If you have overseas investments (New Zealand tax residents with overseas interests)

Post on: 18 Май, 2015 No Comment

Top 10 facts on international tax

If you have overseas investments

If you have a rental property in a country other than New Zealand

If you are a New Zealand tax resident you will be taxed on your worldwide income. This will include any rental income you derive from properties owned offshore. You will also be able to claim deductions for expenses that relate to the derivation of the rental income. You may also be able to claim a credit for any tax paid in the other country on this income.

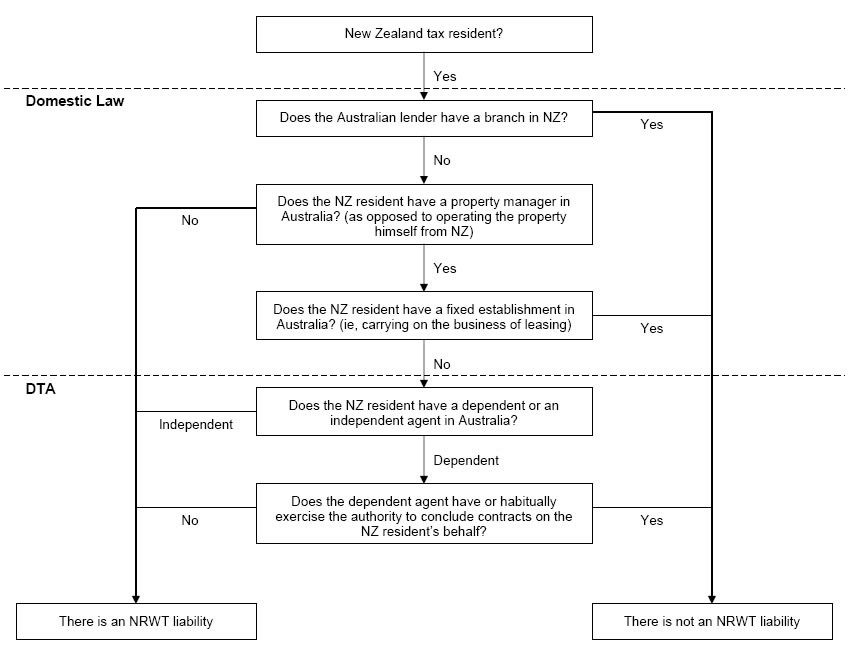

If you have a mortgage over the offshore property with an offshore bank, there may also be a requirement that you deduct non-resident withholding tax (NRWT) from the interest payments. In particular, you should refer to the Non-resident withholding tax payer’s guide (IR291) .

Inland Revenue has also released a Public Item (QB 11/01) that specifically relates to Australian property and interest paid to Australian financial institutions.

Another important point to note is that if the institution where you have a mortgage is resident in a country with whom New Zealand has a double tax agreement, there may be some concessions in relation to the NRWT rate payable.

Approved issuer levy

You may also be able to pay the approved issuer levy of 2% instead of NRWT and you may also be able to only pay every six months.

How your family trust will be treated for New Zealand tax purposes

The New Zealand tax obligations of your family trust will depend on how your trust is classified under New Zealand law.

If you own shares in a foreign company

If you own shares in a foreign company you will be required to pay tax in New Zealand on any dividends received unless:

- you are a transitional resident

Dividends paid by overseas companies to transitional residents or non New Zealand tax residents are not taxable in New Zealand for the transitional period.

Foreign investment fund (FIF) rules / Controlled foreign company (CFC) rules

The FIF and CFC rules are part of New Zealand’s international tax laws. The international tax laws are designed to ensure that New Zealand tax residents pay tax on their overseas investments. The rules are applicable even if you incorporated or purchased these investments before you arrived in New Zealand.

New Zealand might impose tax at the time the income is earned offshore and not at the time the income is distributed to New Zealand. The rules are complex and Inland Revenue recommends that you seek professional advice on the taxation of your offshore investments.

Below is a brief outline on the specific rules.

FIF interests

Subject to various exemptions, an interest in a FIF is a:

- share/interest in an entity which is considered under New Zealand law to be a company or unit trust;

- beneficial interest in a foreign superannuation fund; and

- beneficial interest in a foreign life insurance policy.

Your investment might be exempt from the FIF regime under the various exemptions. The most common exemptions are the:

- exemption for certain Australian resident companies listed on approved indices of the ASX (refer to IR871), and

- de minimis exemption.

CFC interests

Income derived from your offshore share interests might be subject to the CFC rules. Generally, a foreign company will be a CFC if:

- five or fewer New Zealand tax residents own more than 50% of the control interest in that company; or

- a single New Zealand tax resident holds a control interest of not less than 40% unless there is a non associated, non New Zealand resident who has an equal or greater control interest in that foreign company.

Additional disclosures

Please note that you might have to file additional disclosure forms for your offshore shareholdings.

Controlled foreign companies or foreign investment fund disclosure (IR458) form

If you have a credit/debit card issued by an offshore bank

There will not necessarily be New Zealand tax obligations for you just because you hold an offshore credit card or debit card.

If you are a New Zealand tax resident you are generally taxed on the world wide income you derive. This includes foreign income even if it is funding an offshore credit card or if it is simply deposited in an offshore bank account. The fact that foreign withholding tax may have been deducted on foreign income does not mean that this income is no longer taxable in New Zealand.

The income is calculated under the New Zealand rules and must be returned as offshore income. In most circumstances this calculation is conducted on a cash basis. If you are exceeding certain thresholds you might have to account for the income under the financial arrangement rules on an accrual basis.

Undeclared offshore income is an area we are focusing on.

If you are paying interest to an offshore lender you might be liable for withholding tax in New Zealand. This does not apply if the offshore lender has a branch in New Zealand.

As these are complex areas, you may wish to seek professional advice if you have offshore bank accounts.