Invest in a Lump Sum or Small Chunks (Dollar Cost Averaging)

Post on: 26 Июль, 2015 No Comment

There are two major competing philosophies when it comes to investing: do I invest in a lump sum, or do I invest in small chunks (i.e. dollar-cost averaging)?

It also seems that almost every financial analyst has a different perspective when it comes to how to invest. Many recommend investing in small chunks and dollar cost averaging into your portfolio. This is the philosophy embraced by many TV personalities like Suze Orman. She is against investing in lump sums because she equates it to trying to time the market.

However, research on historical returns has shown that investing in a lump sum may actually be the better way to go. Here are the pros and cons of each.

The Pros of Dollar Cost Averaging

The biggest advantage of dollar cost averaging is the ability to invest small chunks over time. The best example of consistent dollar cost averaging would be your 401k. You invest a small amount every-other week with your paycheck (say, $100). Then, over time, your investments will smooth out the volatility in the daily stock market. The idea is that with the same $100, youll buy more shares when stock prices are low, and less shares when stock prices are high. That sounds appealing.

Dollar cost averaging makes a lot of sense in two key situations:

- You Dont Have The Money Upfront

- You Have a Hard Time Investing in the Stock Market

If you dont have the money upfront, investing a little at a time can be a great way to build an investment portfolio.

Also, if you have a hard time investing whether emotionally or just have trouble saving dollar cost averaging into the market can help you psychologically get started investing. By investing in a small amount, say $100 per month, you can feel like youre building a portfolio, while not worrying too much about price and volatility. That way, you can build savings,while minimizing the emotional toll of the stock markets price movements.

But dollar cost averaging isnt all that its cracked up to be by the financial pundits.

The Cons of Dollar Cost Averaging

There are two major disadvantages to dollar cost averaging.

- It Hurts Diversification and Portfolio Allocation

- It Doesnt Make Sense if you have a Lump Sum

Believe it or not, but dollar cost averaging has a negative effect on your portfolio allocation, which can diminish returns over time. Since dollar-cost averaging makes it difficult to get your ideal target allocation, and if youre working towards it with sequential investments, you may not get to it for a long period of time, you run the risk of not capitalizing on stock market returns.

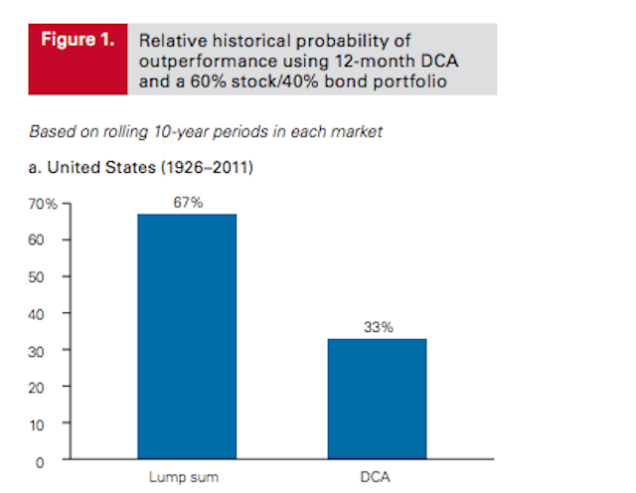

And if you have a lump sum, youre actually in a more ideal position to instantly invest into your target asset allocation. Historical returns show that lump sum investing has yielded higher returns 66% of the time. You can check it yourself using this calculator: Does Dollar Cost Averaging Work. So, if you have a lump sum, you probably shouldnt dollar-cost average it either.

The Alternative Investing in a Lump Sum

The better way to invest is to take a lump sum and invest in your target allocation in one move. The thought behind this strategy is that you can get to your ideal asset allocation immediately, and start taking advantage of market returns. Since statistics are in your favor (66% of the time), this can make sense for most non-emotional investors.

There are two unique scenarios where dollar-cost averaging wins every time, that you should be aware of. First, if you invest your lump sum right before a market crash (October 1987, October 2007), dollar cost averaging will outperform over time. Second, if you invest directly before a market slump (think summer of 2000), where there is no market crash, but a drastic decline over a longer period of time, dollar cost averaging will also outperform.

Im personally a lump sum investor. I prefer to keep my money in a cash account, like a savings account, until Ive decided where I want to invest. This strategy has proven very successful for me over time, because Ive been able to take advantage during odd market movements. Two examples in recent his history:

- My Best Investing Day Ever

- I invested in oil companies like Chevron and Exxon after the BP spill when the oil sector was beaten down

When there is broad market, or broad sector sell-offs, having a pile of cash on hand to invest in allows you to profit down the road. This is also very similar to what Warren Buffett does, by stockpiling cash until the time is right. I also recommend this strategy in my College Students Guide to Investing .

However, I do dollar-cost average as well, specifically in my 401k. However, I also try to make sure that my 401k jives with my total portfolio allocation, and is not just a stand-alone investment. So, even though dollar-cost averaging takes place, I try to not let it impact my overall allocation strategy.