Industry Retail REITs

Post on: 3 Сентябрь, 2015 No Comment

Contents

Retail REITs are Real estate investment trusts that own and operate retail properties. Retail REITs earn revenue by leasing those properties to retail tenants. Many retail REITs also operate retail centers owned by third parties, for which it receives a percentage of the center’s revenues called a management fee.

Retail REITs are particularly sensitive to U.S. Economic Cycles because they lease space to retailers. These retailers struggle during economic down cycles, decreasing the demand for retail property space. This has been a particularily relevant issue as the U.S. economy began to slump in 2008. In 2008 mid-size retailing chains such as Sharper Image (SHRP). Linen’s and Things, and furniture store Levitz have declared bankruptcy. Foot Locker (FL). Zale (ZLC) and Ann Taylor have all announced they were closing over 100 stores, and even off-price retailers like T.J. Maxx are seeing slower sales. [1] Store closures and tenant bankruptcies lower the demand for retail properties, and increase vacancy rates and decreasing rent collections.

Companies Involved

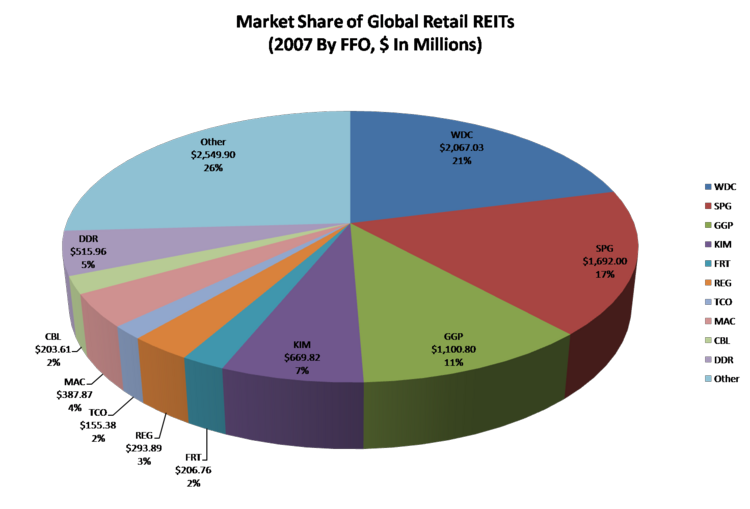

The following retail REITs are listed in descending order of Market Cap as of 4/30/2008. [2]

- Simon Property Group (SPG). Simon Property Group develops and leases regional malls, shopping centers and strip malls. Simon Property Group owns or has an interest in over 379 properties comprising over 256 million square feet of gross leasable area across investments in the U.S. Europe, and Asia, [3] making it the largest public U.S. real estate company. [4] Simon Property Group’s investments tend to be in large metropolitan areas with very high consumer traffic and are comprised of anchor department stores alongside smaller retailers.

- Kimco Realty (KIM). The largest owner and manager of community shopping centers in the Western Hemisphere. [5] As of December 31, 2007 Kimco held interests in 1,959 properties, totaling 183 million square feet of leasable space, in properties scattered across 45 states, Puerto Rico, Canada, Mexico and Chile. Kimco focuses on markets with high barriers to entry, including limited land availability and high land costs, in order to minimize competition. [6] Retailers in its properties focus on consumer staples, such as groceries and drugstores. [7]

- General Growth Properties (GGP). General Growth Properties is the 2nd largest Real Estate Investment Trust (REIT) in the United States by revenue. GGP’s primary business is managing shopping malls, and it owns properties in 45 states. GGP’s properties are usually major shopping centers with at least one large anchor department store to draw customers and attract additional tenants. [8]

- Macerich Company (MAC). Macerich Company owns or manages 74 regional shopping centers and 20 community shopping centers with approximately 78 million square feet of gross leasable area. [9] MAC’s malls are located in high-growth suburban markets, and they are typically large enough (almost 900,000 square feet on average for the company’s wholly owned regional shopping centers) to be considered town centers. [10]

- Developers Diversified Realty (DDR). Developers Diversified Realty Corporation (NYSE: DDR) is a Real estate investment trust that specializes in leasing shopping and business centers that it owns either solely or through joint ventures. DDR owns and manages 740 retail operations (including joint ventures) and development properties spanning approximately 160 million square feet of real estate in 45 states (plus Puerto Rico, Brazil, Russia, and Canada). [11] Most of DDR’s tenants are big- and medium-box retailers.

- Regency Centers (REG). REG directly owns 232 shopping centers and through joint ventures has an interest in another 219, for a total of 451 operating properties. [12] Regency’s community and neighborhood shopping centers are often anchored by supermarkets, drug stores and high-volume retailers which sell consumer necessities.

- Federal Realty Investment Trust (FRT). FRT owns and operates 82 community and neighborhood shopping centers. FRT’s community and neighborhood shopping centers are often anchored by supermarkets, drug stores and high-volume retailers which sell consumer necessities. Federal concentrates on densely populated, affluent communities, which minimizes competition from outlet stores and big box retailers such as Wal-Mart Stores (WMT) .

- Weingarten Realty Investors (WRI). Weingarten Realty Investors develops shopping centers, primarily in Texas and other southern states, [13] [14] which it then leases to commercial tenants. Of the 389 properties WRI owns or operates under long-term leases, 322 are community shopping centers and 67 are industrial projects. [15] Altogether the properties amount to some 65 million square feet of land. [16]

- Taubman Centers (TCO). Michigan based Taubman Centers owns and operates regional shopping centers. As of December 31st, 2007 the company owned a portfolio of 23 shopping centers, 5 of them regional and 18 super regional (having over 800,000 sq feet of Gross Leasable Area). [17] The company’s properties are in urban or suburban metropolitan areas throughout the United States, and its shopping centers are relatively large, ranging in size from between 242,000 and 1.6M square feet of Gross Leasable Area (area available to be leased), with the smallest center housing over 60 stores and the largest over 200. [18]

Cole REIT. Cole, a non-traded REIT, invests primarily in income-producing, single-tenant commercial real estate leased to high-quality, creditworthy tenants under long-term, net leases. They are also conservative to moderate in their use of financing. Cole currently owns and manages more than 1,100 properties valued at nearly $7 billion. This information is current as of February 2011.

Overview

Retail REITs generally have two types of tenants, Anchors and Inline Tenants. Anchors are large stores which take up a disproportionately large share of space in a retail center and draw customers to the center. Typical anchor stores sell consumer staples, as in the case of grocery anchored centers, or are large easily recognized retail chains, as in the case of centers anchored by Barnes & Noble or Macy’s. Anchor stores typically pay lower rents than inline tenants, and sign longer term leases. Inline tenants are smaller tenants which pay higher rental rates and sign shorter leases, and these stores benefit from the foot traffic anchor tenants bring to a retail center and account for the majority of rents at a retail center.

The retail properties owned by Retail REITs vary in size and market focus. Some Retail REITs concentrate on a particular property type to maximize their management expertise, while others other try to diversify their property types. The types of properties owned and operated by retail REITs are generally defined as:

- Neighborhood Shopping Centers: Retail centers containing under 100,000 square feet of GLA (Gross Leasable Area, the total area available for lease). [19]

- Community Shopping Centers: Retail Centers containing between 100,000 to 350,000 square feet of GLA. [20]

- Regional Shopping Centers: Retail centers in containing between 400,000 and 800,000 square feet of GLA. [21]

- Super-Regional Shopping Centers: Centers containing in excess of 800,000 square feet of GLA. [22]

Trends and Forces

U.S. Economic Cycles Will Lead To Fluctuating Revenues

- Retail REITs own and operate retail space, making them especially vulnerable in a general economic downturn. If consumer spending levels decline, demand for retail properties decreases as retail businesses contract rather than expand. Slow demand lowers the rents that tenants are willing to pay for retail properties. For example, leased space at TCO’s centers increased to 93.8% in 2007, up from 92.5% in 2006. [23] However, as the economy enters a down cycle, TCO estimates occupancy to be flat to down in the 1st half of 2008. [24]

- This risk is exacerbated for retail REITs charging above average rents. For example, TCO charges the highest rents of any mall operator. [25] They are able to do this because their sales per square foot, $555 in 2007, are also the highest in the industry. [26] However, during an economic downturn the high margin retailers (GAP. Forever 21, Victoria’s Secret, Bath and Body Works ) which make up the bulk of TCO’s tenant base can be the hardest hit. [27] If their sales decline or stagnate, these retailers will likely no longer be willing to pay the premium TCO charges for store locations in its centers. This is particularly disconcerting as in December of 2007, the most important month of the year for retailers, sales in TCO’s centers remained flat. [28]

- Retail REITs such as KIM, with centers that are anchored by consumer staples, are more insulated against the risk of an economic downturn as consumer staples are traditionally resistant to changing economic conditions. [29]

- Those retail REITs with concentrations in particular sections of the country are also vulnerable to changes in regional economic conditions. For example a large portion of MAC’s retail centers are concentrated in the Southwest United States, primarily Arizona and California. It also has eight centers located in Connecticut, New York and New Jersey. [30] Because of this regional concentration MAC is particularly vulnerable not only to changes in national economic conditions, but to any regional economic changes. Any change in general economic conditions on a national, regional, or local scale which adversely affects MAC’s tenants will decrease the amount of base rent, expense reimbursement and overages the company receives from its tenants, as all of these are tied to tenant performance. As the economy worsens there has been an increase in retailers failing to renew leases or, through bankruptcy protection, cancelling leases. [31]

The Credit Crunch and Fluctuating Interest Rates Increase the Riskiness of Retail REITs’ Debt Payments

- Many retail REITs use variable rate debt to fund expansion. For example, GGP’s operating structure has been to purchase under-performing mall assets, financing the acquisitions with floating rate debt. [32] After GGP purchases an under-performing property using floating rate debt, it renovates the property and refinances, paying off the floating rate debt with less volatile fixed rate debt. This leads GGP, and many other retail REITs with similar strategies, to accumulate large amounts of variable rate debt during period of expansion.

- This accumulation of variable rate debt causes many retail REITs to be particularly sensitive to changes in interest rates, particularly the LIBOR rate which many variable rate loans are tied to. GGP estimates that if the rates on its $3.25B of variable rate debt were to increase a mere 25 basis points it would result in an approximately $8.1M annual decrease in operating income and cash flow. [33]

- Interest Rate fluctuations are also an issue as debt matures. If interest rates rise Retail REITs will have to refinance maturing debt at unfavorable rates — in the case of fixed rate debt, this would lower the company’s cash flow over the life of the loan.

Increasing Competition from Discount Stores Has the Potential to Adversely Affect Anchor Tenants’ Ability to Meet Lease Obligations

- Retail centers are facing increasing risk from outlet stores, discount stores, and other off-price retailers. As these competitors gain market share, they impact the ability of the centers’ tenants to pay rent, and decrease the operators’ collections of base rents, expense reimbursements and overages.

- For example, Kimco Realty (KIM) has seen increasing competition from Wal-Mart Stores (WMT). KIM has traditionally tried to insulate itself from competition with Wal-Mart by locating in affluent, high barrier to entry markets. However, Wal-Mart is developing a new, smaller, grocery based store which is aimed at the kind of high barrier to entry markets where KIM locates it stores. [34] If Wal-Mart were to enter these markets it would have adverse consequences for KIM’s anchor tenants. KIM’s tenants, which focus on consumer staples, compete directly with these Wal-Mart stores.

- The risk from Wal-Mart might seem counter intuitive, as Wal-Mart is one of KIM’s top five tenants. However, Wal-Mart owns 82% of the properties in which its discount stores, supercenters, and neighborhood markets operate. [35] If Wal-Mart expands to areas where KIM’s properties are located, it is more likely they will take market share from KIM’s anchor tenants than lease in one of KIM’s buildings.

- Anchor tenants commonly occupy a large percentage of gross leasable area and pay a substantial portion of base rent at Regency’s properties. In addition, they bring foot traffic to the property benefiting smaller tenants. If an anchor tenant cancels their lease or becomes insolvent, not only would the operator lose the base rent, overages, and expense reimbursements, but its smaller tenants would suffer from the decreased foot traffic. Leases for smaller tenants in a retail center often contain clauses allowing for lease terminations or rent reductions if an anchor tenant leaves the property. If an anchor tenant left the property, smaller tenants can choose to simply cancel their leases rather than wait for REG to locate a new anchor. Because of this, the abrupt departure of anchor tenant can drastically decrease the value of a retail center.