Investment Diversification – What Why and How

Post on: 8 Июнь, 2015 No Comment

By +Peter Mindenhall — Tuesday 01 June 2010

What is investment diversification?

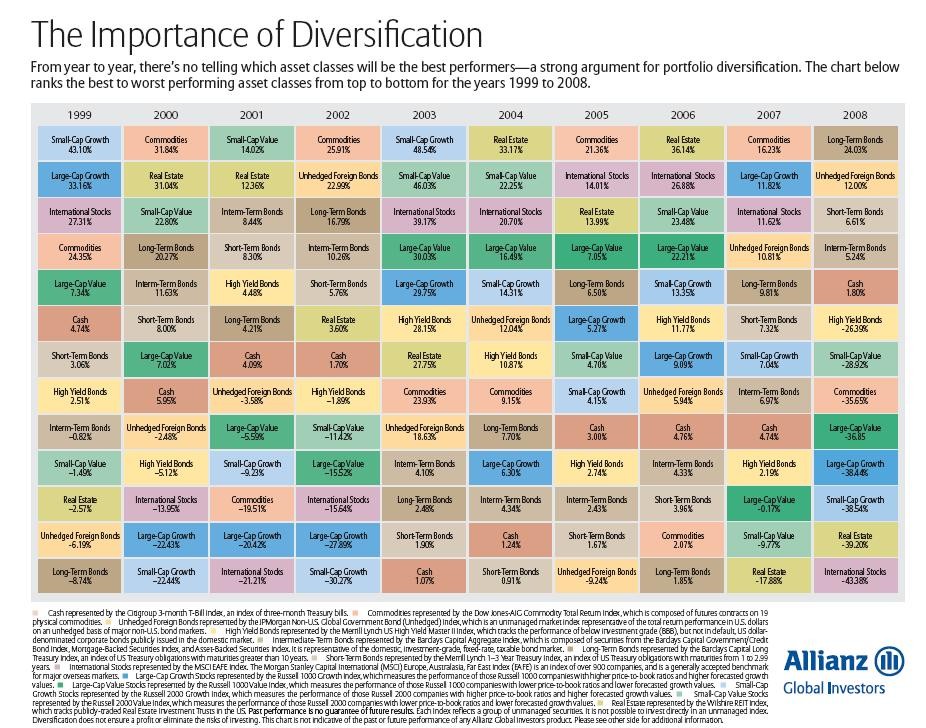

Diversification is a relatively simple concept, it means spreading your capital across different investment vehicles, and not placing all your capital solely in one place.

Why diversify?

The point of diversification is to primarily spread risk. By spreading risk across different investment tools, you reduce the chances of your entire investment capital being wiped out in a sudden market movement in the sector that you happen to be invested in. The phrase Diversification is the key to protection does a pretty good job of summing it up.

Types of diversification

Diversification can be done at numerous levels across virtually all investment platforms. For example; If you were a heavy investor in the gold markets, then by owning physical gold, owning shares in mining companies, as well as gold trading companies, you would be diversified quite well within the sector. (You could also go even further by taking both long and short positions on gold in the markets as well)

You could then of course diversify across a range of different investment platforms. For example; Take positions on a few currencies, owning Government Bonds, having cash in the bank, owning physical gold, owning a couple of Buy to Let properties and investing in some shares.

Of course, depending on your investment capital, there is virtually no end of opportunity to diversify if you take into account all of the investment vehicles available.

Diversification within an investment property portfolio.

There are several ways a property portfolio can be diversified, both within a given sector of the investment property industry, and across the sector itself.

Property sector diversification — Commercial, Residential, Industrial

Geographical diversification — Spread your risks over different economies or different geographical locations. Emerging markets can be advantageous to invest in because the property prices are expected to rise over the period of investment and emerging markets can provide huge capital gains. Established property markets provide more sense of stability, with respect to economic factors such as inflation, and from a paperwork point of view such as ownership laws.

Direct property investment and indirect property investment — REIT’s, PIF’s and PIN’s (Real Estate Investment Trusts, Property Investment Funds and Property Investment Notes — All of which are indirect property investments ) and actual property ownership, such as Buy to Let (typical direct ownership), or car parks and marinas (alternative direct property investments)

Why?

The main reason to diversify a portfolio is to reduce risk, or to hedge If done well it creates more consistency and improves overall portfolio performance.

If one part of the investment sector has poor performance and another is performing well and your portfolio contains both you are going to achieve a better result than if the portfolio just contained the poor performing asset. (Conversely though, it could be said that one would do all the better if it happened that you only held investments in the positively performing sector)

In essence it all boils down to investor protection and knowledge. By diversifying, you allow (to a degree) a margin of error within your investment decisions by covering as many angles as you can.

Do I need to diversify?

If possible, it is recommended on the whole. Unless you are very knowledgeable within a given sector, (and it should still be considered even if you are) diversification should at least be given serious consideration. However, there are limits. If you have a sizeable net worth and substantial funds for investment, diversifying will be easier in a high cost per unit sector. (For example; If you have 100,000 at your disposal to invest, it would not allow you to buy very many properties outright, however, it would allow you to buy some respectable positions across a variety of REIT’s.)

In general, larger portfolios should be diversified; smaller portfolios can be a little more difficult, or at least restrictive, but diversification within them where possible should be considered.

How?

For example; If an investor had liquid capital of $750,000.

He has several choices with what to do it, for this example we’ll show two theoretical examples, one showing a diversified property portfolio and one not: