Investing With Purpose And For Profit Affordable Housing

Post on: 14 Апрель, 2015 No Comment

Successful real estate investors are more than just landlords, they are savvy business executives. They operate much like portfolio managers and business managers who focus on maximizing profits while creating value for clients. This article discusses affordable housing investment as a business and investment strategy. We start with a definition of affordable housing and look at three groups that represent the best target market. Next, we discuss affordability which is the defining characteristic of the target market. Then we turn to profitability and marketability, issues that make a good investment great. Finally we look at financing, action steps, and wider business and social implications of affordable housing investment.

Investment Options

Seniors and People with Disabilities

Student Off-Campus Housing

Affordability is important to investors because it determines two important things: profitability and marketability. Subsidized housing programs like Section 8 helps lower income families afford rent by paying a portion of the market price for rental units. Determine the median income for your area. There are several sources of information to determine median income. The U.S. Census Bureau compiles average incomes for states, counties, and cities. Real estate websites also provide this information for people interested in buying homes in particular regions Information is also available through state and local governments, economic development agencies and housing authorities.

- For affordable rent calculate 30% of median income. This is your expected gross income per affordable rental unit.

- For affordable homeownership calculate 35% of median income for principle, interest, property tax. homeowner insurance, and association fees. Then calculate your expected sale price by deducting the amount for tax, insurance and fees based on going rates for the area. Use the difference, principle and interest, to determine the purchase price based on going interest rates for your area. A banking or mortgage professional can help you quickly determine these amounts.

How to Determine Profitability

Start by determining your operating expenses. For rental units start with taxes and insurance you pay as owner. Do you pay the utilities, if so which ones? Calculate the cost for building and grounds maintenance for multiple unit buildings. Don’t forget transfer costs such as inspection, occupancy certification, registration, and other fees required by your county or municipality.

For sale units, determine your financing costs, closing costs at acquisition and at the time of sale, material and labor costs for construction/rehabilitation and transfer costs. For both determine your marketing and advertising costs. The greatest project will flop if you cannot attract renters or buyers in a timely manner. Even a simple, effective advertising strategy will cost both money and time. Consider these costs of doing business that affect your bottom line.

Next, determine your income. For rental units use the amount of expected gross income per affordable unit. For sale units use the purchase price determined above. Use the standard formula: Income – Expenses = Gross Profit.

Consider your cash flow. If you pay utilities, some programs allow additional amounts to be paid by the subsidizing authority to cover a portion of tenant utilities. Finally, look at your income tax situation. Depreciation will affect your tax liability and will have varying affects on the actual cash flow or real net profit.

How to Ensure Marketability

Focus on locating and modifying units that meet guidelines for rental subsidies which are available through local housing authorities. For sellers focus minimizing construction and rehabilitation costs on units to be sold at market. (Investing in big buildings means big money — and bigger risks. For further reading, refer to Find Fortune In Commercial Real Estate .)

- Start with simple logic. If it is not profitable, it is not marketable. The reverse is also true.

- Take advantage of foreclosed homes. There are many single and 2 to 4 family homes and that have been abandoned due to foreclosures.

- Contact local economic development agencies who acquire these units below market costs and sell to or contract with local developers to rehabilitate and resell. Also, learn the ins and outs of Sherriff’s sales in your area. Check the guidelines for each county you will target as guidelines may differ among counties in the same region or state. These units are often purchased site unseen and may represent significant rehabilitation costs and turnaround time to resell.

- Work with a realtor and learn about the local for sale by owner (FSBO) market. Here you will find opportunities for short sales where the seller or selling agent has made arrangements for a reduced mortgage payoff to facilitate a reduced price for quick sale. These units may be the least expensive to fix up and resell.

Successful investors know when and how to move in the market. Don’t forget to perform ongoing buy-sell-hold analysis on rental units. If labor, material, and financing costs are high, now may not be the time to buy more properties. If there are more renters in your market, now may not be a profitable time to market units for sale even if interest rates are low. If market rent and median income in your area is high, now may be the most profitable time to retain property for the monthly rental income it can generate. Treat your real estate portfolio just like your retirement portfolio with a little more paint and fixtures. (For savvy real estate investors, times of lower prices reveal investment opportunity. For more information, see 7 Steps To A Hot Commercial Real Estate Deal .)

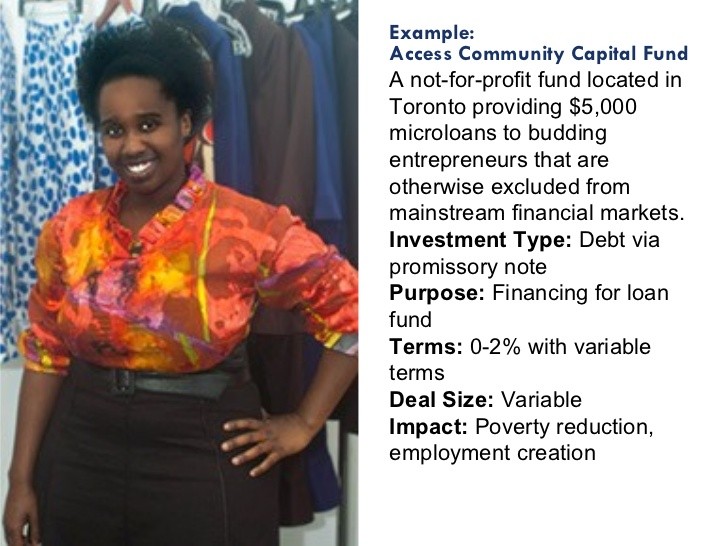

Financing

Research the various financing alternatives available to investors. Read websites for Fannie Mae, Freddie Mac, and HUD Multifamily Financing. Work with a local banker and a commercial mortgage broker or consultant to identify lender programs and find private investors. Join local homebuilder, remodeling, and real estate investor associations. Become a member of the chamber of commerce and affiliate with economic development agencies. Use these relationships to identify public and private financing and operating partnerships.

- Be informed. Learn about affordable housing across the country and in your area.

- Be involved. Make a market for affordable housing. Identify a niche in your area and fill it. Forge partnerships with likeminded investors and financing sources.

- Be a profitable investor. Function as both portfolio manager and business manager. Apply conventional investment wisdom and business strategy advice.

Beyond Landlording

Don’t just be landlords. Be a landlord, an investor and a business executive. As a landlord, incorporate the human element. Remember that you can create a market by helping families and your community. As an investor, create a blue-chip portfolio of real estate. Have the best properties, in the most desired areas, at the best prices, that turn the most profit. As a business executive, create a brand, generate goodwill and maximize the market value of your brand not just on individual units. Remember that your activities also create jobs and employment opportunities for construction workers and real estate sales agents. Your marketing and property managing activities help to attract workers to the labor force in the areas where you units are located. Not only can you create personal profits, but you can also create economic opportunities for people and communities through affordable housing investment. (Owning property isn’t always easy, but there are plenty of perks. Find out how to buy in. Read Simple Ways To Invest In Real Estate .)