Introducing the Wealthfront SingleStock Diversification Service

Post on: 1 Май, 2015 No Comment

W hen LinkedIn went public in 2011, the company had about 1,500 employees. Traditional private wealth managers were ubiquitous on campus in their efforts to sign-up the 50 to 100 early employees and executives who met their firms multi-million dollar minimums. Unfortunately, that was of little help to the 1,400 other employees at the company looking for support. At Wealthfront, we believe everyone deserves sophisticated financial advice. Today, were launching the service I wish the entire LinkedIn team could have had access to back in 2011.

Introducing the Wealthfront Single-Stock Diversification Service. This service will help solve a critical problem for many that work at public technology companies: How to best diversify concentrated holdings in your companys stock. Such holdings are often in concentrated blocks that are cumbersome to manage and sell and confusing to pay taxes on. Almost every employee at a public company ends up with a large amount of her net worth in her employer’s company stock, and at newly public companies it can be 90% or more. Our new service will initially be open exclusively to Twitter employees and shareholders, but will eventually be open to all Wealthfront clients. (If you want your company added to the service, sign up here )

The Challenges of Single Stock Concentration

At Wealthfront, we agree with the academic consensus that diversifying across a broad variety of low-fee and tax-efficient index funds representing major asset classes is the best way to build long-term wealth. Holding onto all of your wealth in one stock (especially a young, volatile tech stock) exposes you to an extreme amount of risk.

Individuals who find they are suddenly managing a large concentration of a single stock understand the risk involved, but are commonly conflicted and wrestle with several tough questions:

- What strategy should I use to sell my stock?

- How can I implement it reliably, without mistakes and with good execution?

- How can I make sure I plan for taxes intelligently?

Choosing a strategy to address these concerns is complex. Faced with these choices, many succumb to decision-paralysis and just do nothing. Unfortunately, doing nothing prolongs the exposure to unnecessary risk. Wealthfront designed its service to make this easier for everyone.

How Does it Work?

The first problem that people have is figuring out what they should do with their stock. Selling too soon locks in your return, but at the expense of upside potential. Holding on to everything lets you capture more upside, but with the tradeoff of far more risk.

The Single-Stock Diversification Service solves this problem by giving users two simple controls :

- How much stock you would like to sell up-front?

- How quickly would you like to sell the remainder?

In building the service, our investment research team analyzed over 200 previous IPOs to arrive at five different options that should address most situations faced by tech employees. Once you select a plan, we’ll automatically sell down your stock, commission-free, on a schedule that fits your needs and desired level of risk. Well also do it in a tax aware way. Our service was built to accommodate exercised stock options, RSUs and in some cases, stock obtained in an acquisition.

Sells Your Stock Throughout the Quarter & Gets You Out of the Market-Timing Business

While it’s impossible to time the market, selling gradually can limit your execution risk — the risk you pick the wrong day to sell your stock (when its price is low) or buy new stock (when its price is high). Selling gradually over time also allows you greater control over your tax bill. The Wealthfront Single-Stock Diversification Service can sell your stock every day throughout each quarter while also respecting trading blackouts. Selling daily throughout your open trading window maximizes the benefit of dollar cost averaging. Selling daily is also something that would be tedious to do on your own, not to mention expensive, as you would likely have to pay commissions on every sale elsewhere. You’ll never pay commissions on the trades Wealthfront makes for you.

Cash generated from the sale of your stock will be placed in reserves for your taxes owed on the sale and your other short term needs, and the remainder will be invested in a diversified, low-cost, and tax efficient investment portfolio customized for your risk tolerance and financial profile.

The Benefits of an Automated Investment Service

Wealthfront has a track record of offering low-cost, high-value automated solutions for long term investors. A little more than two years ago, we launched our automatically rebalanced diversified portfolio. A little over a year ago, we introduced daily tax-loss harvesting. A few months ago, we introduced an entirely new dimension in tax-loss harvesting when we introduced our Wealthfront Tax Optimized US Index Portfolio . This same desire to innovate led us to develop the Wealthfront Single Stock Diversification Service .

Having a large portion of your net worth in a single stock is exactly the type of financial problem that benefits from not only having a plan, but also having an automated investment service to take care of it for you.

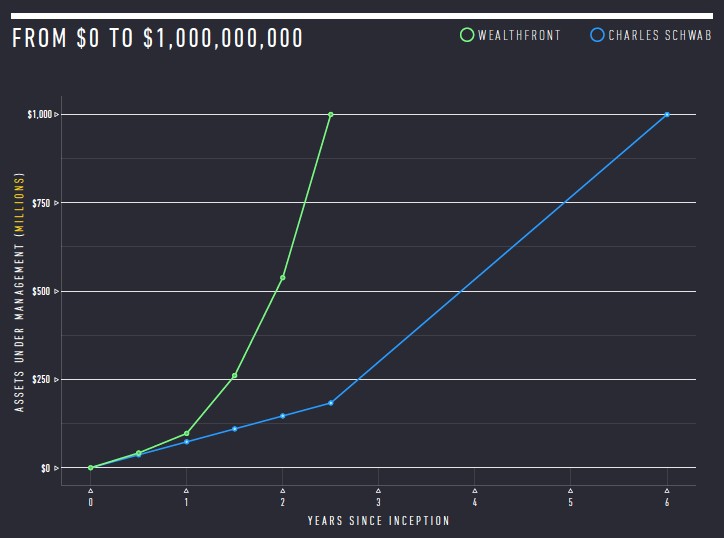

Many of us at Wealthfront have experienced first-hand the difficult decisions required in handling a concentrated stock position. We believe the combination of Wealthfronts single-stock diversification and tax loss harvesting services represents the most compelling product offering available to anyone with a concentrated stock position. With over $800 million in assets under management and strong financial backing. we look forward to helping you reach your financial goals for years to come.

Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront clients. This article is not intended as tax advice, and Wealthfront does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction.

The graphs analyzing the different selling schedules and image of the Wealthfront client dashboard are being provided for informational purposes only and do not represent actual client trading. There is a potential for loss as well as gain that is not reflected in the information presented. Projected returns are not a guarantee of actual performance.

Related Posts:

Announcing the Wealthfront Single-Stock Diversification Service for Facebook

The Math Behind the Single-Stock Diversification Service

Improving Tax Results for Your Stock Option or Restricted Stock

The 14 Crucial Questions About Stock Options