Internal Pay Equity Methodologies

Post on: 6 Апрель, 2015 No Comment

- What is Internal Pay Equity?

- How to Implement Internal Pay Equity

- Internal Pay Equity Spreadsheet Samples

- Practice Pointers

- Investor Desire for Internal Pay Equity

- Legislative Actions

- Media Articles

- Rolling Back Compensation Practice Area

- Hold Until Retirement Provisions Practice Area

- Clawback Provisions Practice Area

- Caps on Pay Elements & Total Compensation Practice Area

- What is Internal Pay Equity?

American capitalist J.P. Morgan is reputed to have had a rule that he would not invest in a company whose CEO was paid more than 50% above the executives at the next level. He reasoned that, if the CEO was paid more, he wouldn’t have a team but only courtiers.

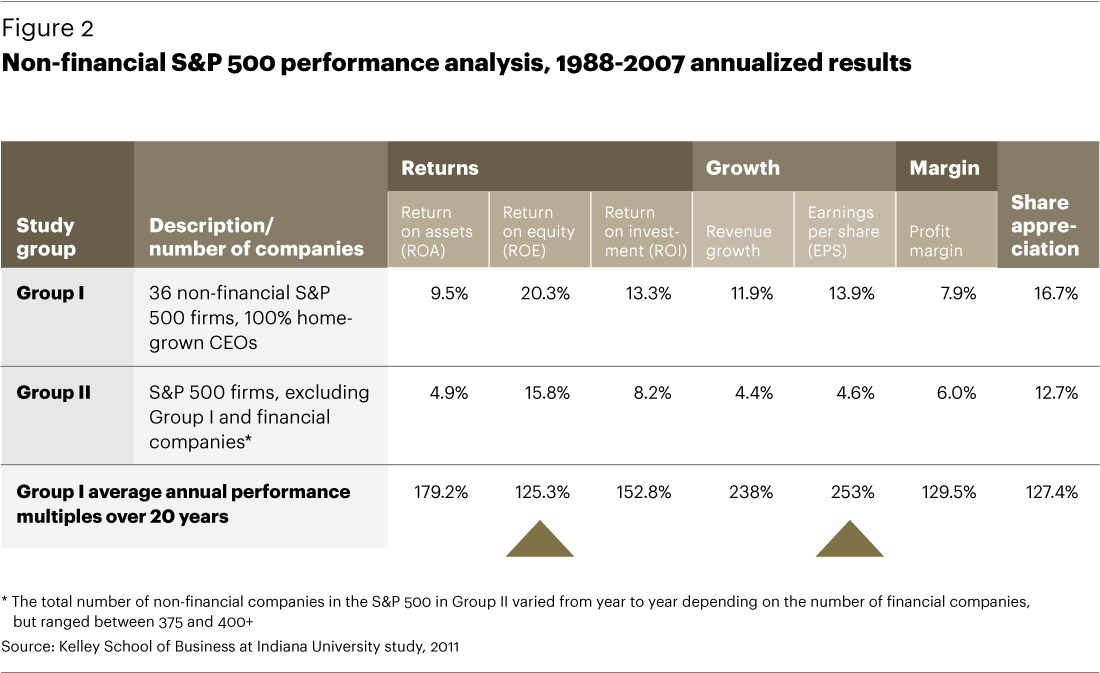

One corrective approach for addressing excessive compensation that we like is what we call the internal pay equity check — following the Dupont and Intel models of checking for internal pay equity at various levels within a company to ensure that the CEO’s compensation has not gotten out of line within the company.

Compensation committees should direct their HR people to provide a comparison chart that goes back to the 1980s (when the gaps began to get out of line) comparing the gaps in compensation levels within the company between the CEO and NEOs and senior and mid-level executives, down to the rank and file (and including all components of compensation, e.g., SERPs and perks and accumulated option and restricted stock gains, etc.) as a framework to bring the CEO’s (and, in some cases, NEOs’) total compensation back in line.

- Why implement it: Jeff Immelt and other CEOs are now speaking out for more boards to implement internal pay equity for two key reasons: (1) restore fairness internally and to address growing internal disaffection and disconnect between the CEO and a company’s senior managers and (2) as an important benchmark to avoid excesses, which is why ISS guidelines were recently revised to focus on internal pay equity disparity.

Regarding excesses, many boards have been lulled by data and surveys into assuming that their CEO’s compensation is in line. An internal pay equity analysis should reveal whether a CEO’s compensation has gotten out of line internally, notwithstanding the external data and surveys (which typically only compare each pay element one at a time, instead of taking into consideration total compensation).

- How to use it: By conducting an internal pay equity analysis, a company can see whether — and where — its CEO’s compensation has gotten out of line. At many companies, a quick glance at the cash component may give the impression that the ratios are not out of line and that a 1.5 or 2x ratio between the CEO and, say, the CFO exists. This is why it is so important to check against all pay elements. At many companies, the two components that will need an adjustment are the equity component and the post-employment provisions (followed next by perks). At a number of companies, it may also be necessary to focus on amounts accumulated from past grants or to be earned from outstanding incentives, which can help uncover additional ongoing inequities or unintended amounts/outcomes.

- What is the correct ratio: Companies will have different structures and cultures, so one shoe may not fit all. (J. Pierpont Morgan used a 1.5x ratio as the test for companies he would invest in.) A key reason for conducting an historical internal pay equity analysis -going back several years — is to see what a company’s ratios were before they started getting out of line—and to ascertain what events or elements may have gotten the company off track. For some companies, this may require going back as long as 20 years. This historic analysis can help a board determine what the proper ratio should be for a particular CEO.

- What is the correct amount: Many boards grapple with the question: how much? Internal pay equity provides an objective way to address that difficult question. For example, if a company has determined that the proper ratio between its CEO’s total compensation and the CFO’s is 2x, but in fact, when adding in the equity and other components, the CEO’s compensation is above 2x — the board will now have an objective benchmark to bring the CEO’s compensation back in line.

- GE CEO Jeff Immelt Speaks Out for Internal Pay Equity: Mr. Immelt said that, to motivate staff and avoid excesses, chief executives’ pay should remain within a small multiple of the pay of their 25 most senior managers. ‘The key relationship is the one between the CEO and the top 25 managers in the company because that is the key team. Should the CEO make five times, three times or twice what this group make? That is debatable, but 20 times is lunacy,’ he said. Mr. Immelt, who last year received $3.2m in salary and no cash bonus, added that his pay was within the 2-3 times range.

- How to Implement Internal Pay Equity

Internal pay equity is a simple benchmarking tool that analyzes the historical relationship between the CEO’s pay against one or more layers of the company’s workforce. Internal pay equity seems to make so much common sense, it is confounding as to why it is not universally used to set CEO pay. After all, it is the primary methodology by which the rest of the work force is paid. This is why many, like General Electric CEO Jeff Immelt, are calling for its greater use.

Internal Pay Equity Alternatives. There are many possible ways to establish an internal pay equity methodology, including:

- A numerical relationship between the CEO’s pay and that of other executive officers (e.g. DuPont)

- A numerical relationship between the CEO’s pay and that of the company’s overall workforce (e.g. Intel)

- A numerical relationship between the aggregate pay of all senior managers and that of company’s overall workforce

Organization structure and culture will influence the appropriate internal pay equity ratio. Here are some examples of considerations to take into account:

- High vs. low number of general managers (high number could lead to lower ratio)

- Team-oriented vs. hierarchical (team-oriented would have a tighter ratio)

- Presence of a COO (if COO is absent, ratio of CEO to 2 nd highest paid may be higher)

- Number of CEOs over time period (a higher number might lead to a higher ratio)

- CEO hired from the outside, while rest of team is internal ( might lead to higher ratio)

Interestingly, internal pay equity was routinely used as a tool to help set CEO pay levels until relatively recently. In fact, at the turn of the last century, J. Piermont Morgan refused to provide a loan to any company unless the CEO was paid no more than 50% greater than any other executive at the company. His rationale was that he didn’t trust any CEO who thought too highly of themselves and were paid accordingly.

Analyzing the Issues: Fred Cook, Founder of Frederic W. Cook & Co. provides these reasons as to why boards should use internal pay equity:

- It is fair

In addition, internal pay equity helps increase transparency and might uncover unintended consequences of historical executive compensation decisions. As peer benchmarking becomes increasingly maligned, it is expected that internal pay benchmarking will once again become the primary benchmarking method that boards use to set CEO pay.

To start the internal pay process, boards should start by evaluating the relationships for both total direct compensation and total remuneration (i.e. including special executive benefits and perquisites, assuming these are significant). Then, if these analyses raise red flags, the analysis can be pursued by component of total compensation, including a break out by long-term incentive component.

Boards should choose a relevant time period for the internal pay audit to cover. In some cases, companies may choose to go back 10 to 20 years (e.g. although this won’t be possible for all companies, since some companies and managers have not been around since the mid-80s; in addition, some business models have changed so dramatically that too far a look-back may not be sufficiently relevant).

It is important to choose a time frame that will allow a good understanding of how the current pay program and pay for particular executive officers came to be, and the changes that have evolved over time. For companies that are already looking at multi-year tally sheets, they can use this data for this analysis.

Once a company has conducted an internal pay equity audit, management and the board should determine whether they feel comfortable both with the internal pay equity relationships that exist today and the changes in those relationships that have taken place over time.

It is important to note that the internal pay audit is intended to be an internal look, not something that is benchmarked across companies. This might be one reason why the practice has diminished in recent years – benchmarking databases maintained by compensation consultants provide no help here. This is an exercise that must be undertaken internally, although guidance from experienced consultants can help guide you through the process.

—Blair Jones, Semler Brossy Consulting Group