Interest Coverage Ratio Investing for Beginners

Post on: 18 Июль, 2015 No Comment

Investing Lesson 4 — Analyzing an Income Statement

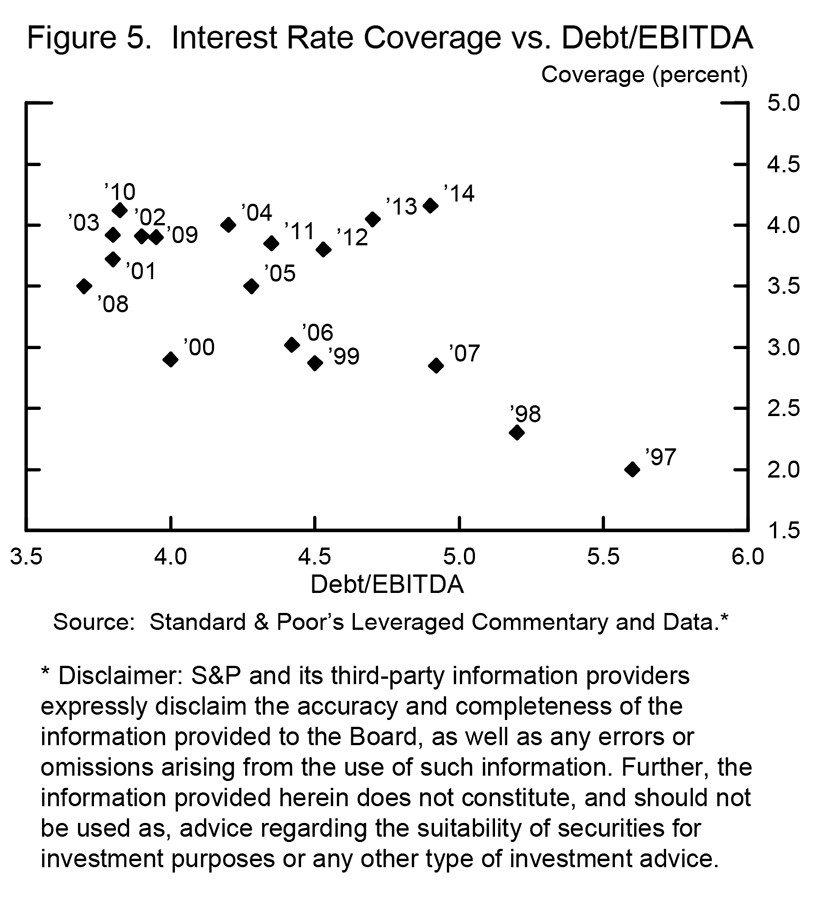

The interest coverage ratio tells you how many times a company can cover its interest payments without defaulting. It is used as a safety gauge for banks and bond holders to estimate the probability of loss on the money they’ve loaned.

Interest Coverage Ratio

The interest coverage ratio is a measure of the number of times a company could make the interest payments on its debt with its earnings before interest and taxes, also known as EBIT. The lower the interest coverage ratio, the higher the company’s debt burden and the greater the possibility of bankruptcy or default.

Interest coverage is the equivalent of a person taking the combined interest expense from their mortgage, credit cards, auto and education loans, and calculating the number of times they can pay it with their annual pre-tax income. For bond holders, the interest coverage ratio is supposed to act as a safety gauge. It gives you a sense of how far a company’s earnings can fall before it will start defaulting on its bond payments. For stockholders, the interest coverage ratio is important because it gives a clear picture of the short-term financial health of a business.

To calculate the interest coverage ratio, divide EBIT (earnings before interest and taxes) by the total interest expense.

General Guidelines for the Interest Coverage Ratio

As a general rule of thumb, investors should not own a stock that has an interest coverage ratio under 1.5. An interest coverage ratio below 1.0 indicates the business is having difficulties generating the cash necessary to pay its interest obligations. The history and consistency of earnings is tremendously important. The more consistent a company’s earnings, the lower the interest coverage ratio can be.

EBIT has its short comings, though, because companies do pay taxes, therefore it is misleading to act as if they didn’t. A wise and conservative investor would simply take the company’s earnings before interest and divide it by the interest expense. This would provide a more accurate picture of safety, even if it is more rigid than absolutely necessary.

Benjamin Graham and the Interest Coverage Ratio

The father of value investing and the entire securities analysis industry, legendary investor Benjamin Graham, wrote a considerable amount during his career about the importance of the interest coverage ratio, especially for the bond investor. Graham believed that selecting fixed income securities was primarily about the safety of the interest stream that the bond owner needed to supply passive income. He asserted, and I wholeheartedly concur, that an investor owning any type of fixed income asset should sit down at least once a year and re-run the interest coverage ratios for all of his or her holdings. If the situation deteriorates for a given issue, history has shown there is often a window of time when it is not particularly painful to switch out to a practically identical bond, with much better interest coverage, for nominal costs. This isn’t always the case, and it may not continue to be in the future, but it arises because many investors simply do not pay attention to their holdings.

In fact, we are seeing this situation play out at the moment. J.C. Penney is in considerable financial trouble. It has 100-year maturity bonds that it issued back in 1997, leaving another 84 years before maturity. The retailer has a very decent probability of going into bankruptcy or experiencing further declines, yet the bonds are still yielding 11.4% when they should be yielding much more given the inherent risk in the position. Why aren’t J.C. Penney bond owners switching to more secure holdings? That’s a good question. It happens again and again, company after company. It’s the nature of the debt markets. A shrewd, disciplined investor can avoid this kind of folly just by paying attention from time to time.

Graham called this interest coverage ratio part of his margin of safety; a term he borrowed from engineering, explaining that when a bridge was constructed, it may say it is built for 10,000 pounds, while the actual maximum weight limit might be 30,000 pounds, representing a 20,000 pound margin of safety to accommodate unexpected situations.

Situations In Which the Interest Coverage Ratio Can Rapidly Deteriorate

One situation in which the interest coverage ratio might suddenly deteriorate is when interest rates are rising quickly, and a company has a lot of very low-cost fixed-rate debt coming up for refinance that they are going to have to roll over into more expensive liabilities. That additional interest expense is going to hit the coverage ratio even though nothing else about the business has changed.

Another, perhaps more common, situation is when a business has a high degree of operating leverage. This does not refer to debt per se, but rather, the level of fixed expense relative to total sales. If a company has high operating leverage. and sales decline, it can have a dramatically disproportionate effect on the net income of the company. This would result in a sudden, and equally dramatic, decline in the interest coverage ratio, which should send up red flags for any conservative investor.