Introduction to QFII

Post on: 12 Июнь, 2015 No Comment

QFII is the abbreviation of Qualified Foreign Institutional Investors. The QFII system is a mechanism used to qualify foreign institutional investors to make investment in China. When a country can not fully realize free currency conversion and liberalize its capital account, it will use QFII as a transitional arrangement to limit the introduction of foreign investment and the opening of the domestic capital market. By this arrangement, foreign investors intending to enter the country��s securities market must meet certain qualifications for getting the approval from the country��s competent authorities, transfer in a required amount of foreign currency and convert it into local currency, and invest in local securities market through a special account under strict oversight.

China has implemented the QFII system since 2002. CSRC officially issued the Measures for the Administration of Securities Investment within the Borders of China by Qualified Foreign Institutional Investors. QFII is allowed to invest in the shares (excluding B shares), treasury bonds, convertible bonds and corporate debentures listed on China��s stock exchanges and other financial instruments approved by CSRC.

l. Application requirements for QFII

(1) Fund management companies

At least 5 years of experience in assets management

Managed a minimum USD5 billion of securities assets in the most recent accounting year

(2) Insurance companies

At least 5 years of history after establishment

Held a minimum USD5 billion of securities assets in the most recent accounting year

(3) Securities companies

At least 30 years of experience in securities operation

No less than USD1 billion of paid-in capital

Managed a minimum USD10 billion of securities assets in the most recent accounting year

(4) Commercial banks

By total assets, ranked among Top 100 in the world in the most recent accounting year

Managing no less than USD10 billion of assets

(5) Other institutional investors (pension funds, trust companies, charitable foundations and donation foundations)

At least 5 years of history after establishment

Managed or held a minimum USD5 billion of securities assets in the most recent accounting year

2. The delivery process for QFII is illustrated as following:

3. Investment quotas for QFII

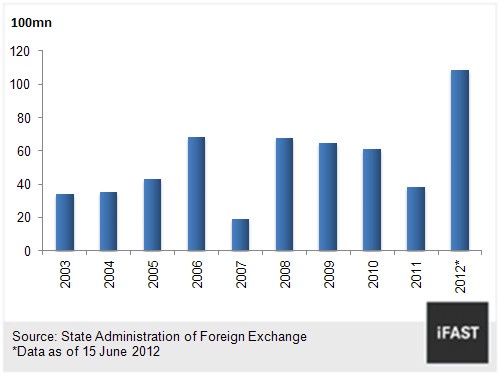

On the basis of what comes first is first handled, investment quotas must be approved by the State Administration of Foreign Exchange (��SAFE��). SAFE may adjust the investment quotas to align them with the economic and financial situations, the supply and demand on the foreign exchange market and the condition of international payments.

(1) The application for investment quotas must not be lower than USD20 million and accumulatively may not be higher than USD1 billion. Before starting investment, QFII must have a RMB cash balance equivalent to no less than USD20 million inside the borders of China.

(2) Qualified investors shall, within 6 months from the approval date of their investment quotas, remit their investment principal into China, and shall not make the remittance outside the time period without consent. If the investment principal is not remitted in full amount within the stipulated time period but exceeds USD20 million, the actual inward amount is the investment quota. If the principal remitted within the said time period accumulatively does not exceed USD20 million, the investment quota will become invalid.

4. Lock-up and repatriation of QFII investment principal

(1) The investment lock-up period is 3 months for qualified investors such as pension funds, insurance funds, mutual funds, charitable funds, donation funds, governments and monetary authorities and for Chinese open-ended funds established by the qualified investors. The investment lock-up period is one year for other qualified investors.

(2) If the inward (outward) remittance of Chinese open-ended funds is no higher than USD50 million, investors may file to the local branch of SAFE after remittance; otherwise, the application must be filed 10 working days in advance.

5. Type of investment targets for QFII

Type of investment targets: RMB-denominated financial investment instruments listed on China��s stock exchanges:

(1) Listed stock, excluding foreign-oriented stock (i.e. B share) listed in China

(2) Treasury bonds

(3) Corporate debentures and convertible bonds

(4) Other financial instruments recognized by CSRC

6. Restrictions on investment by QFII

(1) Individual investment: no higher than 10% of the total outstanding capital stock of a listed company

(2) Overall investment: subject to the special restriction set for the relevant sector, but no higher than 20% of the total outstanding capital stock of a listed company

(3) Any QFII whose shareholding exceeds the above-mentioned restrictions will be required to sell the excess within five working days.

7. QFII custodian banks

(1) Each QFII must appoint a custodian (custodian bank) to act as trustee in respect of opening of securities and cash accounts, execution of foreign exchange transactions, provision of custody service, cash delivery with the settlement company, and reporting services in line with regulatory requirements.

(2) At any time each QFII may only appoint one broker to fulfill its trading orders.