Interest Rates Effect on currency & Foreign Exchange

Post on: 27 Май, 2015 No Comment

How do Interest Rates Affect Foreign Exchange Market [Forex]

Introduction

Interest rates are the price of money. It is a percentage that translates into an amount of money by which you pay for the use of money. This percentage is set by the Superintendence of Banks and Financial Institutions and the transgression of this limit is punishable by law.

What is Interest Rate?

In the field of economics and finance, the concept of interest refers to the cost of having a credit or to profitability of savings. It is a term that, therefore, can describe the profit, utility, value or gain of a particular thing or activity.

If it is a deposit, the interest rate that expresses the payment received by the person or company who deposits the money by putting that amount available to the other. If it is a loan, the interest rate is the amount the debtor must pay to who pays for the use of that money.

Interest Rate Central Bank & Currency

The central banks make transactions with other credit institutions through the interest rate. The central bank has the ability to affect the interest rates of commercial banks at the rate of inflation in the country and the rate of the national currency.

A decrease in interest rates increased business activity and increased inflation. Increase in interest rates leads to a decline in business activity, lower inflation and appreciation of the national currency.

As with any product, the law of supply and demand is fulfilled while easier to get money (more choice, greater liquidity); the interest rate will be lower. Conversely, if there is not enough money to lend, the rate will be higher.

How do interest rates affect the economy?

Low interest rates help the growth of the economy, as they facilitate consumption and therefore demand for products. In generally think that most products are consumed, more economic growth. The downside is that this consumption has inflationary trends.

Interest Rate Effects on Economy

Interest rate could be high and low depending on many factors. High interest rates encourage savings and curb inflation, since consumption decreases with increasing the cost of debt. But to reduce consumption economic growth also slows.

Rising Interest Rates effects on economy like it Increases the cost of borrowing, Increase in mortgage interest payments, Higher interest rates increase the value of Currency.

Low interest Rates help people to buy lot of securities that instill cash in the banking system. Carry traders exchanges currency by selling lower currency with high interest rates that make use of the interest rate differentials.

Another interest rate that is used as a macroeconomic indicator is the Inter-bank Equilibrium Interest Rate which is being applying in daily needs for reference Base Financing Rate.

Interest Rate and Forex Correlation

The central bank interest rate has a substantial impact n currency pairs consequently in Forex trading also. The level of these interest rates and thereafter, the changes that will be made on their level will have a significant impact on the value of the currency and on flows of incoming and outgoing capital of a country.

In the view of interest rate and currency correlation we see that increasing interest rates in most cases stimulate the flow of investment from one currency to another currency. Because currencies represent the economy of a country, the interest rate differentials between countries affect each other currencies,

Interest Rate and Forex Trading

Central banks monetary committee announce the interest rate of its currency. According nations economic aspect the central banks increase rates in order to curb inflation, and cut rates to encourage people in lending that can inject money into the economy. There are eight leading central bank in world. Like the Federal Reserve of US conduct the adjustment of its interest rate in order to insure price stability.

All central banks have own schedule for flashing their interest rate. In a scheduled date if a central bank raises interest rates, the yield available for investments in that currency is improved. The improvement effects on investment generally it attract investors to invest more on this currency. Thus, it will result in increased demand for this currency, which will lead to an end more or less rapidly, increasing the value of the currency.

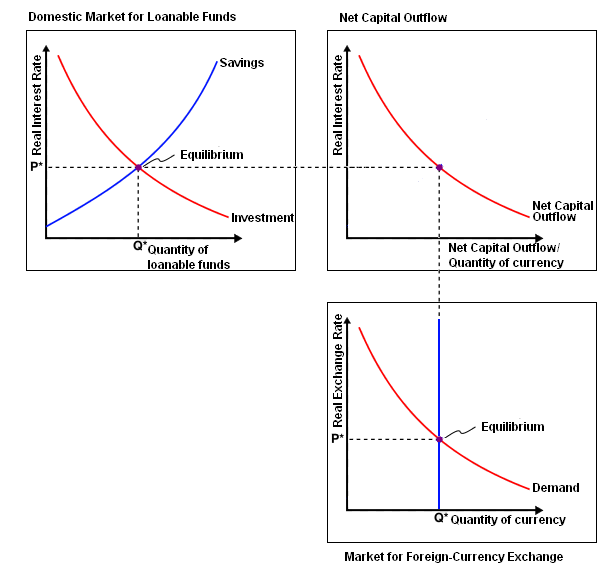

The interest rate in the country significantly affects international capital flows. Increase in interest rates is usually associated with an increased influx of foreign capital, that carry significant pressures to strengthen the domestic currency. When interest rates fall, the process opposite.

Forward Interest Rate

Forward exchange rate is the rate that is used in pre-arranged transactions with the terms of the given date. Thus, at present conclude a contract which provides for the future exchange of two currencies at predetermined quantity and price. Forward interest rate is most important to the fixed income investor. Such as who invest in 1 year 2 year or 6 month treasury bill.

Parity of Interest Rates

The relationship between interest rates and exchange rates are formalized in a more known as parity of interest rates Here apply a a simple method that is called Interest Rate Parity (IRP) Theory. This theory states that if two currencies have different interest rates, then this difference will be reflected in the forward exchange rate or future exchange rate. The Parity of interest rate plays an important role in foreign exchange markets(Forex) it have close connection interest rates, spot exchange rates and foreign exchange rates. Interest Rate Parity also classified in 2 types:

How to Trading in Forex Interest Rate?

To trade in forex need two different currency for a pair. Interest rate is associated with each currency and every currency has an interest rate that is associated with it. So when a forex trader going to trade in pairs they also directly or indirectly involved their two different interest rates.

How to trade forex interest rate decision

The eight global central banks interest rate influence the foreign-exchange market by changing interest rate in different schedule in a year. The rate change drives market largely that create volatility in forex trading. For fundamental analysis required to obtain information on rate and other major announcement by by those leading banks. Below the list of 8 major central banks.

2. European Central Bank (ECB)

3. Bank of England (BoE)

4. Bank of Japan (BoJ)

5. Swiss National Bank (SNB)

6. Bank of Canada (BoC)

First Needs to analysis macro views of a currency to predict before forecast, for your analyzing following economic data required to consider-

2. Gross Domestic Product (GDP)

3. Unemployment figures

4. Housing Market

5. Recent Major announcement by Bank

The rate deviation is supposed to higher then the the related currency get a power to move the market immediately with full of charge. In this case need to underrated direction go as well to reach higher profit level. The most important that need to react accordingly reversal of trend to manage perfectly your profit. Learn how to trade with news this article can help you to evaluate forex news.

Rollover Interest Rates in Forex

Conclusion

In fundamental view there few great economics indicator that impact forex market most and Currency Rate is one of them. I tried to draw an overall picture on interest rate effects on forex shortly its vast topics that can be sectioned more. Put your opinion to us. Thanks for reading.