Investing in Stocks Using Fundamental Analysis

Post on: 16 Март, 2015 No Comment

Fundamental analysis of stocks is the foundation for making long term investment decisions and building a strong and diversified portfolio of securities. Fundamental investors rely on financial analysis of a company to determine how well they are doing now and also how well they may do in the future. By doing a thorough job of stock fundamental analysis, buyers and sellers can have confidence in their investment decisions.

Anyone contemplating an investment of thousands of dollars in a specific stock will naturally want to know something about the company they are considering for their portfolio. Fundamental analysis of stocks paints a picture of a company’s financial strength and their prospects for the future.

It takes time to research and understand the fundamentals of a company. Beginning with the balance sheet and income statement, financial analysis should continue with other important pieces of financial data such as cash flow and earnings per share. As part of any fundamental analysis of stocks, it is important to understand what a company does and how they do it.

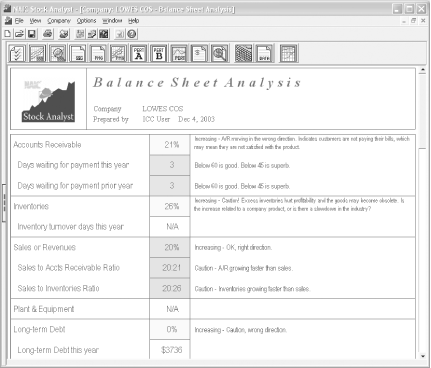

The Balance Sheet

As its name suggests, a balance sheet must balance. The balance sheet is divided in to two columns. The left column lists all of a company’s assets and the right column lists its liabilities plus shareholder equity. The financial strength and general success of a company can be judged, in part, based on the amount of shareholder equity. A small amount of equity might indicate the company is struggling, while a large equity figure would signal to the investor that the company is doing very well.

Balance sheets show long term, fixed assets like machinery and equipment as well as short term assets like cash and accounts receivable. Liabilities include things like mortgages and other debt obligations. Owner equity or shareholder equity is the difference when you subtract liabilities from assets.

The Income Statement

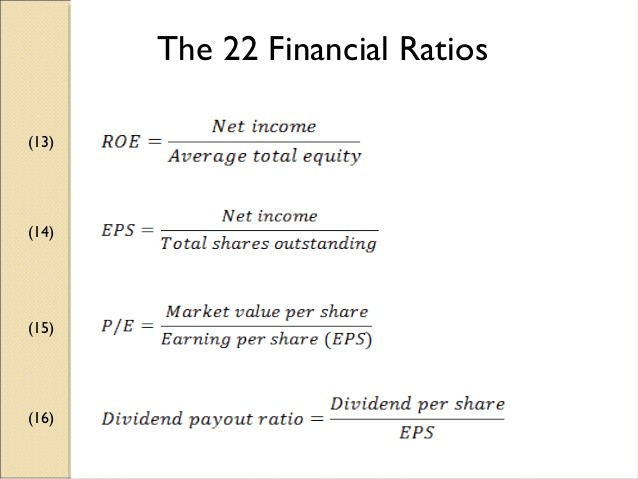

An income statement gives a picture of the revenue that a company earns over a given length of time. It is a periodic statement that shows gross income and fixed and operating expenses. A company will usually prepare quarterly and annual income statements that allow investors a chance to compare performance from quarter to quarter or year to year. The difference between gross income and expenses is called net income. If expenses exceed gross income, a company will have a net loss. The amount of net income or net loss is often referred to as “the bottom line.”

Fundamental or Technical Analysis?

Fundamental analysis relies on financial information, management and the day-to-day operations to value a given company. On the other hand, technical analysis depends more on stock movement, charts and patterns to predict the future direction of a particular stock. While most conservative investors believe in investing in a stock with good fundamentals, technical analysis is more suitable for day traders and those interested in short term trading.

There is no better system. Both fundamental and technical analysis can produce excellent or poor results. Many people combine some aspects of both fundamental and technical analysis when making their investment decisions. The more information you have, the better.