demonstrate our competency in this discipline. As a result, we believe the Technology sector represents an attractive area of investment for a firm with our expertise.

Thank you for your confidence in Westwood. Please call us if you have any questions or would like to discuss our thoughts on the Technology industry.

The information contained herein represents the views of Westwood Management Corp. at a specific point in time and is based on information believed to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Any statement non-factual in nature constitutes only current opinion which is subject to change. These materials are provided for informational purposes only.