Investing 101 Managing Your Portfolio Price

Post on: 16 Март, 2015 No Comment

Risk & Reward

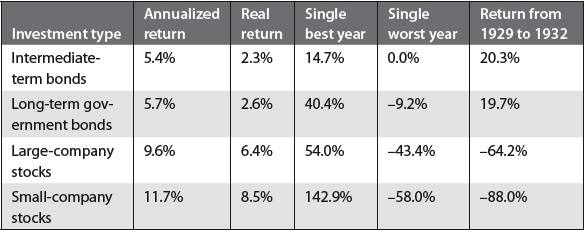

“Risk” refers to the degree to which an investor may lose his or her investment. “Return” refers to how an investment performs—how much it gains or loses over a period of time.

Different types of investments—stocks, bonds, and money market securities—have varying levels of risk and return potential. Generally, the higher the potential return on an investment, the higher the risk involved in pursuing that return. The following will help you determine how much risk and return potential an investment carries.

Sources of Risk

Broadly speaking, your investments are subject to varying degrees of market risk and inflation risk. Market risk is the possibility of your investment decreasing in value, while inflation risk is the chance of diminishing purchasing power. “For the most part, as the market risk of an investment increases, its inflation risk decreases, and vice versa,” says Robert Matricardi, CFP ®. a financial planner with T. Rowe Price.

Balancing Risk

The best way to manage market and inflation risk is to balance them according to your time horizon. For instance, if you’re investing over the short-term, purchasing bonds and cash equivalents can help reduce your exposure to market risk. Investors saving for retirement, on the other hand, may want to minimize the potential for inflation risk by allocating a greater portion of their assets to stock investments. “You could spend 30 years or more in retirement,” says Matricardi. “Holding a larger portion of equities has the potential to reduce your exposure to inflation over time.”

Investment risk is unavoidable. However, you can manage your exposure to risk by allocating your assets based on your time horizon and through proper diversification.

Diversification

Diversification, or spreading your assets across a variety of different types of investments, is an important rule to follow as an investor.

The reason for diversifying is simple. If you include a variety of investments in your portfolio, its overall performance should be less volatile—and you should have less risk—than if you put all your money in one type of investment.

Diversification offers this dual benefit because each kind of investment follows a cycle all its own. Each one responds differently to changes in the economy or the investment marketplace. If you own a variety of assets, a decline in one can be balanced by others that are stable or going up.

Of course, diversification cannot assure a profit or protect against loss in a declining market.

Monitoring & Maintaining Your Portfolio

Once you have set up your investment portfolio, you’ll want to review it at least once a year to make sure that your investment mix is still aligned with your financial objectives. Is your asset allocation still in line with your strategy? Is it time to reallocate your assets?

Be sure that your portfolio is diversified. Diversification can help reduce your portfolio’s market risk under various market conditions. It can also dampen the impact of a volatile market. Diversification cannot assure a profit or protect against loss in a declining market.

Rebalancing: Keeping Your Investment Strategy on Track

Investing is a long-term process. Choosing a well-balanced portfolio should help your investment accounts weather the inevitable ups and downs of the market over time. Sticking with your investment strategy does not mean ignoring your investments. Financial advisors suggest revisiting your asset allocation—the combination of stocks, bonds, and money market/stable value investments in your account—at least once a year to see if your portfolio needs to be rebalanced.

What Causes Your Portfolio to Change?

Over time, the rise and fall of financial markets could disturb your asset allocation, changing your investment mix. For example, suppose several years ago you chose to invest your portfolio to have 60% in stocks, 30% in bonds, and 10% in money market/stable value investments. If the value of your stock investments declined, your overall portfolio allocation could shift to 50% stocks, 40% bonds, and 10% money market/stable value investments. Rebalancing your portfolio simply means making adjustments to your allocation to restore your desired investment strategy.

Diversification cannot assure a profit or protect against loss in a declining market.