Informed Traders Fundamental Traders Technical Traders

Post on: 17 Май, 2015 No Comment

When day trading or long-term trading, fundamental and technical forms of analysis are two of the most common methods that may be employed. These forms work from the same data, but the way they use the information is completely different. It is possible to use both fundamental and technical analysis together, but it is more common for a trader to choose one or the other.

A. Fundamental traders

Fundamental traders believe that the markets will react to events in certain ways and that they can predict future market prices based on these events. For example, if a company receives regulatory approval for a new product, a fundamental trader might expect the company’s stock price to rise. Conversely, if a company has a financial scandal, a fundamental trader might expect its stock price to fall. Fundamental traders need access to all of the obtainable information as soon as it is available, and are therefore institutional traders often have large support teams. Fundamental analysis is as old as trading itself, and has traditionally been done manually, but as computing power increases it has become possible for some fundamental information to be processed automatically.

Examples of data useful for fundamental trading:

- Economic reports: This involves the use of figures which can be generally split into either growth or inflationary. It is important to understand the current economic cycle: Six years ago, investors were looking for “price stability;” therefore inflation was a major issue, and CPI (corruption perception index) and PPI (producer price index) figures were the focus. Now investors are focused much more on growth, so GDP (gross domestic product) and sentiment figures are key. Other figures to consider are weekly and monthly economic data such as Non-Farm Payrolls and the Philadelphia Fed .

- Political factors: Recent factors affecting fundamental trading decisions include the Euro Zone debt and the global slowdown. Also, key politicians and market commentators can affect the markets.

Why fundamental traders think their method is better: Many fundamentalists think that technical trading is too complicated. Fundamental-based investors view charts as nothing more than a ghost of true facts and numbers. They prefer to rely on actual company revenues, profits, cash flows, assets and liabilities. Fundamental traders also keep an eye on new products, brokerage reviews and government statistics.

The downside: The fundamental view is anything but etched in stone. The so-called concrete numbers can be manipulated, adjusted and interpreted in any number of ways. Quite often, the majority rules in how those facts are played out in the pricing of stocks. You often hear on the news that stocks moved higher or lower based on some report or event. One market vagary is that most traders play follow-the-leader and have little idea of how the fundamentals are affecting price movement. It’s an inaccurate perception is that most investors interpret the same fundamental data in the same ways.

B. Technical traders

Technical traders use stock charts; in other words, trading information — such as previous prices and trading volume — along with mathematical indicators to make their trading decisions. This type of stock trader relies on factors such as momentum, patterns, moving averages, etc. The basic premise is that all assets move based on offer and demand more than anything else.

Certain formations and price relationships happen regularly when viewed from a technical perspective. Such formations as head and shoulders, tops and bottoms, double and triple tops and bottoms, price channels and triangles occur quite frequently. Along with price breakouts and failures, higher lows and lower highs, price is consistent in testing itself. Support and resistance price points act as magnets. Stock prices are always testing previous price action. The outcome determines further price action, which develops over time into some kind of measurable trend.

This information is usually displayed on a graphical chart and is updated in real time throughout the trading day. Technical traders believe that all of the information about a market is already included in the price movement, so they do not need any other fundamental information (such as earnings reports). In many instances, individual traders tend to be technical traders.

Now modern technical analysis is usually performed by the trader interpreting their charts, but can just as easily be automated because it is mathematical. Some traders prefer automatic analysis because it removes the emotional component from their trading, and allows them to make trades based purely on the trading signals.

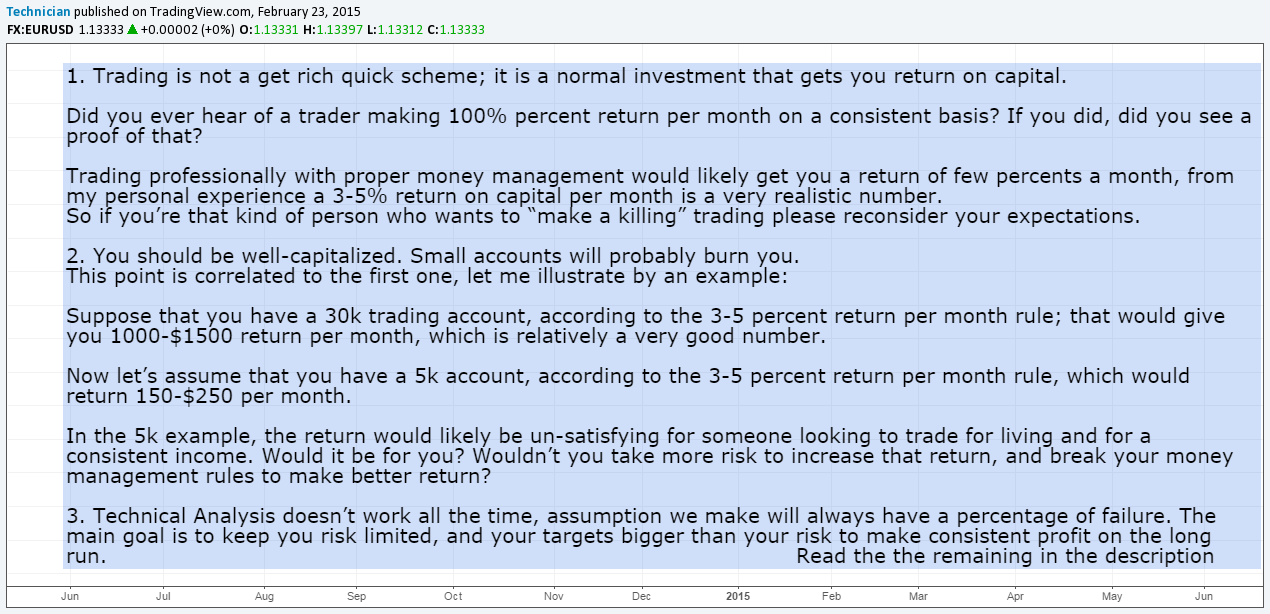

An example of technical trading can be seen by interpreting the daily chart below for Google (Nasdaq: GOOG ).

Firstly, given that the chart shows the shares’ price over the last 12 months, the question that all traders ask is, “Will I buy this stock?”

As you can see, the share price is showing an upward trend, so a technical trader would probably buy, particularly on the dips. Many traders suffer from a fear of buying something that is trending up due to the hunch that the prices are bound to fall soon, especially if the share prices are breaking into new high ground. This was one of the dilemmas encountered with many of the stock prices during the rally of 2013 .

This is one simple example using technical analysis. It has been based on a simple price vs. time chart. It has not involved hours or days studying management accounts, directors’ reports, and financial statements. The technical trader, at times, probably has little or no idea what the company does, who the management is, how many divisions there are, or where it is based. The trader has arrived at this simple conclusion based on what is graphically represented.

This type of trading can be applied to any financial instrument in any market anywhere in the world. Once technical traders have learnt the basics of understanding and interpreting charts, they just need to understand the nuances of the particular market on which they wish to trade.

Which do I choose — fundamental or technical?

It is interesting to note that many traders believe that either fundamental trading or technical trading can exist as a stand-alone strategy! The truth may be more complicated: Each type of trading benefits from the other.

Why technical traders need fundamental traders: All technical trading is executed by comparing prices in the current environment with prices in a previous environment. Highs, lows, moving averages, trend lines and price patterns make up the technical trader’s arsenal for decision making. There are many different indicators and oscillators also available to the technician.

However, none of those changes in price could occur without investors using fundamentals to make decisions in the first place. That takes into account all the numbers and comparisons to previous statistics and expectations. This would support the argument that fundamental-based investing provides the foundation for technical trading.

If all trading decisions to buy or sell were made without the availability of consulting fundamentals — such as annual reports, company news, and the weather or government statistics — then there would be little or no basis to make a reasonable decision.

Therefore, it seems that fundamental traders can function alone, and technical trading becomes an extension of fundamental trading without concern for the fundamentals. In other words, fundamentals came first and technical analysis has been derived from it.

What fundamental traders can learn from technical traders: You can analyze the fundamentals until every fact and figure makes sense. Still, that will not tell you where prices may go in the future. As long as most investors continue to prefer fundamental analysis, technical traders will have a firm basis on which to practice their analytical methods.

C. High-frequency traders

High- frequency traders are technical traders who use complex algorithms to analyze multiple markets and execute orders based on market conditions. Typically, the traders with the fastest execution speeds will be more profitable than traders with slower execution speeds. They normally use a program trading platform that uses powerful computers to transact a large number of orders at very fast speeds.

In 2009, studies suggested high-frequency traders accounted for 60-73% of all US equity trading volume, with that number falling to approximately 50% in 2012.

Many high-frequency traders provide liquidity and price discovery to the markets through market making and arbitrage trading. High-frequency traders also take liquidity to manage risk or lock in profits.

High-frequency trading (HFT) is the use of sophisticated technological tools and computer algorithms to rapidly trade securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second. High-frequency traders focused on HFT rely on advanced computer systems.

There are two types of high-frequency trading:

- Execution trading — When an order (often a large order) is executed via a computerized algorithm. The program is designed to get the best possible price. It may split the order into smaller pieces and execute at different times.

- The “set up” — The second type of high frequency trading is not executing a set order, but looking for small trading opportunities in the market based around certain programmed factors. This is also known as a “set up,” such as the beginning of a pattern that a trader has deemed to be profitable, which is usually preceded by a trading signal like a technical indicator or potential catalyst (market mover).

High-frequency trading is quantitative trading characterized by short portfolio-holding periods. All portfolio-allocation decisions are made by computerized quantitative models. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Specific algorithms are closely guarded by their owners and are known as algos.

High-frequency trading strategies

High-frequency traders move in and out of short-term positions aiming to capture sometimes just a fraction of a cent in profit on every trade. High-frequency traders do not employ significant leverage. accumulate positions or hold their portfolios overnight; they typically compete against other high-frequency traders, rather than long-term investors. As a result, high-frequency traders have a potential Sharpe ratio (a measure of risk and reward) thousands of times higher than traditional buy-and-hold strategies.

High-frequency traders are often dealing in versions of stock index funds like the E-mini S&Ps because they seek consistency and risk-mitigation along with top performance. They must filter market data to work into their software programming so that there is the lowest latency and highest liquidity at the time for placing stop-losses and/or taking profits. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, in which a small mistake can lead to a large loss. Absolute frequency data play into the development of the trader’s pre-programmed instructions.

Problems associated with high-frequency trading

The effects of algorithmic and high-frequency trading are the subject of ongoing research. Regulators claim these practices contributed to volatility in the May 6, 2010 Flash Crash and find that risk controls are much less stringent for faster trades.

Knowingly or not, high-frequency traders have discovered their quotes can blind other investors to the true market price, and this has quickly become one of their biggest weapons against the investing public. High-frequency traders can afford the pipelines, microwave-transmission towers, and other necessary technology to ensure that they are the first to see and react to the real price of assets they are trading. The rest of the traders are left to trade on the equivalent of yesterday’s prices, as the high-frequency traders’ nanosecond trading make a full second seem like a full day’s advantage.

One example of an order that can help a HFT trader identify these short-term fluctuations in liquidity and price trends is a flash order . Flash orders are typically sent to certain traders in a market for less than one second before being routed more widely.

The speed of flash order execution can save the trader placing the order some money, if only the slightest amount, while also providing HFT firms with a potential profit opportunity.

Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, narrows bid-offer spread, lowers volatility and makes trading and investing cheaper for other market participants.