Intrinsic Value of Stocks How to Estimate

Post on: 16 Март, 2015 No Comment

Intrinsic Value of Stock

To know if the price you are paying for a stock is fair, you need to have a good estimate of the value of the underlying business, or the intrinsic value that each share represents. While the stock price fluctuates based on the demand and supply of the shares in the secondary market, the business value only changes when the business conditions change. Over time, the intrinsic value and the stock price tend to correlate, in the short term there might be discrepancies large enough that an intrepid investor can exploit for profit. Learning about intrinsic value will help you value stocks to buy .

While every value investor might have his or her own interpretation of financial statements and myriad of adjustments that the investor has carefully refined over a course of time, the basic principles of estimating intrinsic value remains the same.

Personally I approach each stock valuation in two steps. On some happy occasions, Step 2 might be rendered unnecessary if Step 1 shows enough value to make a purchase determination.

Step 1: Balance Sheet Valuation

Sometimes a company might have a balance sheet that is stronger than the value the stock suggests in the market. Some of the more common metrics to look at are the Book Value of the company compared to the Market Value – known as the Price/Book ratio, Price to Net Tangible Assets (where intangibles such as Goodwill are removed) and Net Current Asset Value (NCAV).

Usually though, an investor will need to adjust the balance sheet to reflect proper market values of the assets that are carried on the balance sheet. For example, inventory is carried at cost which may not be reflective of its market value. If the company follows LIFO inventory accounting, the balance sheet will show cost values that may be many months or even years old. Or in cases where the company may be financially struggling or the industry is in terminal decline, perhaps assigning scrap or liquidation value to the inventory may be more appropriate.

One will often find that a company may be carrying quite a bit of long held assets at very low valuation. This may be the case when the assets have been depreciated for years on end down to a very low value. The real market value of these assets may be significantly higher than what the balance sheet shows, so an adjustment here is appropriate as well.

Net-Net Stocks . These are stocks of companies whose Current Assets – Total Liabilities exceed the current market value. No adjustment is necessary, and the current asset line is hard to fake as it is mostly comprised of cash and equivalents and short term receivables. These are classic value plays, and any such stock will be a great purchase regardless of the company profitability. The argument is that the company can be quickly liquidated and all debts paid off for a quick profit. Even if the management or the conditions are such that the company destroys shareholder value at a good clip if allowed to continue to operate, this opportunity will be quickly realized and shareholders will force a change. These stocks can be rare to find but there are still a few opportunities like this we discuss in the premium area .

Step 2: Determining Earnings Power

While the investment community stays pre-occupied with earnings and profit margins, these metrics are typically less useful to generate good value investing ideas, except in the cases where the company might enjoy a defensible competitive advantage (also called a moat) that it can exploit for the long term. In absence of a moat, every company’s profits will revert to the mean industry profit, and there is no particular advantage in purchase of that stock unless a balance sheet valuation suggests a compelling value.

If a company is not undervalued based on its balance sheet, and has no defensible long term competitive advantage, I am generally not interested.

If a company does possess a moat, an investor will be able to find the evidence of it by comparing the company’s profitability indicators such as Return on Equity, Gross Margins, Net Profit Margin, etc with its competitors. An investor still needs to be able to identify what this particular competitive advantage is and whether it is sustainable. These can be anything from regulatory approvals, better economic scale, superior R&D, brand loyalty, government subsidies, etc.

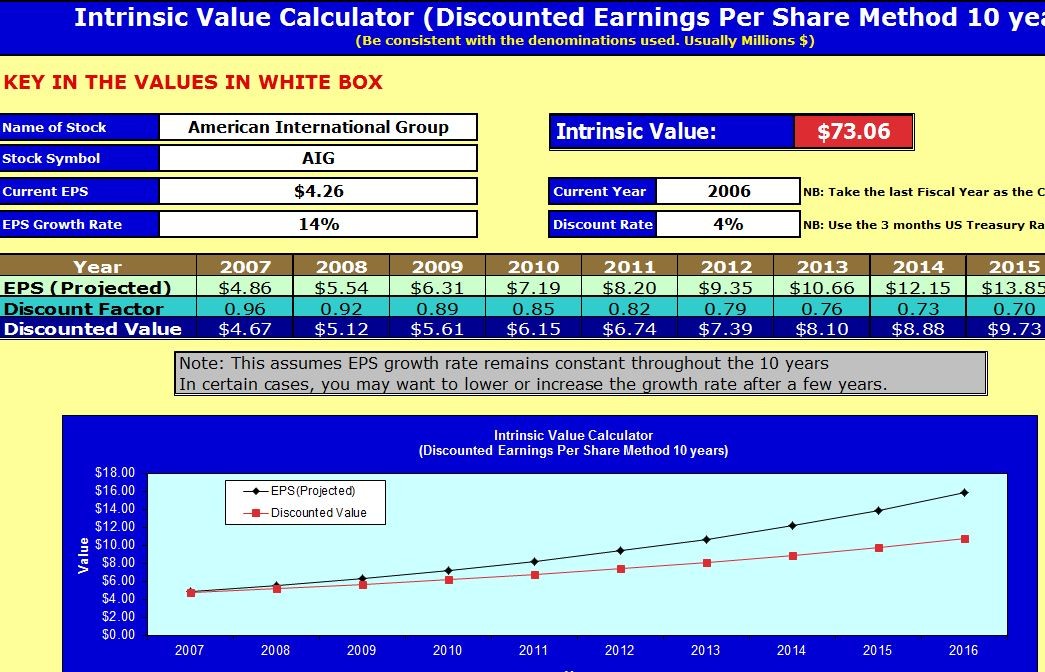

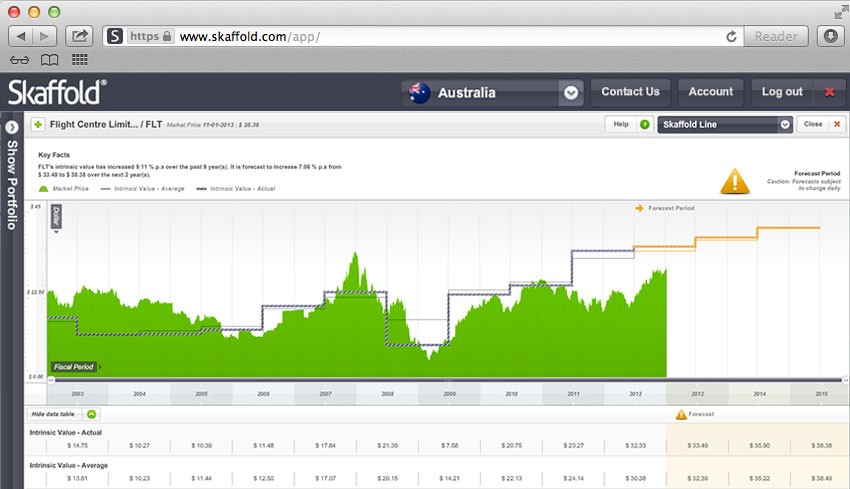

If a moat exists, than an investor can start extrapolating company earnings. growth rates, etc in the future, assume a terminal valuation, select a discount rate and determine a value of these earnings on a per share basis today. The problem I have with this process is that earnings extrapolation, growth rates, terminal valuation and an estimate of discount rate (which is based on the investor’s judgment on how risky the business is going to be in the future) are all just assumptions, and will be very different from the reality when that happens. It can lead to a very precise, but ultimately inaccurate estimation of the intrinsic value.

Value investing is all about getting as close to the sure thing as possible and removing as much risk as we can. That is why I am partial to the Balance Sheet valuation and will only look at the income statement when the company appears to be highly profitable and possess a moat. Markets too have a better time converging on the asset values while future estimates remain volatile as ever.