Index Mutual Funds

Post on: 16 Март, 2015 No Comment

When to Run It

- Slightly to strongly bullish

- Degree of sentiment: +1 to +3

Broader Market Outlook

When you buy an index mutual fund, you need to have a bright long term outlook on the wider market. Because the stocks that comprise an index tend to be so diverse, you really need some momentum across a broad spectrum in order to move the index fund’s value upwards. If your outlook is incorrect and the value of the index mutual fund declines, you will incur a loss.

Potential Risks

An investment in an index mutual fund could lose money over short or long periods of time. An index mutual fund’s performance could be hurt by:

- Stock market risk. which is the chance that stock prices overall will decline. Because index funds tend to track a target index, it may underperform the overall stock market.

- Investment style risk. which is the chance that returns from large-cap stocks will trail returns from the overall stock market.

- Other risks specific to your mutual fund. so be sure to read the prospectus carefully before investing.

About the Security

A mutual fund pools many investors’ funds together and invests the money in diversified assets under the direction of one or more professional fund managers. Investors in a mutual fund hold shares in the fund itself, and do not hold shares in the individual securities held by the fund.

Before investing in any mutual fund, carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. Free prospectuses may be ordered from the fund company or send an email to service@tradeking.com. Many, but not all, prospectuses are available online. Not all mutual funds are available through TradeKing. Read the prospectus carefully before investing. Investment returns will fluctuate and are subject to market volatility so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost.

When you buy shares in a mutual fund, you pay the public offering price (POP). It’s based on the net asset value (NAV) plus the fund’s maximum sales charge, known as the sales load. If it is a no-load fund, the POP and the NAV are the same. The investors who pooled their money participate in the returns generated by the fund, proportionate to the amount of money invested by each. This occurs through changes in the NAV and gains or dividends distributed to investors. As with any security, you should be informed about the possible tax consequences when investing in mutual funds. Consult a tax advisor.

Some mutual funds are open-end, meaning the collective pool of money to be managed in the fund is constantly changing with demand for the fund. Closed-end mutual funds, by contrast, consist of a finite number of shares.

There are several key features of mutual funds, including diversification and professional money management. Besides a sales charge (front-end load or back-end load) investors in mutual funds may incur other costs, such as management fees, 12b-1 fees, and other administrative fees. Your broker’s commission may also negatively affect your returns. At TradeKing a purchase and a sale of no-load mutual funds cost $14.95 each. Investors should also consider the past performance of the fund, past performance of its manager, and the fund’s turnover ratio. However, past performance is no guarantee of future results. To learn more, check out Mutual Funds: An Investor’s Guide.

A handy tool that may help you when reviewing mutual fund investments is the FINRA Expense Analyzer. This tool is created by the Financial Industry Regulatory Authority, and it’s free for all investors.

The Strategy

An index mutual fund is typically comprised of most or all of the stocks that make up a particular index, such as the Dow Jones Industrial Average (DJIA) or S&P 500 or any of the other broad market indices covering different types of companies, industries or sectors. The index on which the mutual fund is based is known as the target index and the mutual fund looks to track its performance. That means if the index goes up or down, the value of the index mutual fund is likely to perform similarly on a percentage basis. In general, these indices, and the index funds which track them, tend to be comprised of large-cap stocks.

The reason to own an index mutual fund is to take advantage of broad-based bullish activity across stocks in the fund’s portfolio. Certainly, some stocks within the index fund may exhibit bearish tendencies at any given time, but you want the overall basket of stocks to demonstrate upward momentum.

You may be bullish on a particular sector measured by a specific index, or on the broader markets overall. So be certain to choose the right index mutual fund to best match your sentiment. Regardless of intention, the market can always behave counter to your analysis. Owning an index fund can result in losses if the mutual fund declines in value. The steeper the decline, the greater the loss will be.

Instant diversification

Because index mutual funds are comprised of many different stocks, your investment, in essence, is instantly diversified. But be careful—diversification doesn’t mean safety. Look at a chart for any given index and you will invariably see certain periods of significant decline. So don’t buy an index mutual fund during uncertain times and naively expect safe haven from the next financial storm. Diversification doesn’t guarantee a profit or ensure against a loss.

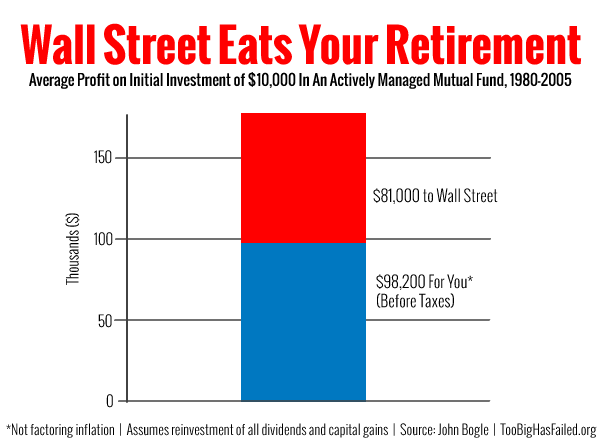

Passive management may mean lower fees

Index mutual funds are “passively managed”, meaning the stocks in the fund stay the same over time as long as they comprise the target index. As a result, the expense ratio (ongoing fees associated with owning mutual funds) tends to be lower than for actively managed funds because there are fewer transaction costs and you’re not paying for the fund manager’s time and expense when researching different stocks. This is as opposed to “actively managed” mutual funds where the fund manager may frequently change the stocks held by the fund (and you pay extra for all those transactions and expertise).

Lower maintenance over the long-term

Some investors choose index mutual funds as a long-term, lower-maintenance trade than choosing individual stocks. If you’re looking for an investment that will perform on par with the markets at large, then index mutual funds may be a strategy to consider. However, you’ll need to weather recessions and bear markets since index funds are designed to track the market through good times and bad.

Just remember: don’t put your money in a mutual fund, go to a faraway island and forget about it. You need to be as vigilant as you can and keep an eye on your investments.

Dollar-cost averaging or lump-sum investing?

There are two common methods for investing in mutual funds. Lump-sum investing is when you plunk down a boat-load of cash all at once, or over a short period of time, such as a few weeks. At the other end of the spectrum, some investors choose to employ dollar-cost averaging. This approach entails investing a fixed amount of money according to a pre-set schedule over many years, such as monthly or quarterly, irrespective of how the index fund is performing. You can think of it as tiptoeing into the fund, as opposed to shooting off all your bullets at once.

In general, lump-sum investing is well suited for investors who feel they can time their investments well, buying in when the index fund is low in price. If correct, the lump-sum investment is likely to outperform similar investments made with a dollar-cost averaging strategy. If instead the lump-sum investment is ill-timed and coincides with a peak followed by a decline, the investment will likely underperform. Ideally speaking, lump-sum investors like their investments to increase at the beginning of the time horizon, and remain at least relatively stable towards the end of the investing period.

Dollar-cost averaging is preferred among investors who choose to invest periodically with smaller amounts. That way, you avoid buying in all at once when the index fund is at an anomalous peak, but you’ll also miss investing a lump sum at the lows. If it declines, you continue buying in. Because you buy more shares as the market declines and fewer shares as the market rises, you lower your average cost per share. Dollar-cost averaging fares better than lump-sum investing if the investment increases in value more towards the end of the investor’s time horizon.

Although we all want the value of our investments to increase over time, lump-sum investors have more of an edge if their timing is well-chosen. However, many investors may not have adequate capital resources for lump-sum investing and prefer to invest over time using dollar-cost averaging.

Please note: If you use an index mutual fund in a market timing strategy, this may involve frequent trading, higher transaction costs, and the possibility of increased capital gains that will generally be taxable to you as ordinary income. Market timing is an inexact science and a complex investment strategy.

Time Horizon

Investing in index mutual funds tends to be a longer-term play (one year or more) and is suited for “buy and hold investors.” More active traders may also wish to consider this strategy if looking to diversity a portion of their portfolio for longer-term investments. Remember to check which fees for different share classes will apply given your time horizon.

When to Get In

Having time on your side is advantageous when investing, so in general getting in sooner than later is preferable. However, there are some timing considerations for your initial investment. If you are using dollar-cost averaging, you would adhere to your periodic investment schedule.

Watch the overall market trends

When you begin your investment in an index mutual fund, make sure you’re not trying to catch a falling knife. In other words, don’t enter the order when the overall trend is still heading down and try to precisely nail the bottom. It’s best to have some sense that the bulls are loose before you buy an index mutual fund. Ideally, you want to see a bullish trend underway or to dive in after a bear market or shorter-term correction has bottomed out and then has resumed upwards.

When to Get Out

When you buy an index mutual fund, it’s usually a long-term investment. Typically, if you’ve reached your goals, if your investing strategy has fundamentally changed, or if you need the money for some long-term objective, you start to exit your position, either in phases, or all at once.

Ideally, you would like to get out during a bull market well before you really need the cash for its intended purpose. That way you can pick your spot and try to sell during economic high times. If you wait until the last second and you have mounting expenses you need to meet (such as when a child goes to college, you want to buy a home, or you’re about to retire) you could find yourself stuck in the midst of a recession, be forced to sell anyway, and be left with much less than estimated when you first initiated the investment.

Since timing the market is an inexact science and is easier said than done, it may be wise to lighten up your holdings in index mutual funds over time as you get closer to the end of your time horizon. Dollar-cost averaging to exit is one method you could employ to do this. In other words, withdrawing a predetermined amount on a pre-set schedule as the date for completion of a financial goal approaches. Another method is based on asset allocation and is discussed in our series on bonds.

Keep in mind that you need to have realistic objectives. When you’re investing in index mutual funds, you shouldn’t expect your money to double over the course of a few months. You are also very unlikely to hit the high point of a rally. By trying to milk a trade for every last percentage point, time and again investors have given back too much of their gains. Don’t be one of them.

If your investment is a loser from the start, you have two options: hold tight and weather the storm, or stick to a predefined rule of acceptable losses and head for the exits. Although transaction costs are often minimal when compared to the total investment amount, they are not negligible. So be sure you understand how fees are incurred if you exit after a relatively short holding period. But don’t let them sway you to stay with a non-performing investment that is no longer in your comfort zone.

Investment Management

In many cases, buying an index mutual fund is a low-maintenance investment. You buy in through either a lump-sum or periodic investments, after reading the fund’s prospectus.

But don’t forget about it like that box of baseball cards at the back of your bedroom closet. Although much doesn’t change day-to-day with respect to the management of index mutual funds, changes can occur. So review a current prospectus periodically to be aware of any noteworthy changes.

Any time you make an investment, you are obviously expecting the results to be outstanding. But as you know, that will not always be the case. Even the most carefully chosen mutual fund can go south in a hurry, resulting in losses. You should also remain aware of trends in the broader markets. If you are expecting a long period of bearish activity, it may make sense to wait it out on the sidelines in cash or other cash-equivalent investment.

If you are scaling in or scaling out of this strategy with dollar-cost averaging, you need to be sure to stick to your investment schedule over the life of the investment. Deviate from your schedule only if there is a significant shift in your personal investment plan or financial picture.

Volatility Factor

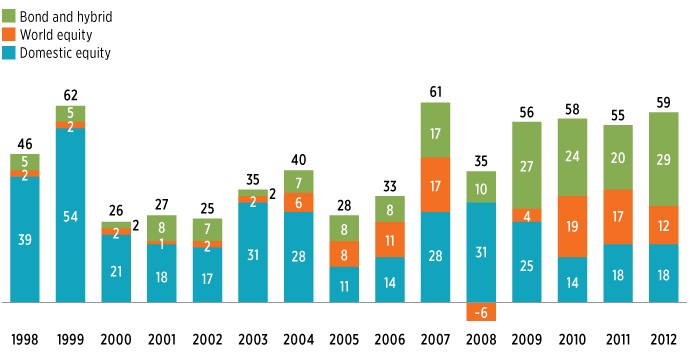

Since some stocks can go up while others go down, an index mutual fund’s price movement will tend to be less volatile than the average stock. This lesser volatility is a double-edged sword. While it tends to be less likely that you’ll lose your shirt in a hurry, you won’t necessarily be pulling in massive gains over the short-term either. In general, indices tend to be less volatile than common stocks on individual companies. However, you need only look at stock indexes in the years 1929, 1987, 2000-2001 and 2007-2008 to see that there are occasionally periods of extreme volatility in the broader markets. Just because an index mutual fund may have lesser volatility than another investment, it does not mean it is low risk.

TradeKing Margin Requirements

After the trade is paid for, no additional margin is required. You cannot trade mutual funds on margin.

Tax Ramifications

There are several ways your mutual fund investment can impact your tax liability. Read Taxes and Mutual Funds and consult your tax advisor for the low-down on this important topic.

TradeKing Tips

Your investment may not be what it seems

- A very common misconception is that all index mutual funds hold the exact same portfolio of securities as found in its target index, when in fact, that may not be the case at all. So when you buy a mutual fund based on the S&P 500, for instance, you may not necessarily own a fractional interest in all 500 stocks that make up that index.

Instead, the fund manager may choose stocks that will likely cause the index mutual fund to behave in a manner that’s similar, but not necessarily track the target index as it moves. This is usually done to save the fund manager transaction costs, since fewer stocks are held in the fund’s portfolio. To add to this, the weightings of the stocks in an index mutual fund may differ from the target index. What’s more, just because two index mutual funds track the same index, it doesn’t mean both are structured the same way.

The bottom line: index mutual funds will not replicate the performance of the target index exactly; instead the goal is to approximate that performance. Consult the prospectus of the fund, where these differences are spelled out in detail. Be sure to read it before investing.

Be wary of earnings season and news events

- Just prior to and during quarterly “earnings seasons,” when corporate earnings are announced—January, April, July and October—major indices tend to be more volatile than usual. Furthermore, other types of announcements can cause increasing volatility as well.

If earnings are coming up, the Fed is about to hold a greatly anticipated meeting regarding interest rates, or you’re generally unsettled by increased volatility, you may want to hold off with making that initial investment and see what happens. On the other hand, if you have good reason to think positive news will boost your upcoming investment, by all means get in before the next big rally gets underway. Either way, be sure you are making an active decision to stay in or out during a time of increased news releases because prices are likely to experience greater volatility during these times.