Investing Wisely Aerospace and Defense (AXE) ETF Forecasts

Post on: 18 Июль, 2015 No Comment

It is Really Quite Simple — F (plus) C (equals) R!

It begins with Accurate Forecasting and Analytic Procedures that produce consistent profits, then it requires Well Honed Fundamental, Technical and Consensus Opinion — Confirmations. and it nearly always ends with Profitable — Results. (F + C = R ! )

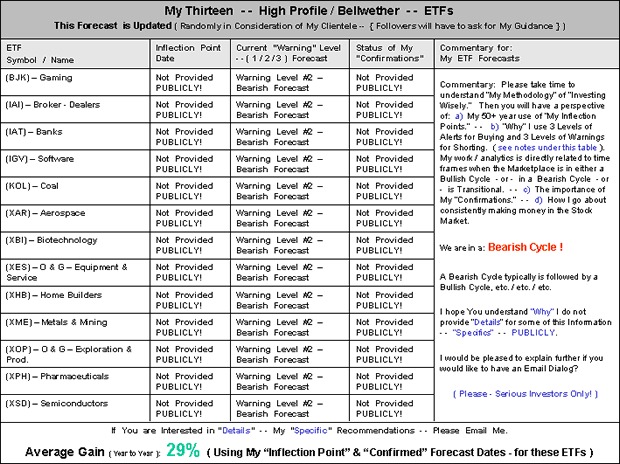

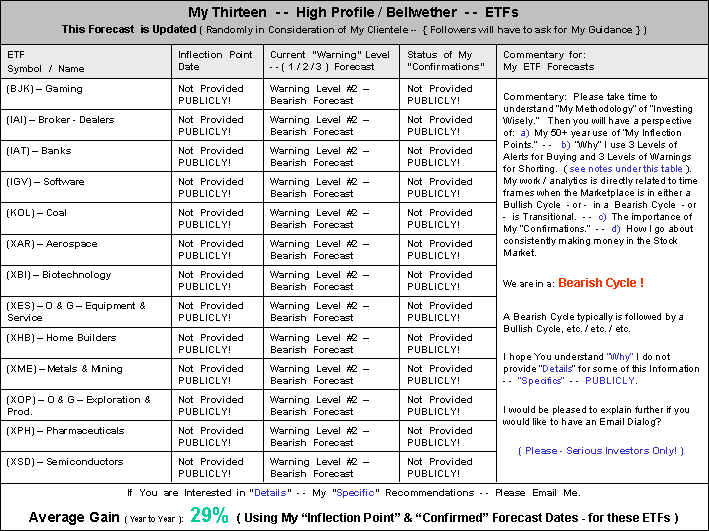

My most recent series of articles, posted here in SafeHaven.com are: BJK. IAI. IAT. IGV. KOL. XAR. XBI. XES. XHB. XME. XOP. XPH. and XSD. These are my High Profile / Bellwether ETFs that I primarily use in my work / analytics. (To view my 5-Year Charts of the above symbols — Click on the Symbol).

Analytics of a large number of Bellwether ETFs provides very clear Guidance when I go about selecting a Company or ETF to Buy or to Short. For me it is a special kind of Sector or Industry Groups that supposedly the Fund Manager believes his or her selection of Companies will out-perform the competition. There is also very good information available about the component Companies (Comparative Analytics) in the portfolio of the ETF. Sometimes there are advantages of Buying the (Regular) ETF if you are Bullish — or — perhaps Buying the (Inverse) ETF, when available, if you are Bearish. I spend a great deal of time studying many more ETFs than the above 13 that I write these articles about.

Note I — for the above ETFs: a) These are DEFINITELY NOT necessarily my current favorite ETFs to recommend for Buying or Shorting to my Clients! Most often there are other / alternate ETFs that have a much better — Risk to Reward Ratio and Profit Projection. b) These ETFs are all supposedly made up with the Component Companies from the Aerospace & Defense Industry Group. c) Remember, there are always the most favorable and least favorable Component Companies to consider on my Buying or Shorting Lists within a ETF or the entire Sector or Industry Group. d) To Plug Further Into my Work / Analytics — Please read or re-read My Rotation Model . It is all about identifying the most favorable Companies and ETFs to Buy and identifying the least favorable Companies and ETFs to Short during the respective Bullish Cycles and Bearish Cycles of the General Market and that particular Company or ETF. There are always the more favorable Companies as well as the least favorable Companies on my lists for Buying in Bullish Cycles and for Shorting in Bearish Cycles of the General Stock Market. e) You also might also want to read or re-read My Methodology . f) Risk and Reward Can Be Calculated. I do this work / analytics on every Company and ETF because it almost totally mitigates the Risk of Investing. You might want to read my views on Risk / Reward .

Professors, F + C = R — Forecast / Opinion of: Aerospace & Defense (XAR): (November 24th.)

My near-term (1 week — 1 month) — to — short-term (1month to 3 months) Forecast is that this Aerospace & Defense ETF has been in Ascending for well over a year. This fact coincides with my Fundamental — Valuation Analytics perfectly. However, it has been flat for the past several months and so have component Company Valuations. My Technical Indicators have been waining since February of this year. The foreseeable appreciation picture for this Aerospace & Defense ETF is not nearly as bright as most financial analysts are publishing. (When I read other financial analyst / blogger articles, which is seldom — many of these Guys / Gals seem to be using a Crystal Ball rather than old fashioned and basic Securities Analysis ).

After a probable Bounce / Mini-Rally I would expect (XAR ) and many Aerospace & Defense Companies to enter another and likely meaningful Pull-Back phase.

As for a meaningful Rally — it will require MUCH more TIME before this ETF will be in Bullish sync with the above Formula and My Methodology for Investing Wisely. This is yet another Warning!

At the current price of $61.50 it is getting ready for another Pull Back — again — after a probable bounce / mini-rally.

This is a Warning that will not be Confirmed other than privately via Email to Clients and select prospective Clients. I do not Publicly provide my Conformations for Bearish Warnings. If you are interested in my private Email recommendations, feel free to let me know. Serious Investors Only — Please.

Here is a list of many of the Component Companies for: SPDR — Aerospace & Defense (XAR): PCP,BEAV,COL,TGI,LLL,BA,HXL,HON,NOC,LMT,RTN,GD,UTX,TDG,TXT,ATK,DGI,SPR,ESL,TDY,EGL,GEOY,HII,HEI

Note II: I would like to reiterate that this list of Aerospace & Defense Companies has and always will have a Quantitative Ranking and Grade within My List of the most favorable and least favorable Companies from which to consider Investing Wisely. (see my Report Cards for how I Rank and Grade each and every Company that I do Analytics on). Second. the Risk and Reward of Investing Wisely can be Accurately Calculated for each Company. Your annual Bottom Line can be improved and your Risk of Investment can be lowered. Please consider reading my Article on Calculating / Measuring Risk vs. Reward . I hope you will permit me to help in that quest for profit.

My most current Report Card definitely does not present a Bullish foreseeable future. (see below).

May I suggest that it is most important for you to understand that my work / analytics is based on My Methodology that focuses on three key aspects of analytics. The first and primary is Fundamental — Valuation and the second is Inflection Point — Technical Analysis and lastly I also have a long look at Consensus Opinion. These are all weighted — Rankings relative to all my Bullish and Bearish Recommendations to my Clients.

stockcharts.com/h-sc/ui?s=$INDU&p=W&yr=1&mn=6&dy=0&id=p50720233760&a=270034212

This comparative General Market Indicator may be the best I have ever seen!

Note III: Buying Companies or ETFs that are not in sync with my fundamental valuations and technical price movement, for me, is just plain foolish as well as — often being expensive. You just might want to plug in to my work / analytics, just a bit more.

If you are interested in privately receiving my on going Forecasts for any of the above Symbols or perhaps your current holdings — just send me a request by Email. I will have a couple of questions for you but promise to reply with my best guidance.

Charts for Aerospace & Defense — ETF

My below two charts also tell the Technical story of the future direction of the Aerospace & Defense Industry Group very clearly.

Please understand that my Technical Analysis work is always supported by my Fundamental — Valuation of all the Industry Groups with-in my universe of (over 300 Industry Groups!).

This Aerospace & Defense is definitely not an ETF to Buy at this time. Over time in reading my articles and keeping track of their accuracy you will perhaps have a better understanding of my logo of — Investing Wisely.

Two-Year Chart: Aerospace & Defense ETF (XAR) with a Compare of the S&P (SPY)

(XAR) and (SPY) are nearly perfectly in sync! That’s Important.

Five-Year Chart: Aerospace & Defense ETF (XAR) with a Compare of the S&P (SPY)

Larger Image

You will quickly note that the — Green — Aerospace & Defense ETF (XAR) has over the longer-term been more recently — In Sync — but much more Volatile than the S&P — 500 (SPY). This is Part Of Investing Wisely.

Notes: A Forecast is just that, an opinion based on the fundamental — valuation, technical charts and consensus opinion this is on data as well as the information that is available at the time of publishing an article. It is the Confirmation of that Forecast that is most important! It provided Confirmed Timing and is very accurate.

The single factor that can upset and therefore delay a very good Forecast is the News. News however, is only a delay in the Bullish or Bearish direction of a given Forecast. That is why it is important to stay with the facts and real data and not be influenced by outside and temporal flows of media and other misguided information.

Each week I intend on featuring another of the above ETFs for your consideration. I am sorry that cannot possible keep a weekly update for you.

If you would like my most current thoughts on this or another company or ETF, please contact me by Email. (Serious investors only — Please!)

My Forecast Summary (for all the above) 13 Select ETFs

Larger Image

Notes for the above Table: Alerts / Warnings have three levels of strength: Level #1 is an initial Alert / Warning to be preparing to Buy or Sell that security. Level #2 is offering more guidance that my Alert / Warning is getting serious. Level #3 is when I have determined that I will use my specific Technical skills to determine — When — to terminate my positions in that security.

Important Caveat for — My Forecasts and Opinions:

Forecasts: I am currently Forecasting a pull back for this Aerospace & Defense ETF. I must use the following explanation to qualify the When the pull back will actually begin. It (the When of a Forecast of a pull back or a rally) is always dependent and pending on much more data from my Confirmations procedures). (please see below for my definition / explanation of Confirmations).

On any given date it is easy for me to accurately determine a short or long-term trend. It is not all that easy to Pin Point the When a new Bullish or Bearish Inflection Point will occur for an ETF or a specific Company.

Understand I write these articles several times per week for my financial blogs and other Advisory Consulting and Individual Clients. And, it is a fact that the combined Bullish and Bearish Inflection Points (historically) only occur 3 — 5 times per year. In other words there are specific time-zone / frames that investing is prudent. The rest of the time you should be Holding securities or in partial or total Cash .

Aerospace & Defense ETF is a near-perfect example: I am Forecasting yet another Bearish Inflection Point. It (Aerospace & Defense ) may have (that) Bearish Inflection Point in the next a number of days or the Bearish Inflection Point may not occur for several more week. I can Forecast, with high probability the Inflection Point is in the making, but I need my very reliable Confirmations to tell me When the next Bullish or Bearish Infection Point occurs for the General Market, Sector, Industry Group, Company or any ETF. You might what to test this remark in more detail with me?

I Email my Clients on the day my Confirmations have all kicked- in and make specific formal (low risk) security recommendations tailored to their financial (needs, goals and objectives). Remember — Those Events occurs just / only 3 — 5 times per year. Projected profits for all my recommendations are always a minimum of 15% per security per recommendation for Buying or Short Selling. During time frames when I am not Recommending or Holding securities, I recommend Cash. Patience and one-on one Communications with me.

I hope you will want to Email me with your questions and thoughts about this Caveat and my procedures for guidance in making both You an my Clients — consistent annual profits.

Confirmations — Defined: Confirmations occur When about a dozen of my special fundamental Valuation models and technical chart Configurations — kick-in.

Often the (waiting process) requires much Discipline and Patience for making Wise Investment decisions. I can easily anticipate a Confirmation kicking in. Unfortunately — It just does not often happen as expected!

That Advice, in a nut-shell, is the incredible value of my Confirmations. And is Why — I Love Confirmations.

Results (Profits): Consistent Profitable Results, like most important things in life, comes after doing hard and conscientious work / analytics for many years. I would add to that those years — experience certainly helps!

If you are seeking Consistent Annual Results (Profits) in your Portfolio(s) — You may want to Visit with me. There are No — Short-Cuts, Systems, or Gimmicks that do the job, despite what you Read in Blogs / Media and are Sold by Wall Street. Nothing will ever replace — Hard Work and Experience !

Report Card on Aerospace & Defense (XAR) — (November 24th.)