Investing in tight oil

Post on: 1 Апрель, 2015 No Comment

Finance Strategies

More on Energy; Should you invest in NA Tight Oil? July 15, 2014

Posted by shaferfinancial in Finance.

www.oxfordenergy.org/wpcms/wp-content/uploads/2014/03/US-shale-gas-and-tight-oil-industry-performance-challenges-and-opportunities.pdf

Here are a couple of key points from the paper:

The evidence so far suggests that the industry has been able to create new opportunities, manage and innovate around the operational aspects (i.e. drill more wells per pad, longer laterals, faster drilling, more hydraulic fracturing/wells, micro seismic, synchronized logistics, etc.) and deal with or address the environmental challenges, despite a rough start and evolving government policies and public acceptance issues. What is not clear from higher-level company data is: if the industry (both large players and independents) can run a cash flow -positive business in both top-quality and in more marginal plays and whether the positive cash flow could be maintained when the industry scales up its operations.

Among all the data and evidence at hand, this comment focuses around the following pieces of industry data that capture a vast amount of relevant context (technical and commercial) and decision- making: (1) recent announcements by large and small industry players, such as write-downs, and (2) financial performance analysis of select US shale gas and tight oil independents.

With regard to the financial performance of companies in this sector, a recent analysis covering 35 independent shale gas- and tight oil-focused companies active across the major US plays and accounting for 3 million barrels of oil equivalent (mboe) per day of production (40% of the total unconventional production in the US at 3Q2013), shows that over the past six years their financial performance has progressively worsened.11 This is despite showing production growth and shifting a large portion of their activity to oil since 2010, presumably to chase a higher margin business.

The analysis shows that capex nearly matches total revenues every year, and net cash flow is becoming negative while debt keeps rising. There are other factors, such as the close link between rising debt and production, the rising cost of debt to total revenues and negative cash flow, which add to concerns about the sustainability of the business. Company data also shows that the cash flow per share of US independents, many of which are investing in shale and tight oil prospects, is negative and has been trending more negative with time.

However, although the market (and some industrial investors) may be wrong, or unable to distinguish profitable from unprofitable opportunities, there remain a large number of investors who have made substantial investment as well as many that believe that these companies will eventually make money, especially from M&A activity.

A key finding of a broader US E&P benchmark study carried out by Ernst & Young in 2013 was that both exploration and development costs are increasing rapidly – by more than 20 per cent in 2012 alone. The oil and gas industry has experienced falling net income margins over the past few years, and shale gas has played a significant part in this trend. It is a complex system, and not the subject of this paper, but it is important to note that, returns and cash flow are all under pressure even at these current high prices and a significant capex and cost reduction is needed. Additionally, production and revenue increases are needed to rebalance the industry’s financial and strategic model. The impact of shale gas and tight oil business activity on these trends is a subject of much debate.

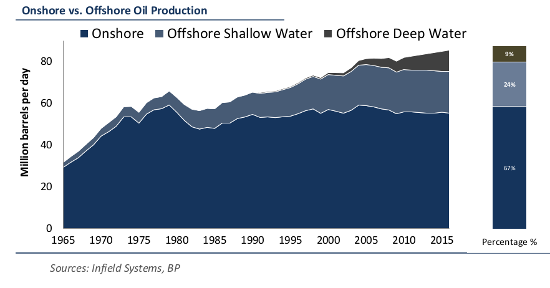

No doubt the industry is bringing more oil to the market. But as an investor the real question is if they are making a profit doing this? As of now, the question has no definitive answer. So for now, investing in these companies is really more about speculating than about purchasing an asset that is creating significant cash flow and income to its owners. Perhaps in the future, but for now it is an open question about profits.