IMBest(SSOSDS) Beating the Market with Leveraged ETFs iMarketSignals

Post on: 16 Март, 2015 No Comment

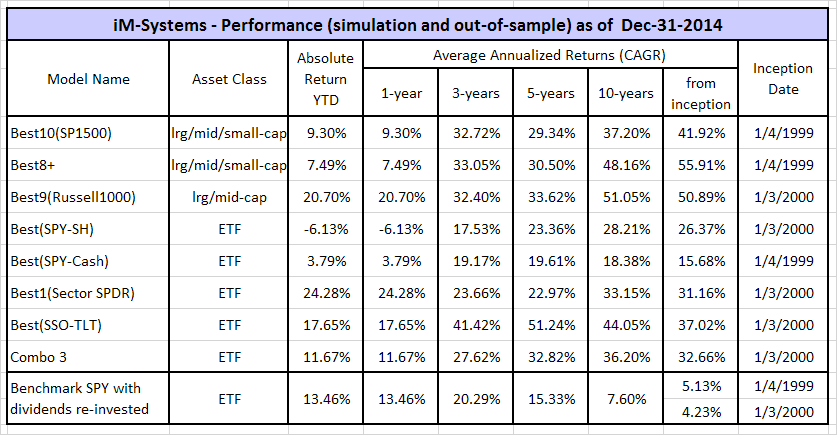

Using the simulated investment periods determined with the iM-Best(SPY-SH) Market Timing System. we calculated performance figures resulting from the model switching between the ETFs SSO and SDS, instead of SPY and SH. The periods when the model was long are listed in Table 3 of iM-Best(SPY-Cash) Market Timing System. SSO and SDS are the leveraged ETFs which seek daily investment results corresponding to twice, and to twice the inverse of the daily performance of the S&P500, respectively. This alternative system would have produced an average annual return of about 55.6% from January 2000 to the end of August 2013, versus 2.6% for a buy-and-hold investment of SPY over the same period.

Performance

The trading performance of the system which switches between SSO and SDS is shown in Figure 1. The annualized return from January 2000 to end of August 2013 was 55.6%; $100 grew to about $42,000 over this period. The maximum drawdown was -42.0% in October 2002. All values are adjusted for dividends, and slippage was assumed at 0.1% of the transaction amounts.

In above chart, the upper green graph shows the ratio of the Best(SSO-SDS) to SPY, the rising trend of that graph indicating that the Best(SSO-SDS) almost continuously outperformed SPY, producing 295 times the value which one would have had from a buy-and-hold investment in SPY over the same period. However, note that from middle of May 2013 to end of August 2013 there was an underperformance of about 9% relative to SPY.

The inception date of SSO and SDS was June 19, 2006 and July 11, 2006, respectively. Prior to this dates values are “synthetic”, derived from the S&P 500. Below is Figure 2 which shows the model’s return from July 14, 2006 onwards using the actual closing prices of SSO and SDS. The annualized return is 81% with a maximum drawdown of only 31%.

Annual Returns

Annual performance from January to December ranged from a maximum of 190% for 2008 to a minimum of -7% for 2000, as can be seen in Figure 3.

Figure 4 shows the rolling 1-year returns starting each trading day from 2000 to 2012 ranging from a minimum of -24% to a maximum of 312%.

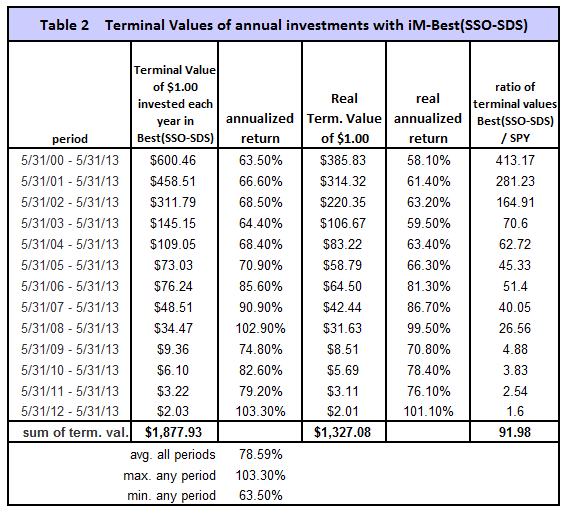

Terminal Values

Terminal values were calculated to the end of May 2013 for annual hypothetical investments of $1. Starting with a dollar during each of the 13 years from 2000 to 2012, one would have invested a total of $13 cumulatively by the end. Summing the 13 terminal values, this strategy would have netted this dollar-per-year investor the amount of $1,878 at the end of 13 years.

Following a buy-and-hold strategy in SPY, one would have only $22, a tiny fraction of what Best(SSO-SDS) provided. Furthermore, the lowest annualized return, for any of the 13 time periods was 63.5% and the average for all the periods was 78.6%. This is shown in Tables 1 and 2.

Conclusion

It is evident that successful market timing will improve returns. Investments in leveraged ETFs is highly risky, and the returns shown are provided for informational use only. The returns over shorter periods are not always better than those of the S&P500. There is no claim made that one would have actually achieved those returns in real life. Note that all performance figures are derived from a simulation model and are the results of backtesting only.