Introduction to investment decisions and its process

Post on: 16 Март, 2015 No Comment

Investment decision is also termed as the capital budgeting. Capital budgeting or investment decision means the process of taking efficient decisions when investing in the capital expenditure.

Capital expenditure contains three characteristics features. They are normally they have results in long term, many a times capital expenditure results in considerable outlays and reversing the capital expenditure is very hard and it is also very expensive.

It is an important issue in the corporate finance; therefore it is referred as the strategic asset allocation. As the capital budgeting decisions are important, businesses should make sure that sufficient time to be spent for planning these decisions as well as see that top executives from the field of marketing, engineering and production are involved carefully weighting up the proposals of capital expenditure.

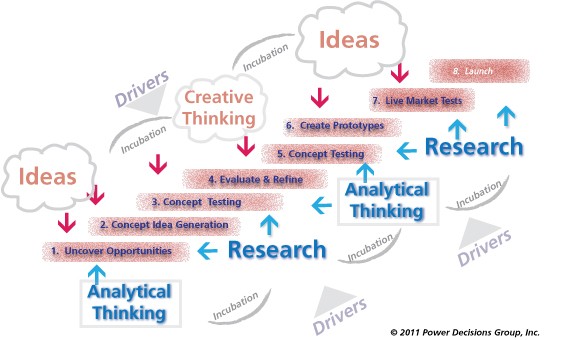

Process of investment decision

Investment decision is a complicated process that deals with the decisions that are associated to the investment of current earnings for the purpose of yielding benefits in future. The process of investment decision encompasses the following steps:

Proposals identification

Proposals identification is the first step in the process of investment decision. Normally proposals for the investment opportunities are developed from the top management or any other officials of the business. In case, if big businesses, the head of the department will evaluate various proposals and produce chosen proposals to the capital expenditure committee planning and sometimes to the officials who are responsible for investment decisions for long term.

Examining proposals

After identifying the proposals, the expenditure planning committee examines the proposals, and make sure that they are suitable with the business strategies from all ways.

Estimating various proposals

After examining the proposals, they are estimated in terms of profitability. For the purpose of estimating the profitability of proposals of capital investment the business utilizes various methods like net present value, payback period, return rate, internal rates of return etc. That proposals that are estimated should be classified into mutually exclusive, contingent and independent proposals.

Ranking the proposals

The proposals that are not profitable they are rejected, but the proposals that are profitable they will not be accepted immediately because of lack of funds. Therefore, after considering urgency, profitability and risk of the proposals business should give suitable ranking to them.

Preparation and final approval of budget of capital expenditure

The proposals that are suitable after estimation are recorded and accepted in the budget of capital expenditure. The proposals of less capital are decided expenditure amount to be incurred on the fixed assets during budget time.

Implementation of proposals

The proposals can be implemented only after the approval of capital expenditure planning committee to spend some specified amount on the proposal. During the period of implanting the project, period of completing the project as well as limit of cost should be decided for the purpose of avoiding delays as well as over costs. For the purpose of controlling and monitoring the implementation of projects, business can utilize the network techniques such as method of critical path and review technique of program evaluation.

Performance review

Investment decision process ends with the estimation of performance of the project. For the purpose of performance a post completion audit is performed by comparing the actual expenditure with actual returns and budgeted expenditure with expected returns. If any adverse variances are found during the source of auditing for their existence should be identified as well as corrective measures should be undertaken for the purpose of avoiding them in future.