International Valuation Glossary

Post on: 10 Июнь, 2015 No Comment

This Glossary is produced to help promote consistency in the usage of words and terms that are common in valuation assignments of different types. Some of the definitions appear in the International Valuation Standards, in Technical Information Papers or in other IVSC publications, but others commonly occurring words and terms used in valuation practice are included.

The definitions included meet the following criteria:

- The Glossary should only include words or terms that either:

- have a meaning when used in a valuation context that either differs from, or is more specific than, their meaning in everyday usage,

- are technical, ie they may not be familiar to a reader who has a reasonable level of business knowledge and sophistication, or that have proved difficult in translation into languages other than English, or

- are definitions used in the International Valuation Standard, a Technical Information Paper or other IVSC publication.

The definitions in this glossary are those recommended by the IVSC, but other definitions and terms exist. Users of this Glossary are advised to check whether the IVS definition was intended before relying on a definition it contains to interpret any document. The International Valuation Standards Council, the authors and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this publication, whether such loss is caused by negligence or otherwise.

The copyright in this Glossary belongs to the IVSC. Individual words and terms defined in the Glossary together with their associated definitions may be used in documents produced in the normal course of business or for educational purposes providing the source of the definition is acknowledged as the IVSC. Otherwise the Glossary is subject to the terms of use of this website.

The IVSC keeps this Glossary under review and any updates are made on 1 January and 1 July each year. It welcomes suggestions for either additional definitions or amendments to an existing definition. If suggesting a new definition please have regard to the criteria noted above. The final decision on whether to accept a recommendation rests with the IVSC Standards Board. The IVSC cannot enter into correspondence over any decisions made in respect of this Glossary.

Glossary updated: 1 January 2015.

Suggest a change or addition to Glossary

Click one of the letters above to advance the page to terms beginning with that letter.

All Risks Yield

The reciprocal of the Capitalisation Factor, usually expressed as a percentage.

Annuity

A series of annual payments made or received at intervals either for life or for a fixed number of periods.

Appraisal

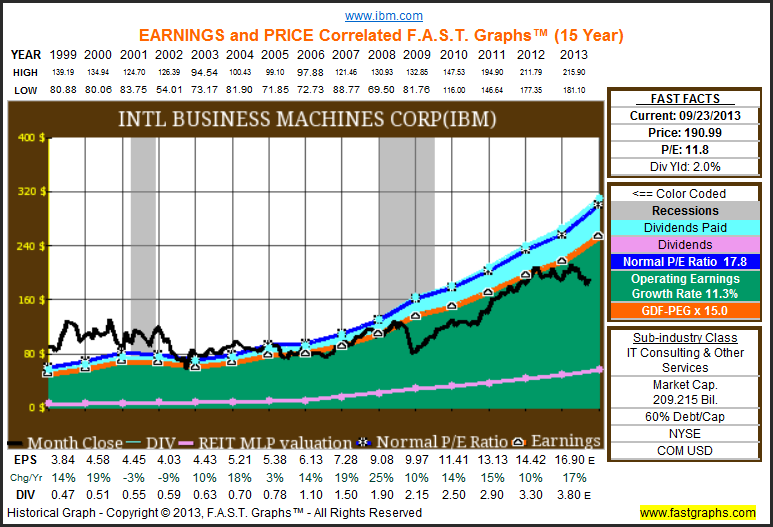

Arbitrage Pricing Theory

A multivariate model for estimating the cost of equity capital, which incorporates several systematic risk factors.

A method of indicating the value of a business, business or business interest based on a summation of the net value of the individual assets and liabilities. Since each of the assets and liabilities will have been valued using either the market, income or cost approaches, it is not a distinct valuation approach.

Basis of Value

A statement of the fundamental measurement assumptions of a valuation.

Beta

A measure of systemic risk of a stock; the tendency of a stock’s price to correlate with changes in a specific index.

Blockage Discount

An amount or percentage that would be deducted by market participants from the current market price of a publicly traded stock to reflect the decrease in the value per share of a block of stock that is of a size that could not be sold in a reasonable period of time given normal trading volumes.

Book Value

Business (Business Enterprise)

A commercial, industrial, service, or investment entity (or a combination thereof) pursuing an economic activity.

Business Risk

The degree of uncertainty of realising expected future returns of the business resulting from factors other than financial leverage.

Capital Asset Pricing Model (CAPM)

A model in which the cost of capital for any stock or portfolio of stocks equals a risk-free rate plus a risk premium that is proportionate to the systematic risk of the stock or portfolio.

Capital Structure

The composition of the invested capital of a business enterprise; the mix of debt and equity financing.

Capitalisation

- the conversion of a periodic income to an equivalent capital value,

- the Capital Structure of a business entity, or

- the recognition of expenditure in a Financial Statement as a capital asset rather than a periodic expense.

Capitalisation Factor

The multiple applied to a representative single period income to convert it into a capital value.

Capitalisation Rate

The return represented by the income produced by an investment, expressed as a percentage.

Carrying Amount

The amount at which an asset is recognised in the financial statements of an entity after deducting any accumulated depreciation and any accumulated impairment losses.

See also: Book Value

Cash Flow

Cash that is generated over a period of time by an asset, group of assets, or business enterprise. Usually used with a qualifying word or phrase.

Contract Rent

The rent specified in a lease. May differ from the market rent.

See also: Market Rent

Contributory Asset Charges

A charge to reflect a fair return on or return of Contributory Assets used in the generation of the cash flows associated with the intangible asset being valued.

Contributory Assets

Any tangible or intangible assets used in the generation of the cash flows associated with the intangible asset being valued.

See also: Contributory Asset Charges

Control Premium

An amount or a percentage by which the pro rata value of a controlling interest exceeds the pro rata value of a non-controlling interest in a business enterprise, to reflect the power of control.

Cost Approach

A valuation approach based on the economic principle that a buyer will pay no more for an asset than the cost to obtain an asset of equal utility, whether by purchase or by construction.

Cost of Capital

The expected rate of return that the market requires in order to attract funds to a particular investment.

Credit Risk

The risk that one party to a contract will cause a financial loss for the other by failing to discharge an obligation.

Current Assets

Cash and assets that are reasonably expected to be converted into cash within one year in the normal course of business.

See also: Current Liabilities

Current Liabilities

Debts or obligations that are due within one year.

See also: Current Assets

Default Probability

The likelihood of a counterparty not honouring its obligations.

Depreciated Replacement Cost Method

A method under the cost approach that indicates value by calculating the current replacement cost of an asset less deductions for physical deterioration and all relevant forms of obsolescence.

Discount for Lack of Control

An amount or percentage deducted from a pro-rata share of the value of 100 percent of an equity interest in a business, to reflect the absence of some or all of the powers of control.

Discount Rate

A rate of return used to convert a future monetary sum or cash flow into present value.

Discounted Cash Flow Method

A method within the income approach in which a discount rate is applied to future expected income streams to estimate the present value.

Economic Life

The total period of time over which an asset is expected to generate economic benefits for one or more users.

See also: Useful Life

Economic Obsolescence

A loss of utility caused by factors external to the asset, especially factors related to changes in supply or demand for products produced by the asset, that results in a loss of value.

Enterprise Value

The total value of the equity in a business plus the value of its debt or debt-related liabilities, minus any cash or cash equivalents available to meet those liabilities.

See also: Invested Capital

Entity Specific Factors

Factors that are specific to an entity and not available to market participants generally.

See IVS Framework.

Equity

The owner’s interest in an asset or business after deduction of all liabilities.

Equity Instrument

Any contract that creates a residual interest in the assets of an entity after deducting all of its liabilities.

Equity Risk Premium

A rate of return added to a risk-free rate to reflect the additional risk of equity instruments over risk free instruments (a component of the cost of equity capital or equity discount rate).

Equity Value

The value of a business to all of its shareholders

Excess Earnings

That amount of anticipated economic benefits that exceeds an appropriate rate of return on the value of a selected asset base (often net tangible assets) used to generate those anticipated economic benefits.

Excess Earnings Method

A method of estimating the economic benefits of an intangible asset by identifying the cash flows associated with the use of the asset and deducting a charge reflecting a fair return for the use of contributory assets.

Expected Negative Exposure

The discounted payments and unrealised losses an entity expects to pay to a counterparty.

Expected Positive Exposure

The discounted receipts and unrealised gains an entity forecasts will be recieved from a counterparty

External Obsolescence

A loss of utility caused by economic or locational factors external to the asset that results in a loss of value.

External Valuer

A valuer who is not employed by the owner or manager of an asset.

Fair Value

i. The estimated price for the transfer of an asset or liability between identified knowledgeable and willing parties that reflects the respective interests of those parties. For use in financial reporting under International Financial Reporting Standards. fair value has a different meaning:

ii. In IFRS 13 “Fair Value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

The distinction between these two definitions and their usage is discussed in the IVS Framework paras 39-43 and IVS 300, paras G1-G2

Fairness Opinion

An opinion on whether the financial terms of a proposed corporate transaction are fair to the equity holders of an entity involved.

Financial Instrument

A contract that creates rights or obligations between specified parties to receive or pay cash or other financial consideration, or an equity instrument.

Financial Reporting Standards

Any recognised or adopted standards for the preparation of periodic statements of an entity’s financial position. These may also be referred to as accounting standards.

See also: International Financial Reporting Standards

Financial Risk

The degree of uncertainty of realizing expected future returns of the business resulting from financial leverage.

Financial Statement

A periodic statement of an entity’s financial position

Free Cash Flows to Equity

Cash flows available to pay out to equity owners after funding operations of the business, making necessary capital investments, and increasing or decreasing debt financing.

See also: Free Cash Flows to the Firm

Free Cash Flows to the Firm

Cash flows available to pay out to equity holders and debt investors after funding operations of the business enterprise and making necessary capital investments.

See also: Free Cash Flows to Equity.

Functional Obsolescence

A loss of utility resulting from inefficiencies in the subject asset compared to its replacement that results in a loss of value.

Going Concern

A business enterprise that is expected to continue operations for the foreseeable future.

Any future economic benefit arising from a business, an interest in a business or from the use of a group of assets which is not separable.

Highest and Best Use

The use of an asset that maximises its potential and that is physically possible, legally permissible and financially feasible.

Impairment

A loss in the future economic benefits, or service potential of an asset, over and above the systematic recognition of the loss of the asset’s future economic benefits or service potential through depreciation or amortisation.

Income Approach

A valuation approach that provides an indication of value by converting future cash flows to a single current capital value.

Initial Yield

The initial income from an investment divided by the price paid for the investment expressed as a percentage.

Intangible Asset

A non-monetary asset that manifests itself by its economic properties. It does not have physical substance but grants rights and economic benefits to its owner.

Internal Rate of Return

The discount rate at which the present value of the future cash flows of the investment equals the acquisition cost of the investment.

International Financial Reporting Standards

Standards and interpretations adopted by the International Accounting Standards Board (IASB). They comprise:

- International Financial Reporting Standards,

- International Accounting Standards, and

- Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC) or the former Standing Interpretations Committee (SIC)

Invested Capital

The sum of equity and debt in a business enterprise. Debt can be either (a) all interest-bearing debt or (b) long-term, interest-bearing debt. When the term is used, it should be supplemented by the appropriate qualifying words.

See also: Enterprise Value

Investment Method

A valuation method under the Income Approach that capitalises expected future income or utility as a basis for estimating value.

Investment Property

Property that is land or a building, or part of a building, or both, held by the owner to earn rentals or for capital appreciation, or both, rather than for:

- use in the production or supply of goods or services or for administrative purposes, or

- sale in the ordinary course of business.

Investment Value

The value of an asset to the owner or a prospective owner for individual investment or operational objectives.

Lease

An agreement whereby a lessor grants the right to use an asset for an agreed period of time to a lessee in return for a payment or series of payments.

Lessee

A person or corporate entity to entitled to use an asset under the terms of a lease.

Lessor

A person or corporate entity that grants another the rights to use an asset under the terms of a Lease in return for the receipt of a payment or series of payments.

Levered Beta

The beta reflecting a capital structure that includes debt.

See also: Beta

Liquidation Value

The net amount that would be realized if a business is discontinued and its assets are sold individually. The appropriate bases of value and any appropriate additional qualifying assumptions should also be stated.

A measure of the ease with which an asset may be converted into cash. A highly liquid asset can be easily converted into cash; an illiquid asset is difficult to convert into cash.