International Diversification with Stocks

Post on: 3 Май, 2015 No Comment

Share the post International Diversification with Stocks

When it comes to ones portfolio, its generally important to avoid putting all of your eggs in one basket. At least, thats conventional wisdom thats dispensed to most people.

Frankly, I find it hard to disagree with that conventional wisdom. For example, keeping ones entire savings in cash is usually not considered to be smart. At least, not for someone with many years to retirement. The rate of return of investments matters, and youre not likely to get much by keeping money in cash or cash equivalent. Im not picking on the obvious asset class here; the notion of not putting everything in one basket can apply elsewhere too

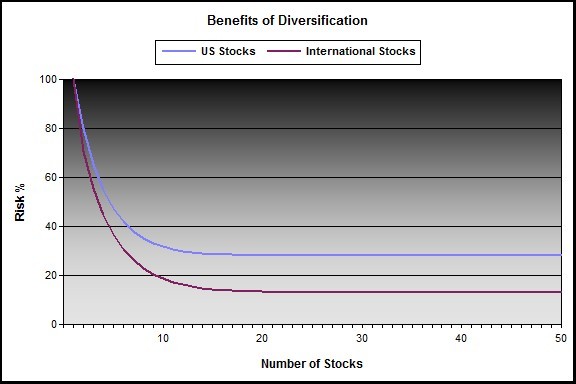

So, we keep our funds in different asset classes. Cash, bonds, real estate, stocks.you get the idea. With respect to the latter, there can be significant diversification opportunities as well. We can invest in individual stocks, ETFs, maybe funds. In terms of companies, we can invest in small companies, mid-size, or large blue chippers.

There is also the opportunity to find investment opportunities in different countries as well. Sometimes, it might entail buying shares in a multi-national company traded on a specific exchange but doing business in many different markets. There is some inherent diversification in such companies, as they are managing risk by doing business in different markets.

Other times, there are simply companies that do business in specific markets and are traded on those companys markets. Its possible to buy shares of companies on a variety of different exchanges. For example, one could purchases shares trades on the NYSE in the U.S. Others following the Australian market might be focused on asx share prices. Or, perhaps people might buy shares of companies traded on the NIKKEI, which is Japans stock exchange. Whatever the case, stocks are traded on many exchanges globally, and this presents quite a few opportunities for investors to diversify.

That being said, how many people actually look to diversify internationally? Ive shared a story about how I attended a going away part for someone retiring years ago, of a full generation older than me. He enthusiastically encouraged everyone to put their investments fully into the companys stock! I couldnt believe how everyone applauded him for that, when clearly he was making such a ridiculous suggestion. Sure, it may have worked for him but it was a very risky move that could have really damaged his retirement plans if it was a different company in different market conditions.

So, given that approach to diversification, I wonder how many people really focus on international stocks at all. Investing everything in ones home country might offer a lot of diversification, but in a global economy could it be somewhat analogous to that guy who put everything in one companys stock?

Frankly, I dont focus nearly enough on stocks outside of my own home country. Ive talked about it and written about it, but checking my own portfolio, its extremely domestic in focus. Not exclusively, but perhaps too much so now. Maybe its time to revisit this? After all, investment opportunities are in many corners of the world.

My Questions for You

Do you diversify your investments internationally, or do you primarily focus on domestic investments?

If you dont diversify internationally, whats your rationale?

Share the post International Diversification with Stocks

Comments

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% Bryce @ Save and Conquer says

Our asset allocation in percentages is 41/9/50 Total US Stock Market/Total International Stock Market/Bonds. Remember that many US firms have international components. The company that my wife and I work for has many divisions in the US, but also in Denmark, Germany, Spain, France, Italy, Netherlands, Norway, Russia, Israel, Philippines, China, and more.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% Mark Ross says

Im from the Philippines, whats the name of your company that you are working for Bryce?

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% S. B. says

Most U.S. multinationals already have a high level of international exposure. But I also diversify through Vanguard international funds and ETFs, as well as a few individual mega-cap stocks from the UK and China.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48&r=G /% C. the Romanian says

Well, one thing is clear: you can safely cut Romania off the list of international diversification :)) I am looking into getting into the stock market (I am still a complete noob here so I still have to do some research) but in my case it will clearly have to be something outside Romania.