Investing Alongside Carl Icahn While Limiting Your Downside Risk Icahn Enterprises L P (NASDAQ

Post on: 22 Апрель, 2015 No Comment

Executive summary:

- One can invest in top holdings of a billionaire investor while strictly limiting one’s downside risk with a hedged portfolio, such as the one shown below.

- This portfolio has a negative hedging cost, meaning the investor would effectively be getting paid to hedge.

- This portfolio is designed for an investor who is willing to risk a maximum decline of up to 16%.

- Investors with higher or lower risk tolerances can use a similar process, though their potential returns may be different.

_________________________________

In a recent article, we considered a source of ideas for a hedged portfolio — the top holdings of a highly rated mutual fund. Another source of ideas for a hedged portfolio is the top holdings of a billionaire investor. In this post, we’ll start with the top holdings in Carl Icahn’s Icahn Enterprises, L.P. (NASDAQ:IEP ) and go over how an investor with $500,000 to invest could construct a hedged portfolio using some of those names while limiting his risk to a maximum drawdown of 16% in the worst case scenario. First though, a note about why Carl Icahn’s top holdings came to mind.

On Tuesday morning, I happened to read Seeking Alpha contributor John Vincent’s analysis of Icahn’s latest portfolio moves (Tracking Carl Icahn’s Portfolio — Q4 2013 Update), and one of the stocks mentioned in it, Forest Labs (NYSE:FRX ), caught my eye. As the screen capture below from our admin panel shows, as of February 17th, FRX had the highest expected return in our portfolio construction tool’s universe, at 26% (adjusted expected return is what we refer to simply as expected return in our hedged portfolios).

Forest Labs of course closed up more 27% on Tuesday, on news it was to be acquired by Activis, Plc. (NYSE:ACT ).

Let’s review some of the basics of hedged portfolios and then see how we can go about creating one using some of Icahn’s holdings.

Risk Tolerance, Hedging Cost, and Potential Return

All else equal, with a hedged portfolio, the greater an investor’s risk tolerance — the greater the maximum drawdown he is willing to risk (his threshold) — the lower his hedging cost will be and the higher his potential return will be.

Constructing A Hedged Portfolio

In a previous article (Rethinking Risk Management: A New Approach To Portfolio Construction), we discussed a process investors could use to construct a hedged portfolio designed to maximize potential return while limiting risk. We’ll recap that process here briefly, and then explain how you can implement it yourself. Finally, we’ll present an example of a hedged portfolio that was constructed this way with an automated tool. The process, in broad strokes, is this:

- Find securities with high expected returns.

- Find securities that are relatively inexpensive to hedge.

- Buy a handful of securities that score well on the first two criteria; in other words, buy a handful of securities with high expected returns net of their hedging costs (or, ones with high net expected returns).

- Hedge them.

The potential benefits of this approach are twofold:

- If you are successful at the first step (finding securities with high expected returns), and you hold a concentrated portfolio of them, your portfolio should generate decent returns over time.

- If you are hedged, and your return estimates are completely wrong, on occasion — or the market moves against you — your downside will be strictly limited.

How to Implement This Approach

- Finding securities with high expected returns. In our previous article, we mentioned the top holdings of a 5-star mutual fund. In this one, we’ll start with the top holdings in Icahn’s holding company. As of 12/31/2013 those were Apple Inc. (NASDAQ:AAPL ), CVR Energy Inc. (NYSE:CVI ), Chesapeake Energy (NYSE:CHK ), Federal Mogul Corp (NASDAQ:FDML ), Forest Labs. Herbalife (NYSE:HLF ), NetFlix (NASDAQ:NFLX ), and Icahn Enterprises itself. To quantify expected returns for these securities, you can, for example, use analyst’s price targets for them and then convert these to percentage returns from current prices. In the case of Forest Labs in particular, you should note that the vast majority of acquisitions of these type close, and since the stock is already trading above the stated acquisition price, its expected return from its closing price Tuesday is likely to be negligible. In general, though, you’ll need to use the same time frame for each of your expected return calculations to facilitate comparisons of expected returns, hedging costs, and net expected returns. Our method starts with calculations of six-month expected returns.

- Finding inexpensive ways to hedge these securities. First, you’ll need to determine whether each of these top holdings are hedgeable. Then, whatever hedging method you use, for this example, you’d want to make sure that each security is hedged against a greater-than-16% decline over the time frame covered by your expected return calculations (our method attempts to find optimal static hedges using collars as well as married puts going out approximately six months). And you’ll need to calculate your cost of hedging as a percentage of position value.

- Buying the securities with the highest net expected returns. In order to determine which securities these are, you may need to first adjust your expected return calculations by the time frame of your hedges. For example, although our method initially calculates six-month expected returns and aims to find hedges with six months to expiration, in some cases the closest hedge expiration may be five months out. In those cases, we will adjust our expected return calculation down accordingly, because we expect an investor will exit the position shortly before the hedge expires (in general, our method and calculations are based on the assumption that an investor will hold his shares for six months, until shortly before their hedges expire or until they are called away, whichever comes first). Next, you’ll need to subtract the hedging costs you calculated in the previous step from the expected returns you calculated for each position, and sort the securities by their expected returns net of hedging costs, or net expected returns. If any of Icahn’s top holdings have negative net expected returns (that is, the cost of hedging them is more than their expected return over the same time frame), you’ll want to exclude them.

- Fine-tuning portfolio construction. You’ll want to stick with round lots (numbers of shares divisible by 100) to minimize hedging costs, so if you’re going to include a handful of securities from the sort in the previous step and you have a relatively small portfolio, you’ll need to take into account the share prices of the securities. That won’t be an issue in our example here of a $500,000 portfolio, but for an investor with, say, a $100,000 portfolio, stocks such as Priceline.com. trading at more than $1000 per share, would be problematic. Another fine-tuning step is to minimize cash that’s leftover after you make your initial allocation to round lots of securities and their respective hedges. Because each security is hedged, you won’t need a large cash position to reduce risk. And since returns on cash are so low now, by minimizing cash you can potentially boost returns. In this step, our method searches for what we call a cash substitute: that’s a security collared with a tight cap (1% or the current yield on a leading money market fund, whichever is higher) in an attempt to capture a better-than-cash return while keeping the investor’s downside limited according to his specifications. You could use a similar approach, or you could simply allocate leftover cash to one of the securities you selected in the previous step.

An Automated Approach

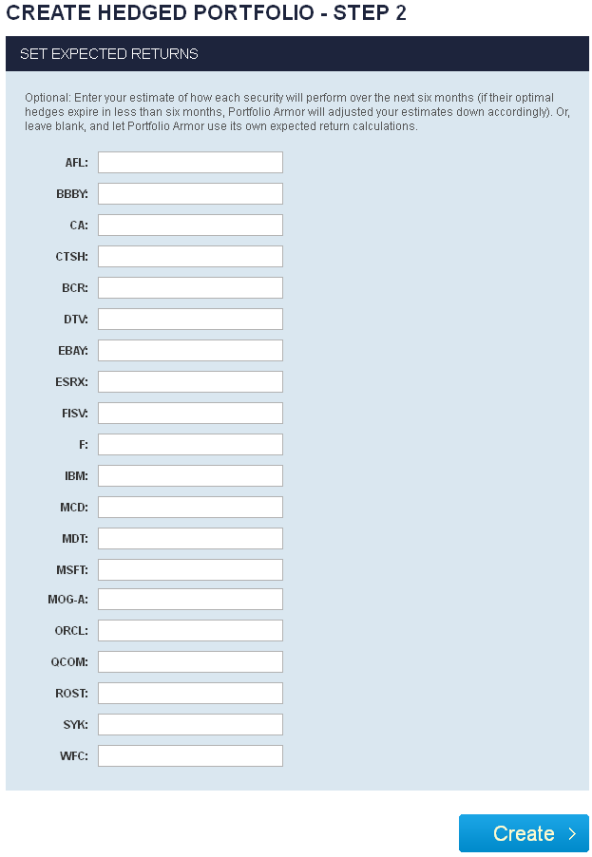

Here we’ll show an example of creating a hedged portfolio using the general process described above, facilitated by the automated portfolio construction tool at Portfolio Armor. In the first step, we’ll enter the ticker symbols of Icahn’s top holdings, the dollar amount of our investor’s portfolio (500000), and the maximum decline he’s willing to risk in percentage terms (16).

In the second step, we’re given the option of entering our own expected returns for each of the securities. In this example, we will leave these blank, and use the tool’s own expected return calculations.

A few minutes after clicking the create button above, we were presented with the hedged portfolio below. The data in it is as of Tuesday’s close.

Why These Particular Securities?

The tool ended up including three of Icahn’s holdings: AAPL, CHK, and NFLX. Those were the three top holdings of his for which it had calculated positive expected returns after subtracting hedging costs (positive net expected returns). The tool added Facebook (NASDAQ:FB ), MGM Resorts (NYSE:MGM ), Delta Airlines (NYSE:DAL ), and Yahoo (NASDAQ:YHOO ) to the portfolio, based on their high net expected returns. YHOO actually appears twice there: once hedged with an optimal collar with its cap set at its six-month expected return, and once hedged as a cash substitute, with an optimal collar with its cap set at 1%. Although these two positions include the same underlying security, the difference in the way they are hedged results in different hedging costs and different net expected returns.

Each Security Is Hedged

Note that in the portfolio above, each of the underlying securities is hedged. Hedging each security according to the investor’s risk tolerance obviates the need for broad diversification, and lets him concentrate his assets in a handful of securities with high expected returns net of their hedging costs. Here’s a closer look at the hedge for the first position, AAPL:

As you can see in the image above, AAPL is hedged with an optimal collar with its cap set at 17.57%. Using an analysis of historical returns as well as option market sentiment, the tool calculated an estimated return of 17.57% for AAPL over the next six months. That’s why 17.57% is used as the cap here: the idea is to capture the expected return while offsetting the cost of hedging by selling other investors the right to buy AAPL if it appreciates beyond 17.57% over the next several months.[i] As you can see at the bottom of the screen capture, the net cost of this optimal collar, as a percentage of position value, was 0.05%.[ii]

Negative Hedging Cost

Although minimizing hedging cost was only the secondary goal here after maximizing potential return, note that, in this case, the total hedging cost for the portfolio was negative, meaning the investor would have effectively gotten paid (a little more than $600) to hedge this portfolio.

Higher Risk, Higher Potential Return

As we noted in a previous article, a hedged portfolio for an investor willing to risk no more than a 5% decline featured a potential return of 3.71%. This hedged portfolio, for an investor willing to risk a 16% decline, features a potential return of 16.79% over six months. That potential return is what the portfolio will return if each of its underlying securities achieves its expected return. But in the worst-case scenario — if every one of these securities went to zero before their hedges expired — the investor’s downside would be strictly limited to a decline of 15.76%.

[i] This hedge actually expires in 5 months; as you can see in the screen capture of the portfolio, the expected return for AAPL has been adjusted downward accordingly, on the assumption that an investor will hold his positions for six months, until they are called away or until shortly before their hedges expire, whichever comes first.

[ii] To be conservative, the net cost of the collar was calculated using the bid price of the calls and the ask price of the puts. In practice, an investor can often sell the calls for a higher price (some price between the bid and ask) and he can often buy the puts for less than the ask price (again, at some price between the bid and ask). So, in practice, an investor may have been able to get this hedge for less than $30, or 0.05% of the position value.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Since you’ve shown interest in IEP, you may also be interested in