IFA s Concerns with Laddered Bond Portfolios

Post on: 17 Апрель, 2015 No Comment

Index Funds Advisors, Inc. acts as a fiduciary for our clients. As such, we have reviewed many different investment approaches, all of which are available to our clients. IFA derives no benefit in advising one particular strategy over another. This applies to the choice between using bond index funds vs. individual bonds. To borrow from Investopedia, a bond ladder is a portfolio of individual bonds with maturity dates evenly spaced across several years, so that the bonds are maturing and the proceeds are being reinvested or spent at regular intervals. An investor who sets up a bond ladder usually does so with the intention of mitigating interest rate (or term) risk and ensuring future liquidity. While at first blush, it may appear to be a sound strategy, IFA cautions investors to think very carefully before proceeding to implement it. The benefit of maintaining control over cash flows comes at a substantial cost.

The primary concern with a bond ladder is the exposure to the default risk, manager continuity risk, and selection risk of individual bonds, particularly if the ladder is constructed with corporate or municipal bonds. Investors are dependent on a bond manager maintaining standards of selection and the continuity of that skill and prudence from one bond manager to another. Back in 2008, Schwab’s actively managed YieldPlus fund, which was meant to be a safe and higher yielding alternative to money market funds, imploded with a 15.4% decline over a 12-month period. Of all the different types of risk that an investor may assume for the purpose of capturing an additional return (a risk premium), default risk is the least desirable because its payoff structure is heavily negatively skewed. Specifically, if a bond does not default, then the bondholder simply earns a spread over the Treasury of the same maturity. For investment grade corporate and municipal bonds, the spread is usually modest. Note that for municipal bonds, the spread is relative to the after-tax yield of the Treasury. In the event of a default, however, the loss is usually substantially larger than what the gain would have been otherwise. While a complete loss of principal is rare among defaults, hapless bondholders took a shellacking from infamous corporate bankruptcies, such as Enron and Worldcom, whose bondholders received about 16 cents and 36 cents on the dollar 1. respectively. Regarding Lehman Brothers, the bondholders are expected to receive about 21 cents on the dollar 2 more than four years after the initial default. Investors who think that insured municipal bonds are immune from default risk should consider the fact that during the 2008 financial crisis, the two largest insurers, Municipal Bond Insurance Association (MBIA) and Ambac, narrowly averted bankruptcy, thanks to government bailouts. The details may be found in this article from Investopedia .

The second concern with bond ladders is the high cost of implementation and maintenance. Individual investors who trade bonds pay very high costs compared to institutional investors, such as bond mutual funds that trade in much larger sizes. This, of course, excludes investors who acquire Treasury bonds via the Treasury Direct program or use bank CDs to build their ladders. As the chart below illustrates, there is an inverse relationship between the size of the trade and the cost of executing the trade. Although an investor utilizing a bond ladder would theoretically only buy bonds and never sell them, she should still not expect to easily overcome the headwind of high trading costs.

An additional concern with bond ladders is the lack of a statistically significant sample of transparent data on the managers risk and performance compared to a diversified portfolio of bond mutual funds. In such a study, the total fees of advisor/broker and trading costs must be considered. Providers of laddered bonds claim the cost to implement is less, but somehow must cover their cost of trading desks and bond traders. That may be included in a higher investment advisor/broker fee. We have 40 years or more of data on bond funds and bond indexes, but little, if any data, on the laddered approach adjusted for risk taken and/or risk budgeted. Just looking at a few client performance reports has no value. The analysis needs to start with the investors overall risk capacity, leading to a risk budget that is implemented with an allocation of equities and bonds matched to that risk capacity. If the laddered bond portfolio contains too much risk or too little risk for the bond allocation, then we have not properly spent our risk budget and the the expected return of the whole portfolio will be impacted. A broker or advisor who offers to construct a bond ladder for you should be asked to provide a complete history of a large and representative sample performance (net of all fees and expenses and a disclosure of how they profit from them) of bond ladders they have implemented for other clients. If they cannot or will not provide it, then you should definitely think twice about continuing that relationship.

IFA’s final concern with bond ladders is the lack of clear direction on how best to implement them. Even though it has the appearance of a passive strategy in its strict adherence to buy and hold, it is in reality active because it puts the investor (or her broker/advisor) into the position of a being a bond-picker. Deciding which company’s or municipality’s bonds to favor at the expense of all the others is vexingly difficult if not impossible for all but seasoned professional bond managers, and even they fall short of passive benchmarks more often than not, according to the Standard and Poors Index vs. Active Funds Scorecard. The chart below summarizes the consistent failure of professional bond fund managers to beat their benchmarks. Of course, the reason for this failure is the drag of the management fee expenses and the internal expenses of running the fund. The purpose in showing these charts is to remind investors that they have zero reason to expect an above-benchmark return with individual bonds.

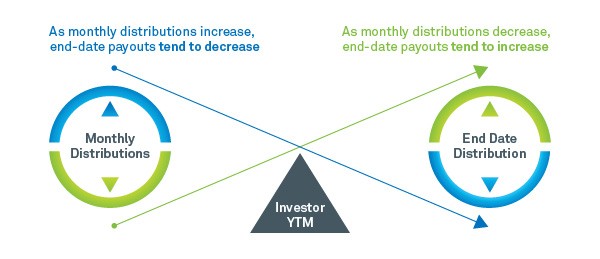

Lastly, buyers of individual bonds who are not withdrawing funds from their portfolio have the problem of how to deploy the cash received from bond coupon payments. The deleterious impact of cash drag should not be ignored. As a Vanguard research paper 3 demonstrated, over a fifteen year period from 1989 to 2004, more than half of the total return from an investment in a bond index fund was derived from interest earned on reinvestment of coupon payments. Investors in individual bonds will find it difficult to capture this important component of returns. While it is true that an investor may put temporary excess cash into a no-load bond mutual fund, of all the actual laddered bond portfolios that we have seen from clients and prospects, very few, if any, were actually doing that.

Investors who wish to avoid these pitfalls of bond ladders do have a viable alternative. They can simply buy a combination of low-cost passively managed bond funds that focus on different ranges of maturities. A bond fund mitigates default/downgrade risk via diversification among issuers, and it can take full advantage of lower trading costs for large trades. Furthermore, it has the potential to add value by taking advantage of the current structure of the yield curve. For example, with the current yield curve (as of 1/10/2013), a 5-year bond fund can maximize returns by buying 5-year bonds and selling them after they become 4-year bonds. During a time period when the yield curve is flat or inverted, it may make sense to keep maturities at the shorter end. Furthermore, a passively managed bond fund from a reputable company should have a transparent performance history where investors can clearly see the returns received through all different types of interest rate environments. An investor (or her advisor) who chooses to follow this prescription can easily maintain the portfolio by using either deposits or withdrawals to keep it in balance. Ideally, bonds (or bond funds) should be held as part of a larger portfolio containing equities and real estate investment trusts. Having a bond ladder that is walled off from the rest of the portfolio can lead to sub-optimal behavior, such as a failure to sell bonds and buy equities after equities have experienced a significant decline.

As a recent Vanguard research paper 4 concluded, an investor who favors individual bonds over low cost bond index funds must place a very high value on the control of cash flows to justify the higher costs and additional risks. While ladders serve an emotional need for certainty, investors should not be duped into thinking that this move outwits the markets. Nothing does.

3 Donaldson, Scott J. 2005. Taxable Bond Investing: Bond Funds or Individual Bonds? Vanguard Research.

4 Bennyhoff, Donald G. 2012. A Topic of Current Interest: Bonds or Bond Funds? Vanguard Research.