Investing in Bull Markets is Easy But What About Bear Markets

Post on: 29 Май, 2015 No Comment

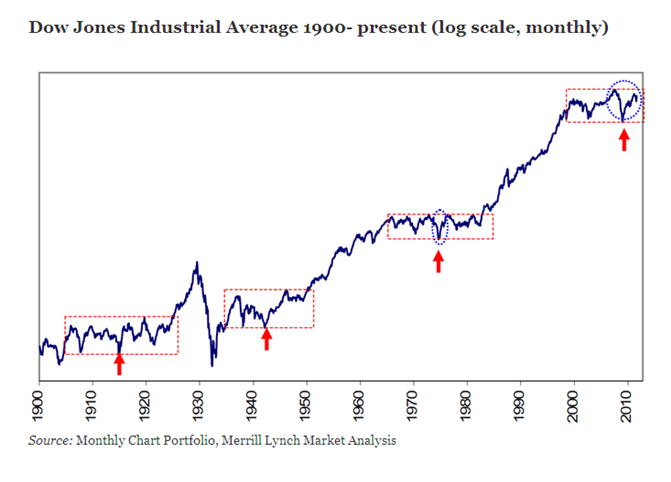

The past five years have been easy ones for investors – bull markets usually are. But what about bear markets? It’s one thing to invest in the stock market when general price levels are rising, but quite another when the momentum reverses. This is not an attempt to predict a bear market, just to say that after five rising years, the tide could turn any time. Will you be ready when it does?

Anyone can look like an investing genius in a bull market.

There’s really no easy way to handle a down market, unless you’re completely invested in cash. Of course, investing 100% of your money in cash has risks all its own. For one, interest rates arent keeping up with inflation, so you’ll be falling behind even if you’re not losing any money on paper. For another, even after a bear market, stocks will start another upward run, and you wont participate in it if all of your money is in cash.

What can you do to prepare yourself for a bear market?

Recognize that the market becomes more selective

When you are investing in a bull market, you’ll make money as long as you are running with a herd. That means generally keeping your money invested were most others do, particularly institutional money. But during bear markets, the investment winds begin to change – often without any obvious signs. What kind of stocks do investors look for during down markets?

High dividend stocks . Stocks that pay high dividends generate cash flow even if the price of the stock doesn’t rise. That’s a good place to be during a falling market. Not only will you earn income on your stocks, but that revenue stream tends to keep those stocks from falling as much as the general market.

Value stocks. Earnings and fundamentals don’t matter so much during bull markets. But during bear markets they’re everything. The idea is to find solid companies whose stock prices are low relative to their competitors. That’s not an easy thing to do, but there are more of them as prices fall.

Fad stocks will fall out of favor- fast. During bull markets, investors often jump on fad stocks for example, companies that have exciting new product offerings, but not necessarily the earnings to support them. Investors might dump those stocks in a big way when the general market head south.

The “Nifty Fifty” will likely shift. A lot of investors don’t like that term, not the least of which is it’s dated. But whatever we choose to label it, there is a list of stocks that appear frequently in every major portfolio. During bull markets its often just a matter of loading up on enough of them and riding the elevator up. But the stocks that make up the nifty fifty during a bull market could change radically in a bear market.

The best investments are likely to be outside of stocks

During bear markets, the best investments are likely be found outside the stock market. In addition, some of the best moves you can make in response to a bear market have nothing to do with investments at all. Well get to those in a minute.

We already discussed how cash is the safest investment during a bear market. If nothing else, it’s a single best way to keep from losing money during a market collapse. If you anticipate a bear market, a substantial amount of your portfolio should be invested in cash and cash equivalents, like treasury securities, certificates of deposit, and money market funds.

But as cash has its own downsides – mainly inflation – and you may well have to be in other investment sectors as well.

Real estate is one popular choice. As money leaves the stock market, it often seeks other havens and that includes real estate. Real estate upturns have sometimes been triggered by falling stock markets. If you suspect a bear market in stocks is coming, you may want to move some of your portfolio into rental real estate. If you don’t want to get your hands dirty, you could also consider real estate investment trusts (REITs) .

Still another possibility is to move a small amount of money into precious metals. It is often thought that precious metals move counter to equities, which would offer some upside potential in the event of a bear market in stocks. I’m not entirely convinced of this connection, but it may be worth investigating.

Paying off debt will be one of the best “investments” you can make

Perhaps the single best investment you can make it a bear market is paying off debt. While it wont be earning you investment returns in the traditional sense, it will be eliminating a guaranteed payout, which is virtually the same thing.

Let’s say that you have a $10,000 credit card debt with a 10% rate of interest. By paying off the debt, you effectively lock-in a 10% rate of return on the money used to payoff the card. But that’s not all.

By paying off credit card debt, you are also eliminating an “X factor”, which is the variable rate of interest that is attached to most credit cards. By paying off the debt, you are converting a known to an unknown. That is to say, you’ll no longer need to be concerned with rising interest rates on your credit card debt.

The revenge of lifestyle inflation

This is another non-investment area that you may want to look at closely in the event of a bear market. Bull markets tend to cause lifestyle inflation. After all, as your investment portfolio rises in value, there is a tendency to expand lifestyle in the process. This could result in a new and larger home, one or more new cars, and a pattern of high-priced vacations, entertainment, and a greater frequency of restaurant meals.

Bear markets are something of a reversal of the lifestyle inflation trend. Paper wealth declines with stock prices, and you suddenly find yourself feeling poorer. But there is a tangible aspect to this that can help you in a bear market. By reversing the trend of lifestyle inflation, you can free up more of your budget to building up your investment portfolio.

One of the best ways to offset the negative effects of falling stock prices on your portfolio is to increase the amount of money that you contribute your portfolio each year. No, it won’t wipe out your investment losses, but it will help you to build up capital that you’ll be in a better position to take advantage of the next bull market wave.

Are you at all concerned that a bear market may be coming soon? If you are, what steps are you taking to prepare for it?