Income Taxes in the Cash Flow Statement

Post on: 22 Апрель, 2015 No Comment

Income Taxes in the Cash Flow Statement

By Hugo Nurnberg

In Brief

A Proposal for More Precise Presentation

SFAS 95, Statement of Cash Flows. classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains and losses on investing and financing activities, such as gains and losses on plant asset disposals and early debt extinguishments. As a result, net cash flow from operating activities (NCFO) is contaminated by the income tax effects of investing and financing activities. To avoid such contamination, the author argues for amending SFAS 95 to require income tax allocation in the cash flow statement. By allocating income taxes in the cash flow statement, the income tax effects of transactions and events would be reported in the same section of the cash flow statement as the transactions and events themselves, resulting in a more precise presentation of the net cash flows from operating, investing, and financing activities.

Under SFAS 95, Statement of Cash Flows. most business enterprises are required to provide a cash flow statement with every income statement, classifying cash flows as operating, investing, or financing. SFAS 95 classifies income tax payments as operating outflows, even though some income tax payments relate to investing and financing activities.

Worldwide, classification of income tax payments in the cash flow statement varies. The accounting standards of most countries conform to SFAS 95, but a joint U.K.Irish standard classifies income tax payments in a separate category. The standards of the Australian Accounting Standards Board, the Canadian Accounting Standards Board, and the International Accounting Standards Board classify income tax payments as operating outflows unless they can be specifically identified with investing or financing activities.

Because income tax payments are operating cash flows under SFAS 95, net cash flow from operating activities (NCFO) includes the income tax effects of certain gains and losses relating to investing or financing activities, such as gains and losses on plant asset disposals and early debt extinguishments.

This writer favors FASB amending SFAS 95 to conform more closely to prevailing financial decision models. More precisely, income tax payments should be allocated among operating, investing, and financing activities so that the net cash flow subtotals for each activity reflect after-tax cash flows. This will enhance the reliability of investment decisions and strengthen empirical studies based on databases that take these subtotals directly from published cash flow statements.

SFAS 95 Classification Rules

Under SFAS 95, the cash flow statement classifies cash inflows and outflows as related to operating, investing, or financing activities, and presents net cash flow subtotals for each of these three activities.

Operating activities. SFAS 95 defines operating activities as all transactions and events not defined as investing or financing activities. Under SFAS 95 (as amended by SFAS 117), operating cash inflows include interest and dividend collections on debt and equity securities of other entities, unless they are donor-restricted for long-term purposes; customer collections from the sale of goods and services; and other receipts not defined as financing or investing inflows, such as supplier refunds, collections on lawsuits, and most insurance proceeds. Operating cash outflows include interest payments (unless capitalized); payments for inventories; payments to employees; payments to suppliers of other goods and services; payments for taxes, duties, fines, and other fees; and all other payments not defined as financing or investing outflows, such as customer refunds, payments under lawsuits, and charitable contributions.

Investing activities. SFAS 95s definition of investing activities includes making and collecting loans; acquiring and disposing of debt or equity instruments; and acquiring and disposing of property, plant, equipment, and other productive assets. More specifically, investing cash inflows include receipts from collecting or disposing of loans; receipts from the sale of debt or equity securities of other entities; and receipts from sales of property, plant, equipment, and other productive assets, including business dispositions. Similarly, investing cash outflows include payments to make or acquire loans; payments to acquire debt or equity securities of other entities; and payments to acquire property, plant, equipment, and other productive assets, including capitalized interest payments and business acquisitions.

Financing activities. SFAS 95s definition of financing activities (as amended by SFAS 117) includes obtaining resources from owners and providing them with a return on, and a return of, their investment; receiving donor-restricted resources that must be used for long-term purposes; borrowing money and repaying amounts borrowed, or otherwise settling the obligation; and obtaining and repaying other resources obtained from creditors on long-term credit. Under SFAS 95 (as amended by SFAS 117), financing cash inflows include proceeds from issuing debt or equity securities, proceeds from other short- or long-term borrowings, and proceeds from contributions and investment income that are donor-restricted for long-term purposes. Financing cash outflows include dividend payments, outlays to reacquire or retire equity securities, and repayments of amounts borrowed.

For example, under SFAS 95, income tax payments and refunds are operating flows, even when directly related to certain investing and financing activities. A more precise calculation of cash flow from operating activities would exclude the income tax effects of investing and financing activities. An allocation of income taxes to the same section of the cash flow statement as the transactions and events themselves would result in more precise net cash flow subtotals for operating, investing, and financing activities.

Example

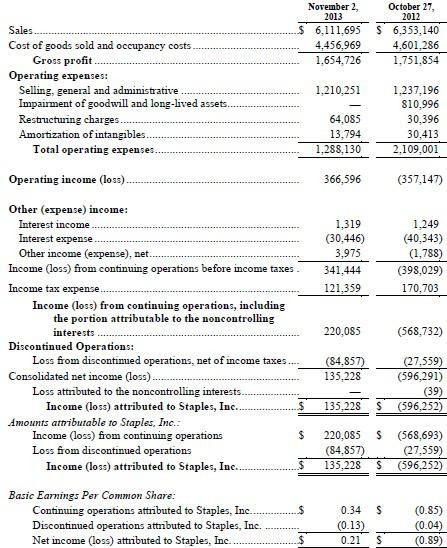

The Exhibit illustrates the difference in net cash flow subtotals with and without income tax allocation. Panel A summarizes the assumed transactions and events: $200,000 of cash operating revenues less cash operating expenses; $30,000 of gains on plant asset disposals ($100,000 proceeds less $70,000 net book value); $92,000 of income tax expense (at a flat 40% rate); no receivables, inventories, payables, deferred tax assets or liabilities, or financing activities; $150,000 of plant assets acquisitions; and a $40,000 cash balance at the beginning of the period. After-tax net income is $138,000. Panels B and C reflect the cash flow statement under SFAS 95 (without income tax allocation) and as proposed (with income tax allocation).

SFAS 95 presentation (no tax allocation). Under SFAS 95, NCFO is $108,000 and net cash flow from investing activities (NCFI) is $50,000. Using either the direct or indirect method, the $108,000 NCFO under SFAS 95 is penalized by $12,000 of income tax payments on the $30,000 plant disposal gain, and the $100,000 plant disposal proceeds are reported on a before-tax basis as an investing inflow. This outcome is more apparent using the direct method, where the $108,000 NCFO is derived by subtracting the $92,000 total income tax payment from the $200,000 net operating inflow excluding income tax payments, as reflected in the SFAS 95 column in Panel B. Using the indirect method, subtracting the $30,000 before-tax disposal gain from the $138,000 net income results in the same $108,000 NCFO, as indicated in the reconciliation in the SFAS 95 column in Panel C, but the $12,000 penalty is less apparent. The $92,000 total tax payment is reported as a separate line item under the direct method, or as a supplemental disclosure under the indirect method.

Proposed presentation (tax allocation). By allocating income taxes in the cash flow statement, NCFO becomes $120,000 and NCFI becomes $62,000. Using the direct method, the $92,000 total tax payment is allocated $80,000 to operating activities and $12,000 to investing activities. As a result, the $120,000 NCFO is the difference between $200,000 of net operating inflow excluding income tax payments and $80,000 of income tax payments thereon, as reflected in the Authors Proposal column in Panel B. Using the indirect method, the $18,000 after-tax disposal gain is subtracted from the $138,000 net income, resulting in the same $120,000 NCFO, as indicated in the reconciliation in the Authors Proposal column in Panel C. Under either method, the $120,000 NCFO with tax allocation does not include the $12,000 of income tax payments on the $30,000 plant disposal gain. Additionally, $88,000 of plant asset disposal proceeds is reported as an investing inflow, equal to the $100,000 sales proceeds less the $12,000 income tax payments on the disposal gain, as reflected in the Authors Proposal column in Panel B.

SFAS 95 prohibits allocating income taxes in the cash flow statement, reasoning that tax allocation would be so complex and arbitrary that the benefits, if any, would not justify the costs involved. Although the same type of criticism was once directed at intraperiod tax allocation in the income statement, that procedure has long since become part of GAAP.

FASB should consider requiring tax allocation in the cash flow statement. It is not too complex and arbitrary, and its benefits more than justify its costs. Without income tax allocation, the income tax effects of certain investing and financing cash flows are commingled with operating cash flows.

Although intraperiod tax allocation for cash flow reporting requires estimates of tax payments attributable to individual investing and financing activities, these estimates may be made by methods already developed for income statement reporting purposes. Moreover, although any estimate may be complex or arbitrary, it is better than no estimate at all. Without intraperiod tax allocation, NCFO is understated by the tax on gains and overstated by the tax savings on losses related to investing and financing activities. By allocating income taxes in the cash flow statement, the income tax effects of transactions and events are reported in the same section of the cash flow statement as the transactions and events themselves, resulting in a more precise computation of net cash flow subtotals from operating, investing, and financing activities. This will enhance the reliability of investment decisions and improve empirical studies based on databases that take these subtotals directly from published cash flow statements without adjustment.

Palliatives Acceptable Under GAAP

As long as SFAS 95 continues to prohibit tax allocation in the cash flow statement, a recommended palliative is to voluntarily disclose material income tax effects of gains and losses relating to investing and financing activities. This way, users are apprised of the tax effects of these gains and losses on reported NCFO. In the example above, transparency is increased by disclosing that income tax payments include $12,000 on a plant disposal gain and that disposal proceeds are reported as an investing inflow. It makes apparent that NCFO would have been $12,000 more but for the $12,000 tax on the disposal gain.

In practice, some companies make such voluntary disclosures. For example, Sinclair Broadcast Group, Inc. discloses in the management discussion and analysis (MD&A) section of its 2000 Form 10-K that the $69.1 million reported NCFO for 2000 is after deducting $115.1 million of income tax payments on the sale of its radio broadcast assets, which proceeds were reported as investing inflows. For Sinclair, NCFO uncontaminated by the taxes paid on this investing activity would have increased $115.1 million to $184.2 million, or 167% more than the $69.1 million reported amount.

Similarly, in the cash flow statement included in its 2001 Form 10-K, Delmarva Power & Light Company (DPL) reported a $60,749,000 NCFO and a $528,215,000 investing inflow from sales of electric generating plants in 2001. In the MD&A section, DPL discloses that NCFO was reduced by a $77,800,000 increase in income tax payments for 2001 primarily attributed to the gain on the plant sale. Accordingly, NCFO uncontaminated by income tax payments on that sale would have been as much as $138,549,000, or 128% more than the $60,749,000 reported amount.

Palliatives Not Acceptable Under GAAP

Some companies allocate income taxes in cash flow statements despite the prohibition of SFAS 95. For example, in its 2000 Form 10-K, Duquesne Light Company reports an investing inflow of $1,547,607,000 from sales of generation assets net of federal income tax payments of $157,424,000. It also reports NCFO of $237,999,000 for 2000. If Duquesne Light had classified all income tax payments as operating outflows consistent with SFAS 95, NCFO for 2000 would be $80,575,000, or 66% less than the reported amount.

An even more dramatic example of tax allocation in the cash flow statement is found in Amcol International Corporation and Subsidiaries 2000 Form 10-K. Under investing activities, Amcol reported a $654,581,000 inflow from the sale of the absorbent polymers segment, followed immediately by a $75,587,000 outflow for tax payments related to that sale. For 2000, it also reported NCFO of $36,603,000 from continuing operations and an outflow of $327,000 from discontinued operations, for a total NCFO of $36,276,000. If Amcol classified all income tax payments as operating outflows, total NCFO for 2000 would be negative $39,311,000 rather than positive $36,276,000.

Presumably, Duquesne Light and Amcol allocate income taxes in the cash flow statements because reported NCFO would otherwise be misleading, but neither discloses that fact. Disclosing the tax effects of the investing activities would have been an acceptable practice under extant GAAP to avoid reporting misleading NCFO amounts. Amending SFAS 95 to permit tax allocation would be better still.

Other Disclosure Issues

As noted earlier, SFAS 95 requires disclosure of income tax payments, as a separate line item under the direct method or in a note to the financial statements under the indirect method. SFAS 95 does not explicitly address the reporting or disclosure of income tax refunds. As a result, income tax payments may be reported either net or gross of income tax refunds. An unambiguous example of net reporting is the 2001 Form 10-K of Mapics Inc. Note 18 discloses income tax payments, net of income tax refunds, of $3.9 million and $328,000 for 1999 and 2000, respectively, and income tax refunds, net of income tax payments, of $1.6 million for 2001. An unambiguous example of gross reporting is the 2001 Form 10-K of Home Shopping Network Inc. Note 12 discloses income tax payments of $12,499,000, $5,680,000, and $3,935,000, and income tax refunds of $1,053,000, $1,250,000, and $0, respectively, for 2001, 2000, and 1999. More common, however, are ambiguous disclosures of tax payments and refunds without specifying whether there were both payments and refunds in individual years. For example, Parlex Corp. in Note 10 of its 2002 Form 10-K, discloses income tax payments of approximately $600,000 and $2,469,000 in 2001 and 2000, respectively, and income tax refunds of $3,348,000 in 2002. Gross reporting is manifestly more informative than net reporting of income tax payments and refunds.

Time for Reconsideration

Fifteen years have passed since FASB issued SFAS 95. Since then, several limitations and defects of SFAS 95 have been identified that justify its reconsideration, including the prohibition of income tax allocation in the cash flow statement. One would hope that FASB will ultimately conclude that the benefits of income tax allocation in the cash flow statement more than justify its costs. By allocating income taxes in the cash flow statement, the income tax effects of transactions and events would be reported in the same sections as the transactions and events themselves. This would result in a more precise classification of cash flow from operating, investing, and financing activities.

The Australian, Canadian, and International Accounting Standards Boards now permit income tax allocation in the cash flow statement whenever income taxes can be specifically identified with investing or financing activities. At a minimum, FASB should do likewise. Better still, it should require income tax allocation in the cash flow statement.

Hugo Nurnberg, PhD, CPA. is a professor of accountancy at Baruch College, City University of New York.

The CPA Journal is broadly recognized as an outstanding, technical-refereed publication aimed at public practitioners, management, educators, and other accounting professionals. It is edited by CPAs for CPAs. Our goal is to provide CPAs and other accounting professionals with the information and news to enable them to be successful accountants, managers, and executives in today’s practice environments.