IBM Stock valuation DCF Valuation and intrinsic value for value investors

Post on: 29 Апрель, 2015 No Comment

Fundamental Analysis and Stock Valuation Simplified. Learn more.

International Business Machine | IBM | — Computers — software

$ in Millions. Fiscal year ends in December. Figures are consolidated and restated.

Warren Buffett purchased 5.4% stake in IBM for more than $10 billion back in 2011 which was very surprising because he had a notorious aversion to technology companies. We have added the 2002 to 2010 financial statements of IBM in our database, check the Performance, Valuation and Growth Pages where you can clearly see why Buffett liked Big Blue. Also check out Warren Buffett’s investment in Petro China.

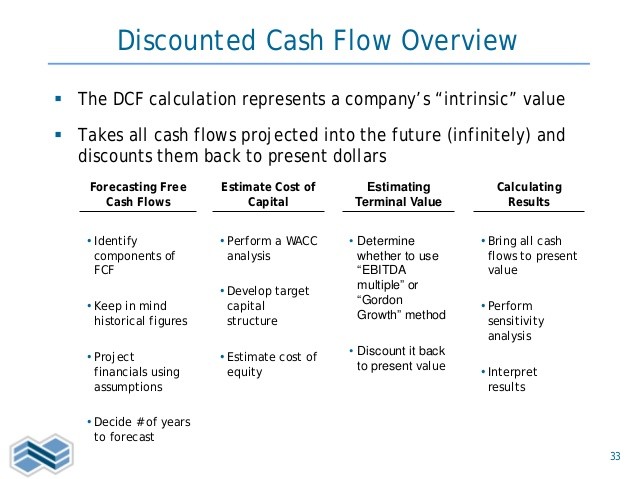

Intrinsic value and stock valuation

Market Capitalization and Net Worth

Net worth also called as Shareholder Equity, Stockholder’s Equity, Net Asset Value or Book Value. It essentially means total assets minus total liabilities.

When you buy shares of a company, you are essentially buying a share of the company’s net worth and a share of the company’s future cash flows. If the company’s net worth and cash is growing, the value of the company is going up because of which the company’s share price goes up.

The above chart displays the share price and the book value per share. Generally the share price is above the book value price but during a recession (e.g. 2008) or due to some other factors, the share price can go below the book value per share. Smart bargain investors buy shares when the current market price is below the book value i.e. the stock is undervalued but at the same time you have to ask yourself why the current market price is going below the book value price. Is it because of some serious fundamental problems with the company?

Market Price. $157.17 on 28-February-2011

Enterprise Value of International Business Machine is ___ $ (Sign up for Premium Service to see the enterprise value.)

Market Capitalization = Share price x No. of shares ( theoretical price at which you can buy the whole company )

Enterprise Value = Market Capitalization + Short term debt + Leases + Long term Debt + Preferred Stock — Cash in hand

CROIC — Cash Returned on Invested Capital

What the hell is CROIC aka CROCI, Cash Returned on Invested Capital, tells us how efficiently a company’s operations and management can invest and reinvest capital to generate even more cash. Capital intensive companies such as airlines and auto manufacturers tend to have very low CROIC because they require huge capital investments to generate relatively small amounts of cash.

Look for companies with positive and increasing CROIC ideally above 10% but it should not be extremely high (e.g. 45%) because that cannot be sustained for long.

9 year Median CROIC for International Business Machine is 14.2 %. Taking a median, unlike averaging, does not skew the number to either the high or low side.