Index Funds I Should Have Bought An Index Fund

Post on: 16 Март, 2015 No Comment

An index fund is a mutual fund that tracks a certain index. Large market indexes include the S&P TSX, Dow Jones and S&P 500. Index funds based on these indexes are a great way to invest in the stock market without buying individual stocks or actively managed mutual funds. Unfortunately, I didnt always know about index funds. My first time investing, I went into the bank to open an RRSP account and I chose an actively managed dividend fund with a good 5 year history.

Though I hadnt invested before, I thought I knew what I was doing. I read a bit online, found a mutual fund with a good track record and a MER below 2%. I knew dividends can greatly help your long term returns so I figured dividend funds would be a good choice. So why do I regret the investment?

Past History Does Not Indicate Future Performance

While its great that a mutual fund had a solid five years of returns, it doesnt mean that the next year will do just as well. In fact, there are studies that indicate its all the more likely that the fund will have a bad year. Not only do all investments have their ups and downs, but there are other factors such as a major change in the portfolio of the mutual fund or even a new fund manager behind the scenes.

Management Expense Ratio

A Management Expense Ratio (MER) of around 1.7% isnt necessarily considered high when there are other funds at 2.5%. However, considering I now dont invest in any mutual funds with MERs over 0.5%, this means I was losing at least 1% of my return in my previous mutual fund.

Mutual Fund Not Sticking To Its Purpose

When trying to set up a balanced portfolio, you might pick certain funds to fill a missing piece, whether its a certain industry, country, or type of investment. So if youre looking for a Canadian dividend fund. you need to be aware that youre not only getting Canadian dividend paying stocks in that fund, but anything else a fund manager may decide to add in an attempt to increase the return.

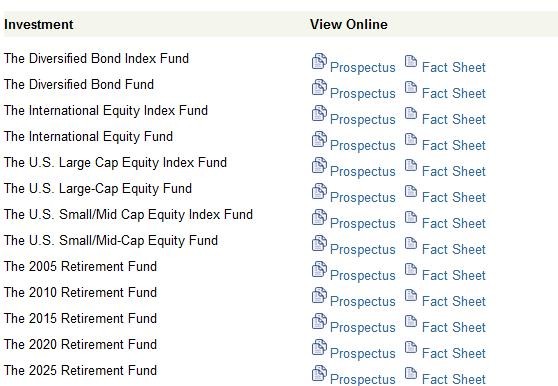

How I Started Investing In Index Funds

I was lucky enough to cash out my mutual fund through the Home Buyers Plan near its peak price, and before the crash in 2008. Then I decided to setup a TD e-Series Funds account. buying the TD U.S. Index and TD International Index. In a few years I plan to add the TD Canadian Bond Index to reduce the risk of an all-stock portfolio.

Monevator and Green Panda Treehouse also wrote about their first time investing. Whats your story of your first time investing?