Investing Like Peter Lynch Strategies For Picking Stocks

Post on: 6 Июль, 2015 No Comment

by Guest Blogger on 2012-03-18 9

We often publish different investing philosophies espoused by guest writers. What follows is yet another argument for stock picking. This time, we bring to you a guest post by Joel Reese, from the stock investment site called WeSeed.com, where you can learn how the stock market works.

Several years ago, I had a little extra money in my pocket. I decided, “I think I should give this investing stuff a shot.” I did a little digging, then I got a can’t miss, sure thing, stone-cold-lock tip about a semiconductor company.

I blindly put an order in through my discount broker and bought into the stock at $48 per share. It went up to $60. Hey, I’m a genius! I thought. Then it dropped like a stone. It hasn’t broken $20 since.

Hey, I was young(ish) and foolish. Don’t do what I did.

That doesn’t mean you shouldn’t invest in individual stocks, even though a lot of people say you should stay far, far away. In his excellent book I Will Teach You to Be Rich. Ramit Sethi cites some imposing stats: Mutual fund managers beat the market a mere 25 percent of the time.

Sethi the man behind the must-read blog IWillTeachYouToBeRich.com insists that experts simply can’t guess which stocks will outperform the market. “If these experts who devour annual reports and understand complicated balance sheets can’t beat the market, what chance do you have of picking stocks that will go up?” He asks. “That’s why individual investors like you and me should not invest in individual stocks.”

But Sethi is buying into a fallacy about the market: that the guys in the mirror-glass buildings are the best ones to judge a stock. Yes, they have all the charts and balance sheets. Yes, they have the beautiful silk ties, impressive MBAs, and jaw-dropping salaries.

But there are some advantages to being a small investor: Peter Lynch notes in his epochal One Up on Wall Street that the best person to make a stock pick is… YOU. This is called the street lag theory.

“Under the current system, a stock isn’t truly attractive until a number of large institutions have recognized its suitability and an equal number of Wall Street analysts (the researchers who track the various industries and companies) have put it on the recommended list. With so many people waiting for others to make the first move, it’s amazing that anything gets bought.”

In other words, if you wait for a stock to make its way from Main Street to Wall Street, you’re already late to the party. If you make some good stock picks before Wall Street catches on, then you stand to make huge gains.

We’re not saying you should put all of your money in individual stocks: that would be fairly Evel Knievel-esque. You should start with index funds, but that’s another lesson entirely. Make sure youve got your basic portfolio down pat, then for the adventurous part of your portfolio, you can look into a little more stock picking if you are so inclined.

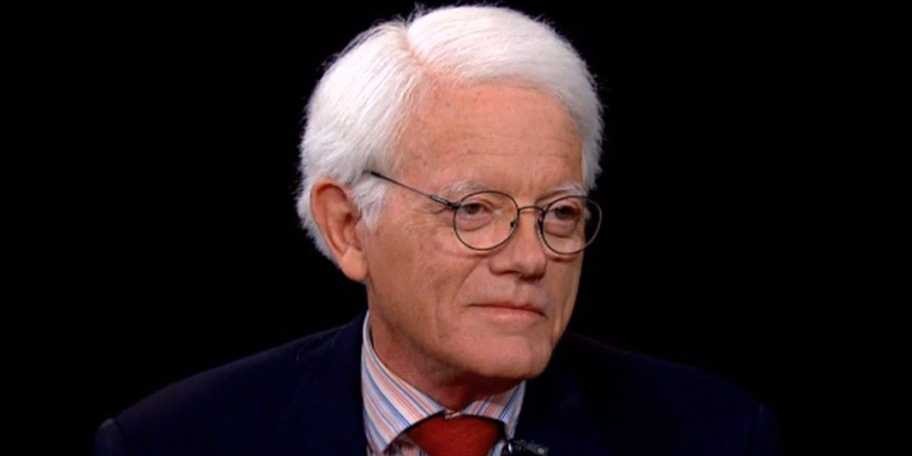

Image from BusinessWeek.com

Investing Like Peter Lynch: Strategies For Picking Stocks

Since were talking about Peter Lynch here, allow me to go over a bit of this investment gurus background. Lynch got his undergraduate financial degree from Boston College and his MBA from the Wharton School of the University of Pennsylvania. He then proceeded to head the Fidelity Investments Magellan Fund in 1977, which catapulted him to investment rock start status. Hes shared his tips along the years, including:

- Be an expert on the stocks you pick or the industries you decide to invest in. That is, know what you buy and own, and be able to easily explain your investments. How confident and knowledgeable are you about your holdings?

- Dont get too hung up or caught up in how interest rates and the economy are behaving or moving. I understand this to mean that we should create an all weather portfolio comprised of strong companies that can withstand any type of economy.

- Take your time to identify top notch companies and stocks. Spend enough time doing the research.

- Dont take unnecessary risks with investments that may not pan out (even if they have higher returns). Dont speculate or gamble.

- Know a companys fundamentals and go for those with excellent management and solid financials.

- Be open to committing mistakes and learning from them. I believe that the best lessons that we learn are those from the mistakes we make.

- Dont be complacent. Paranoia can be good for you.

So Ive paraphrased Peter Lynchs well known nuggets of wisdom, but I also thought to provide some steps to put his advice to good and practical use:

1. Start by amassing a little money. (The operative word there is “little.”) Sign up with a reputable online broker and begin by putting some money aside via an automatic deduction from your paycheck. Keep it in a cash account while you start to get comfortable in the world of stocks. Go for a discount broker that has the reputation and lower commissions. Look for a stock brokerage thats very supportive of the small investor such as ShareBuilder. which actually has an automatic investing program that may work out for those who are looking for an affordable way to build a stock portfolio over time.

2. Check out a virtual trading platform to get a feel for investing and trading. Many investing sites and cheap brokers offer free investment resources. You can learn how the stock market works if you try paper trading first. regardless of whether you decide to become a long term investor (a wise approach) or a short term trader.

Tip: I’m with WeSeed.com, so I’m partial. But there are other sites that can help you get a feeling for investing and how it works, thanks to their paper trading platforms. Check out top notch brokers like Scottrade. OptionsHouse or OptionsXpress. where you can hone your stock picking skills with practice portfolios. But note that some of these brokers cater to more active traders.

3. Try different investing strategies. If youre comfortable with mutual fund investing already but would like to give the Peter Lynch strategy a shot as well, then look at companies that you know (keep in mind, though, that Lynch wasn’t just about which stores have long lines of customers: he’s big into earnings and P/E ratios, for starters). Most virtual trading sites are free, so go wild and try out several theories when you pick stocks and select what goes into your portfolio. Remember that mutual fund or index investing and stock picking are not mutually exclusive strategies.

So jump on in, but be forewarned: investing in stocks is far from a sure thing. As Lynch himself writes:

“People who succeed in the stock market also accept periodic losses… Calamitous drops do not scare them out of the game. If seven out of ten of my stocks perform as expected, I’m delighted. If six out of ten of my stocks perform as expected, then I’m thankful. Six out of ten is all it takes to produce an enviable record on Wall Street.”

Do you subscribe to Peter Lynchs strategies?

Note that The Digerati Life advocates the core and explore methodology and an investment portfolio which is comprised of at least 90% index funds using asset allocation and diversification strategies, and at most 10% individual stocks and other assets that are purchased through market timing, stock picking or any experimental approach to investing.

Categorized under: Investment