Investing for Millennials Overcoming Risk Aversion in the Stock Market

Post on: 17 Июнь, 2015 No Comment

Us millennials are a different generation when it comes to money and investing. We grew up in the face of two huge economic events the tech bubble and the housing crisis. We grew up in a decade of war overseas. And we have been growing up in a world of increasingly polarized news its the news, spun how you want it to be. All of these things have us investing in a different way than our parents, and a recent UBS study confirm it.

Investing for millennials looks a little like this:

- Conservative and risk adverse, holding more cash than previous generations

- Savings and budgeting is what creates wealth, not investing

- Worried about helping parents, whose portfolios have been impacted by market events

- A distrust for TV, online, and social media personalities when it comes to investing and money management

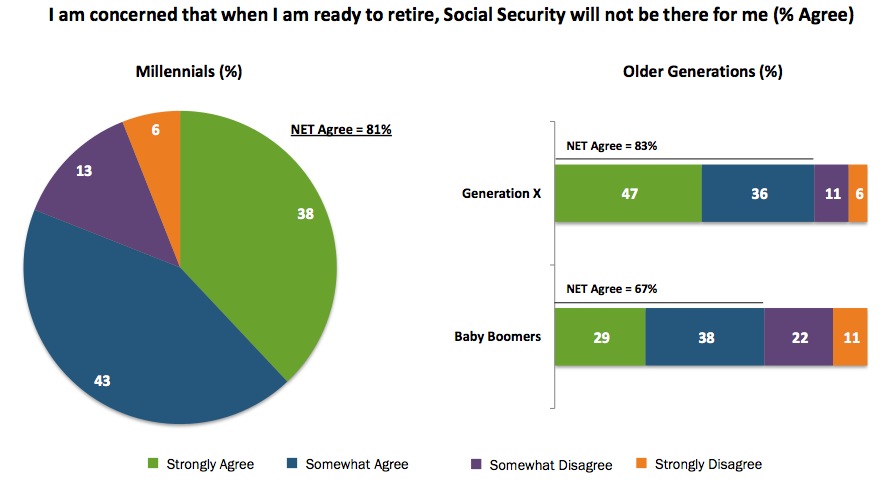

But the fact is, millennials need to invest because long term investing in the stock market is one of the best ways to grow wealth over time. Im fearful that too many millennials are going to simply going to save, and then wake up at 65 with a small nest egg and wonder what happened.

We need, as a generation, to take in the events that have happened, but craft a strategy around them that will enable success over the long term. Heres what Im talking about.

The Pitfalls of Being Too Risk Adverse

There is a great thing about holding a lot of cash and feeling comfortable for today you only will feel safe and comfortable today. If you invest too conservative over the next 20 years, youll be faced with a problem that Ive talked about several times and thats coming up short on money in retirement.

In my article How to Invest if you Dont Make Much Money. I shared the story of my friends mom who just saved all her life. She had a 401k at her company, but kept all of her investments in the Stable Value fund because she didnt want to lose any money. She was too fearful of losing. The problem was, after 30-40 years of savings/investing, she only had about $300,000 in the account. The money just never grew beyond the 1% the Stable Value fund paid. So, her money didnt work for her.

And guess what, she was now faced with having to work for as long as her body could hold up 70 or beyond. She had to wait until 70 to get the largest Social Security payment possible, since her own savings could support her. How do you think she felt? Heartbroken Sad that she hadnt simply made different investment choices 20 years earlier.

Saving and Budgeting Wont Help You Reach Your Financial Goals

The truth is, saving and budgeting alone wont help you reach your financial goals, and anyone who tell you otherwise is not telling you the entire story. Yes, saving and budgeting can HELP you. but they arent the answer.

You need your money to grow! You need your money to work for you. Or you need to earn more money.

Ive shared with you how you can change the math on living on half your income. I show you how there is more to just saving half your income you can also boost your earnings. Which is also why we talk about the 6 Income Streams You Need to Setup in your Twenties. Combining these two strategies is the start of a solid financial plan that will enable you to succeed over the long term.

Investing for Millennials in a Way that is Comfortable

But at the end of the day, millennials will still need to invest. So, you can make more money, and save more money but saving money alone will not help you grow your money. You need to invest it, but you need to invest it in a way that is comfortable.

Heres my breakdown of how millennials (and other risk adverse investors) can setup a portfolio that makes them feel comfortable. Its a strategy that I use, and I know that it works.

First, you need to have an emergency fund. If you dont have one, get one. This is your cash pile. I recommend at least 6 months of expenses saved, but if youre very cautious, there is no harm in having 9 months or even a year. For example, if you want to start a business, having 12 months of cash can bring some peace of financial mind. Or, if you dont work in a stable job, the bigger the cash pile, the better. So, if your expenses are $2,000 a month, were talking a minimum of $12,000 just in cash.

Next, you need to take advantage of free money. This means maximizing any 401k matches that your employer offer. If you qualify for a 401k at work, you must do it. No exceptions. In this account, you need to invest in the stock market, and let it grow over time. Yes, it will fluctuate, but it will grow over the long term.

Finally, you need to invest yourself. This means investing in a IRA or traditional brokerage account. Weve put together an easy free guide on investing. and we also have free video training to help you get started investing. But, since most millennials dont trust me ask your parents how to get started! You need to invest even if its only $100 per month. The power of compounding will help you grow your money over time!

Now its your turn whats holding you back from getting started investing, or have you already taken the first step?