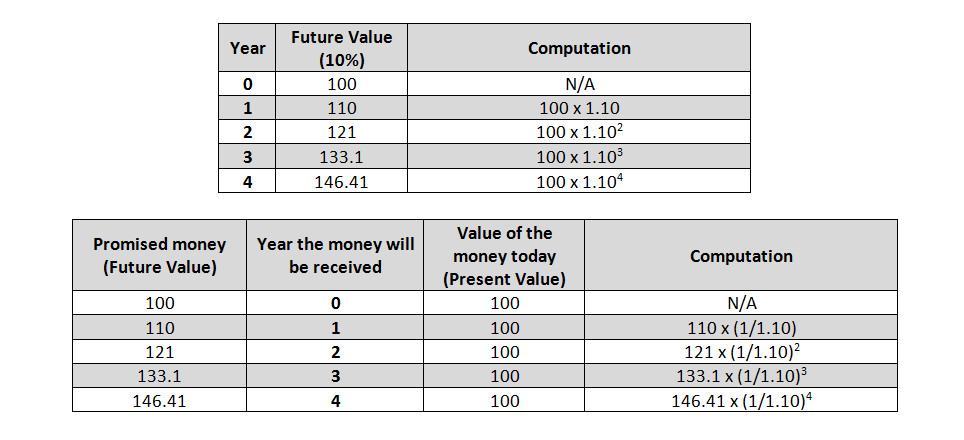

In order to illustrate the concept of the time value of money

Post on: 25 Апрель, 2015 No Comment

Essential Concepts

in Managerial Finance

Chapter 2 Analysis of Financial Statements

Chapter 3 The Financial Environment: Markets,

Institutions, and Investment Banking

CHEPKO DANIL. PA R T

Essential Concepts

in Managerial Finance

Chapter 2 Analysis of Financial Statements

Chapter 3 The Financial Environment: Markets,

Institutions, and Investment Banking

CHEPKO DANIL VITALEVICH/SHUTTERSTOCK.COM

Chapter 4 Time Value of Money

Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.

33733_ch02_ptg01_hires.indd 18

COMSTOCK IMAGES/GETTY IMAGES

Chapter 2

ANALYSIS OF FINANCIAL

STATEMENTS

Learning Outcomes:

LO 1

Describe the basic nancial information that is produced by corporations and explain how the rms stakeholders use

such information.

LO 2

Describe the nancial statements that corporations publish and the information that each statement provides.

LO 3

Describe how ratio analysis should be completed and why the results of such an analysis are important to both managers

and shareholders.

LO 4

Discuss potential problems (caveats) associated with nancial statement analysis.

inancial statement analysis involves evaluation of a rms nancial position to identify its

current strengths and weaknesses and to suggest actions that the rm might pursue to

take advantage of those strengths and correct any weaknesses. In this chapter, we discuss

how to evaluate a rms current nancial position using its nancial statements. In later chapters,

we examine actions that a rm can take to improve its nancial position in the future, thereby

increasing the price of its stock.

Chapter 2

Analysis of Financial Statements

Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.

33733_ch02_ptg01_hires.indd 19

annual reportA report

issued by a corporation to its

stockholders that contains basic

nancial statements, as well as

the opinions of management

about the past years operations

and the rms future prospects.

balance sheetA statement that shows the rms

nancial positionassets and

liabilities and equityat a

specic point in time.

LO 1

FINANCIAL REPORTS

Of the various reports that corporations provide to their

stockholders, the annual report probably is the most important. This report provides two types of information:

1. Discussion of operationsdescribes the

firms operating results during the past year and discusses new developments that will affect future operations.

2. Basic nancial statementsinclude (a)

the balance sheet, (b) the income statement, (c) the

statement of cash flows, and (d) the statement of retained earnings. Taken together, these statements give

an accounting picture of the firms operations and financial position. Detailed data are provided for the two

most recent years, along with historical summaries of

key operating statistics for the past five or 10 years.1

The quantitative and verbal information contained

in the annual report are equally important. The financial statements indicate what actually happened to the

firms financial position and to its earnings and dividends

over the past few years, whereas the verbal statements attempt to explain why things turned out the way they did.

To illustrate how annual reports can prove helpful, we

will use data taken from a fictitious company called Unilate Textiles. Unilate is a manufacturer and distributor

of a wide variety of textiles and clothing items that was

formed in 1990 in North Carolina. The company has

grown steadily and has earned a reputation for selling

quality products. In the most recent annual report, management reported that earnings dropped 8.5 percent due

to losses associated with a poor cotton crop and from

Firms also provide quarterly reports, but they are much less comprehensive

than the annual reports. In addition, larger firms file even more detailed

statements that give breakdowns for each major division or subsidiary with

the Securities and Exchange Commission (SEC). These reports, called 10-K

reports, are made available to stockholders upon request to a companys

corporate secretary. Many companies also post these reports on their websites.

Finally, many larger firms also publish statistical supplements that give financial statement data and key ratios going back 10 to 20 years.

Part 2

increased costs caused by a three-month employee strike

and a retooling of the factory. Management then went on

to paint a more optimistic picture for the future, stating

that full operations had been resumed, several unprofitable businesses had been eliminated, and profits were expected to rise during the next year. Of course, an increase

in profitability might not occur, and analysts should

compare managements past statements with subsequent

results to determine whether this optimism is justified.

In any event, investors use the information contained

in an annual report to form expectations about future

earnings and dividends. Clearly, then, investors are quite

interested in a companys annual report.

Because this book is intended to provide an introduction to managerial finance, Unilates financial statements

are constructed so that they are simple and straightforward. At this time, the company uses only debt and common stock to finance its assetsthat is, Unilate does not

have outstanding preferred stock or other financing instruments. Moreover, the company has only the basic assets that are required to conduct business, including cash

and marketable securities, accounts receivable, inventory,

and ordinary fixed assets. In other words, Unilate does not

have items that require complex accounting applications.

LO 2

FINANCIAL STATEMENTS

Before we analyze how Unilates financial position

compares to other firms, lets take a look at the financial

statements the company publishes.

The Balance Sheet

The balance sheet represents a picture taken at a specific point in time (date) that shows a firms assets and

how those assets are financed (debt or equity). Figure2.1

shows the general set up for a simple balance sheet.

Table2.1 shows Unilates balance sheets on December 31

for theyears 2010 and 2011. December 31 is the end of

the fiscal year, which is when Unilate takes a snapshot

of its existing assets, liabilities, and equity to construct the

balance sheet. In this section, we concentrate on the more

recent balance sheetthat is, December 31, 2011.

Assets, which represent the firms investments, are

classified as either short-term (current) or long-term (see

Figure2.1). Current assets generally include items that

will be liquidated and thus converted into cash within

one year, whereas long-term, or fixed, assets include

investments that help generate cash flows over longer

periods. As Table2.1 shows, at the end of 2011 Unilates

current assets, which include cash and equivalents,

accounts receivable (amounts due from customers),

Essential Concepts in Managerial Finance

Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.

33733_ch02_ptg01_hires.indd 20