Investing in Reits and property developers Get Latest Markets Reits News Updates

Post on: 16 Июнь, 2015 No Comment

Beware: Commercial Reits in Singapore tend to be slightly riskier than retail Reits due to the large supply of office space already available as well as their greater exposure to global economic risks. — ST FILE PHOTO

PROPERTY is a favourite asset class of Singapore investors. This is partly because it is tangible and provides a natural hedge against inflation.

Other alternative asset classes like commodities only give capital gains. Property, by contrast, can be rented out to provide a steady income.

Investing in property, however, is not cheap. Property prices were at an all-time high prior to the recent government cooling measures in January.

Perhaps one way to respond to the new rules is to look beyond buying flats and condominiums directly. Rather, one can buy shares of real estate investment trusts (Reits) and property developers.

Reits are governed under specific rules:

- They are required to distribute at least 90 per cent of their net income to shareholders in dividends

- A minimum of 70 per cent of their assets must be invested in properties

- At least 75 per cent of their income must be derived from rental income

- To discourage overleveraging, their debt- to-asset ratio is limited to 60 per cent if the Reit has a credit rating and 35 per cent if it doesn’t.

Reits are a diversified group of properties under an investment trust.

The structure helps an investor diversify his portfolio into several property projects.

Reits offer more than just the benefits of diversification. They have a higher dividend yield than most other stocks listed on the Singapore Exchange (SGX) as they are required to distribute 90 per cent of their income to keep their favoured tax status.

This results in most Reits paying a dividend yield of 5 per cent or more — even though yields have come down in the last two years due to overwhelming demand.

Property developers are typically purchased for capital appreciation since they have no income distribution requirement and a lower dividend yield.

But Reits have also benefited from capital appreciation over the past two years. Instability in the global economy caused by the eurozone debt crisis, debt and growth issues in the US and fears of a hard landing in China have driven investors to seek safety in dividend-paying stocks.

As a result, Reit prices rose as much as 50 per cent.

What to watch out for

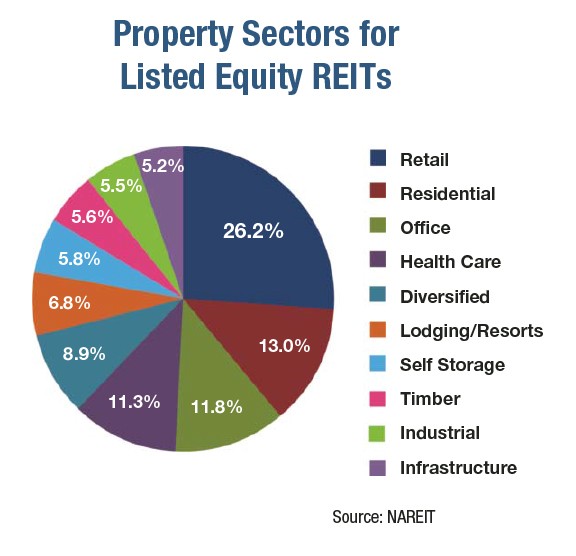

When investing in Reits, it is crucial to understand the asset mix which determines how the Reit will perform in various economic environments.

For example, Reits may focus on commercial, industrial or retail property. Each performs differently. Some are aggressive investments and others are defensive.

Retail Reits tend to be the most stable since the demand for retail space is usually the least affected by fluctuations in the economic cycle.

Occupancy rates remain high even during an economic downturn, ensuring a steady revenue stream.

The downside is that rental income is lower and their yields tend to be the lowest among the Reits.

Another factor to consider is the type of retail properties under the Reit.

Suburban Reits, or Reits holding properties next to densely-populated residential areas, are generally more resilient than Reits holding properties downtown.

For example, the revenue fluctuations for Fraser Commercial Trust are lower as most of its properties are in suburban areas. Starhill Global, which has most of its investments along Orchard Road, has greater fluctuations in revenue.

Commercial Reits tend to be slightly riskier than retail Reits due to the large supply of office space already available as well as their greater exposure to global economic risks.

Out of the three types of Reits, industrial Reits pay the highest dividend yield.

But their exposure to economic cycles is also the greatest and industrial companies perform poorly in economic downturns. This leads to the possibility that rentals will drop due to a fall in demand. However, longer lease terms of five years or more can smooth out industrial Reit earnings.

Another factor to consider is the track record of management: Have new acquisitions added to dividends per unit? How well has management grown rental revenues while keeping a lid on costs?

Another consideration is a Reit’s spread over the 10-year government bond yield. This means how much more a Reit is paying, in terms of dividend yield, compared to that given by a comparable safe government bond.

Since investors use Reits mostly to generate passive income, a risk-free asset like Singapore government bonds serves as a useful benchmark. If Reit yields over government bonds are at historical lows, the compensation for taking on the added risk is probably not adequate.

While the business model of most Reits is easier to comprehend than other types of stocks, investor diligence is required.

Like all investments, one must consider the chance of a share price decline, which has the potential to completely offset the Reit’s generous dividend yield.

Why property developers?

Next, we move on to property developers.

Their aim is to develop new projects. Their income tends to be chunky since property projects take years to complete. The benefit, however, is most property projects are profitable since nearly all costs of production can be passed onto buyers.

Besides passing on the costs, most real estate companies have pricing power which enables them to set a target price that locks in a profit.

Some developers have a healthy product mix. CapitaLand, for example, is involved in commercial, retail and residential development. This provides a diversified earnings stream.

What to watch out for

While Reits depend on a simple model of rents versus costs, property developers have a more complex business model.

First, property earnings fluctuate based on a non-steady stream of projects that are completed and sold within a year, making it more meaningful to average profitability over the lifespan of the projects.

Developers are also more affected than Reits by the state of the economy. Property is a cyclical industry. New developments are sold easily in rising markets while holding costs are incurred in downturns.

Other key factors are the availability of credit and the interest rate on mortgage loans.

Due to low interest rates, more people are taking loans to buy property. This results in an increase in property demand, with quick sales and high profits for developers. The FTSE ST Real Estate index, which tracks property counters, has seen a rise from a low of 533 points in 2012 to a high of 830 points in 2013 — an increase of over 50 per cent.

Of course, that was before government policies hit the demand and profitability of real estate.

In January, the government introduced a series of residential property cooling measures which included higher additional buyer stamp duty (ABSD), and tighter loan-to-value limits which mean increased cash downpayments.

While this has dampened the property market, other government policies are likely to boost it.

For example, expanding the number of people in the country from 5.3 million to 6.9 million would require a substantial increase in infrastructure and housing. Property developers are likely to benefit as a rise in population boosts demand.

To conclude, investing in real estate stocks requires similar homework as what is done when buying a property.

Investors also need to assess management capability, understand the rental return, the direction of housing prices, macroeconomic demand and the effects of government policies.

The writer is a second-year student at Singapore Management University (SMU) Lee Kong Chian School of Business and one of the student trainers in the Citi-SMU Financial Literacy Programme for Young Adults.

Jointly launched by Citi Singapore and SMU in April 2012, the programme is Singapore’s first structured financial literacy programme for young adults. It aims to equip young adults aged 17 to 30 with essential personal finance knowledge and skills to give them a firm foundation in managing their money, and a financial head start early in their working lives.