Investing in Dividend Growth Stocks Why Growth Matters

Post on: 16 Март, 2015 No Comment

Peter Gridley / Getty Images

The Importance of Dividend Growth

In recent years, income investors with longer time horizons and a greater tolerance for risk have increasingly turned to dividend-paying stocks in favor of bonds. In addition to providing income and the potential for capital appreciation, dividend-paying stocks also tend to outperform the broader stock market over the long-term. But within the universe of dividend stocks is another segment that has provided even better returns over time – stocks with growing dividends.

The numbers speak for themselves. In its white paper, “Why Dividend Growth Matters,” Goldman Sachs calculated that $100 invested in the S&P 500 Index in January 1972 would have grown to $1,585 by March 2012. Not bad, but the same investment in dividend-paying stocks would have grown to $3,000. However, $100 invested in the group labeled “dividend growers and initiators” would have expanded to $4,031 – more than 2.5 times the amount an investor would have received by taking a passive, index-focused approach. In addition, the dividend growers/initiators group produced their superior return (9.48% versus 6.49% for the S&P 500 on an average annualized basis) with about 10% less risk. In other words, the segment provided a much better trade-off of risk and return than the market as a whole.

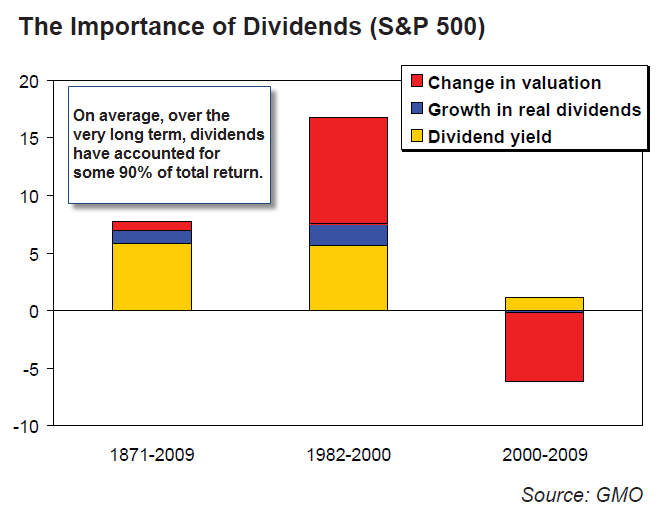

Why would this be? For one, dividends tend to make a substantial portion of stocks’ total return over time due in part to the compounding effect of the income being reinvested each quarter. But there’s also another reason. In its piece, Goldman writes: “..a company that can grow its dividend must have a business capable of generating strong and growing free cash flow (and) a management team that is disciplined in its use of cash and focused on shareholders. As a result, we believe investors want to own these successful, shareholder-oriented companies, thereby contributing to the share price appreciation over time.”

In addition, a rising dividend is not just a signal that the company has a positive outlook for its future prospects, but also a factor that imposes discipline on the company by forcing it to make wise decisions about what to do with its cash.

Keep in mind that in order to generate the kind of outperformance cited above, an investor would have needed to reinvest the dividend – and thereby gain the long-term benefits of compounding – rather than taking the payout in cash.

Dividend Growth Helps Offset Low Rates and the Potential for Higher Inflation

Dividend growth becomes even more attractive in an environment of ultra-low interest rates and the prospect of more muted bond market returns in the years ahead. While an investor who bought a 10-year U.S. Treasury note in the latter half of 2012 would have locked in a yield of 1.6% to 2% for a decade, someone who purchased dividend growth stocks would have had received not just income, but the potential for rising income over time.

Dividend growers also have been an effective investment during periods of inflation because companies were able to pass on the proceeds of higher prices. Scott Offen, co-manager of Fidelity Equity Dividend Income Fund (FEQTX) and Fidelity Strategic Dividend & Income Fund (FSDIX), had this to say in October, 2012: “With the threat of inflation and the possibility of losses, dividend growth is incredibly important,” says Offen. “I don’t think most investors are going to get the returns they want without dividend growth.”

Similarly, Todd C. Ahlsten, Chief Investment Officer at Parnassus Investments, says “Bond yields are at historic lows, and this environment makes it difficult for income investors to beat inflation over the long term. I believe that owning companies with strong, time-tested businesses that can increase dividend payments over time is an attractive way to potentially generate income that can stay ahead of inflation over time.”

Selecting Dividend Growers: a Brief Overview

While investing in dividend growers may sound easy at first, keep in mind that there’s no way to tell ahead of time whether a stock will initiate or raise its dividend, and if so by how much. Dividends are up to the discretion of management and are subject to the business cycle, which means that just because a company has a history of rising dividends doesn’t mean it will in the future.

To find dividend stocks with the potential for growth, investors often analyze a company’s cash flow statement to see if it has enough cash to raise out the dividend. If a company is paying a dividend that is a substantial portion of its earnings (a “high payout ratio”), there’s a lower chance that the dividend will increase in the future. Conversely, a company with a low payout ratio has more latitude to boost its dividend over time. Companies that are boosting debt or issuing new shares in order to maintain the dividend are also among those unlikely to experience future dividend growth. Investors don’t necessarily have to do this work on their own, since there a wide variety of mutual funds and exchange-traded funds that focus on stocks with rising dividends, such as the Vanguard Dividend Appreciation ETF (ticker:VIG).

The Bottom Line

While dividend growth stocks have many benefits, keep in mind that stocks are, in many cases, not an appropriate substitute for bonds — as outlined here. Even dividend-paying stocks are only appropriate for investors who have a three- to five-year time horizon and the ability to withstand short-term losses.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.