Investing In Bonds For Conservative Investors

Post on: 31 Май, 2015 No Comment

Smart investing includes investing in bonds to lower the overall portfolio risk. Bonds returns are historically higher than cash equivalents and less volatile then stocks.

Investing in bonds is type of investment that provides a return in the form of fixed periodic payments and the eventual return of principal at maturity. Unlike a variable-income security, where payments change based on some underlying measure such as short-term interest rates, the payments of a fixed-income security are known in advance.

Historically, bonds have returned more than cash investments, and exhibited less volatility than stocks. In addition, the return on bonds has often offset the negative return on stocks during periods of market downturn. As a result, investing in bonds is complementary to an all-stock portfolio, as it generally lowers the overall portfolio risk.

There are different issuers of bonds, like governments, agencies, cities or corporations. They issue bonds because they need money for whatever reason and issuing bonds is one of the ways to borrow money. You, as a buyer of the bong, are actually lending the money to the issuer under specific conditions, written in the prospect of the bond.

Bonds Characteristics

You need to be aware of characteristics of investing in bonds. All of these factors play a role in determining the value of a bond and the extent to which it fits in your portfolio.

Face Value/Par Value

The face value (par value or principal) is the amount of money a holder will get back once a bond matures. A newly issued bond usually sells at the par value. Corporate bonds normally have a par value of $1,000, but this amount can be much greater for government bonds.

What confuses many people is that the par value is not the price of the bond. A bond’s price fluctuates throughout its life in response to a number of variables. When a bond trades at a price above the face value, it is said to be selling at a premium and when a bond sells below face value, it is said to be selling at a discount.

Coupon (The Interest Rate)

The coupon is the amount the bondholder will receive as interest payments. It’s called a coupon because sometimes there are physical coupons on the bond that you tear off and redeem for interest. Today, bonds are more or less issued electronically.

Bonds normally pay interest every six months, but it’s possible for them to pay monthly, quarterly or annually. The coupon is expressed as a percentage of the par value. If a bond pays a coupon of 10% and its par value is $1,000, then it’ll pay $100 of interest a year.

Maturity

The maturity date is the date in the future on which the investor’s principal will be repaid. Maturities can range from as little as one day to as long as 30 years.

A bond that matures in one year is much more predictable and thus less risky than a bond that matures in 20 years. Therefore, in general, the longer the time to maturity, the higher the interest rate. Also, all things being equal, the price of a longer term bond will be more volatile than a shorter term bond.

Bonds Main Types

U.S. Treasuries

Marketable securities from the U.S. government are known collectively as Treasuries. U.S. Treasuries are classified according to the length of time before maturity. These are the three main categories:

- Bills — debt securities maturing in less than one year . Notes — debt securities maturing in one to 10 years . Bonds — debt securities maturing in more than 10 years .

U.S. Treasuries are widely considered the safest type of bond, since it is backed by the full faith and credit of the U.S. Treasury Department. There are different types available to meet specific investing needs

Municipals

Municipal bonds, known as munis, are the next progression in terms of risk. Munis are issued by state and local governments and they don’t go bankrupt that often, but it can happen. The major advantage to munis is that the returns are free from federal tax. Furthermore, local governments will sometimes make their debt non-taxable for residents, thus making some municipal bonds completely tax free. Because of these tax savings, the yield on a muni is usually lower than that of a taxable bond. Depending on your personal situation, a muni can be a great investment on an after-tax basis.

Corporate Bonds

Corporate bonds are characterized by higher yields because there is a higher risk of a company defaulting than a government. The upside is that they can also be the most rewarding fixed-income investments because of the risk the investor must take on. The company’s credit quality (financial health) is very important: the higher the quality, the lower the interest rate the investor receives.

Other variations on corporate bonds include convertible bonds. which the holder can convert into stock, and callable bonds, which allow the company to redeem an issue prior to maturity.

Issuers

The issuer of a bond is a crucial factor to consider whyle investing in bonds, as the issuer’s stability is your main assurance of getting paid back.

Bonds long term credit ratings.

For example, the U.S. government is far more secure than any corporation. Its default risk (the chance of the debt not being paid back) is extremely small — so small that U.S. government securities are known as risk-free assets. The reason behind this is that a government will always be able to bring in future revenue through taxation.

A company, on the other hand, must continue to make profits, which is far from guaranteed. This added risk means corporate bonds must offer a higher yield in order to entice investors — this is the risk/return tradeoff in action.

The bond rating system helps investors determine a company’s credit risk. Blue-chip firms, which are safer investments, have a high rating, while risky companies have a low rating. The table below illustrates the different bond rating scales from the major rating agencies: Moody’s, Standard and Poor’s and Fitch Ratings.

A general rule of thumb when investing in bonds is the higher the interest rate, the riskier the bond.

Bonds Advantages

Investing in bonds has several advantages compared to others asset classes:

- Capital preservation. Unless an issuer goes bankrupt, a bondholder can be almost completely certain that they will receive the amount they originally invested. Bonds pay interest at set intervals of time. which can provide valuable income for retired couples, individuals, or those who need the cash flow without needing easy cash advances or other types of income. Bonds can have large tax advantage. when a government or municipality issues various types of bonds to raise money to build bridges, roads, etc. the interest that is earned is tax exempt.

Bonds Risks

While generally considered safer and more stable than stocks, bonds have certain risks:

- Interest rate risk: when interest rates rise, bond prices fall. If you need money and have to sell your bond before maturity in a higher rate environment, you will probably get less than you paid for it. Interest rate risk declines as the maturity date gets closer. Credit risk: if the issuer runs into financial difficulty or declares bankruptcy, it could default on its obligation to pay the bondholders. Liquidity risk: if the bond issuer’s credit rating falls or prevailing interest rates are much higher than the coupon rate, it may be hard for an investor who wants to sell before maturity to find a buyer. Bonds are generally more liquid during the initial period after issuance as that is when the largest volume of trading in that bond generally occurs. Call risk or reinvestment risk: If a bond is callable, the issuer can redeem it prior to maturity, on defined dates for defined prices. Bonds are usually called when interest rates are falling, leaving the investor to reinvest the proceeds at lower rates.

How Much Should You Invest In Bonds?

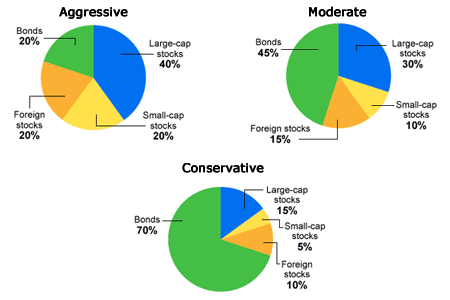

A good rule of thumb to determine the percentage of your assets that you should invest in bonds is to simply look at how old are you. A 20 year old should have 20% invested in bonds, a 40 year old should have 40% invested in bonds and so on.