Hussman Funds Weekly Market Comment April 18 2005 How Hedging Works

Post on: 17 Сентябрь, 2015 No Comment

How Hedging Works

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

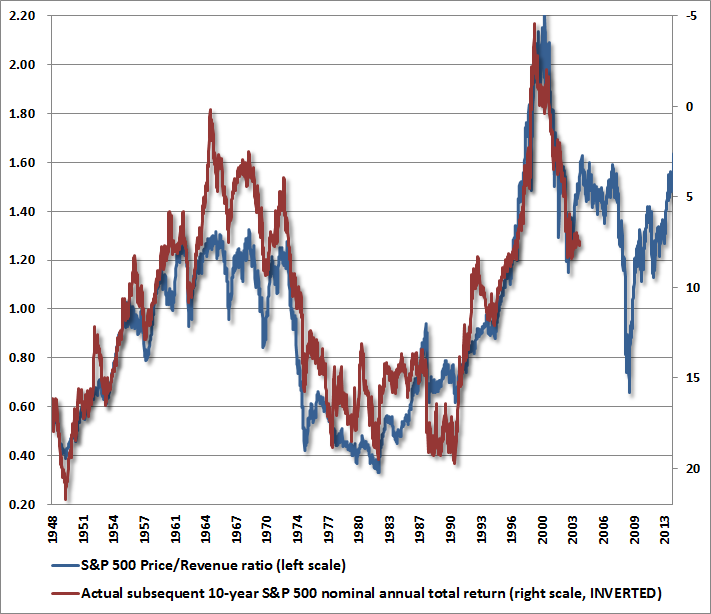

Wow. Nothing like immediate service. Despite the apparent association, though, between the recent deterioration in the Market Climate and last week’s market plunge, I’ve got to emphasize that an unfavorable Market Climate does not imply a useful forecast for short-term market returns. Nor should the recent shift in the Market Climate be taken as a “sell signal” or “bear market call.” Still, if you’ve got a lot of stock exposure, you should be honest with yourself about the amount of risk you can tolerate. If a decline of, say, 30% in the value of your unhedged stock investments (index funds, standard stock funds, etc) would seriously harm your financial security or lead you to abandon those positions, you’re probably taking unacceptable risks here.

As of last week, the Market Climate for stocks remained characterized by unusually unfavorable valuations and unfavorable market action. The Strategic Growth Fund is currently hedged by fully offsetting the value of our stock holdings with short sales in the S&P 100 and Russell 2000, using long put / short call option combinations described in more detail below. To put this in a longer-term perspective (and to clarify small distinctions in my use of the term fully hedged) our stock holdings were briefly fully or near-fully hedged during the generally difficult market period from April-August 2004, but we often held a certain number of offsetting call options during that period (see the June 30, 2004 annual report for an example). At present, our hedge has no such soft edges, and instead resembles how the Fund was hedged during the bulk of the mid 2000 — early 2003 market decline. Not bearish per se, but firmly defensive.

Shorter term, however, the stock market appears deeply oversold and “compressed.” As such, market action is probably not likely to tell us much in the coming sessions, other than producing a whole lot of volatility. If you look at a chart of the Dow Industrials, you’ll see a pretty good “shelf” that has provided support around the 10,400 level, while the S&P 500 has a nice shelf around 1160. In general, when the market plunges clean through one of those supporting shelves, it’s not at all unusual for it to mount a rally back toward the prior support, even if it’s bound to fail again. So don’t be surprised if the major indices mount an explosive 3-4% advance in the near future, to clear the current oversold condition. That’s not a forecast, but it shouldn’t be ruled out (I don’t trade on that type of possibility, and neither should you – but if you’ve got a boatload of shorts, you should also review your ability to financially tolerate the risks of the market heading sharply higher instead of lower).

As I’ve frequently noted in prior years, it’s common in unfavorable Market Climates for the market to periodically produce fast, furious, prone-to-failure advances to clear oversold conditions. It’s critical to remember though, that oversold conditions, in and of themselves, should not be taken as “buy” points in unfavorable Climates. Declining markets can become persistently oversold to lower and lower levels before mounting an unpredictable “clearing rally,” and I haven’t the faintest idea how any trader could be nimble enough to both anticipate the start of the thing and get out at an appropriate time. Suffice it to say that we’re defensively positioned, and I fully anticipate missing out on the occasional fast, furious, failing advance until we observe reasonable evidence that market risk is worth taking.

In short, we’re fully hedged – a position that I would characterize as very defensive but not “bearish” (the dollar value of our shorts never materially exceeds our long holdings). My opinion is that over-long investors might want to lighten up, particularly if we get a clearing rally. Over-short investors ought to seriously consider the possibility of a clearing rally that doesn’t, in fact, fail. In effect, it doesn’t matter whether your position is long or short. Don’t take risks that would lead to unacceptable losses if you were totally and completely wrong. This is not a market that’s likely to be accommodating to anybody who is reckless about risk here.

In bonds, the Market Climate remains characterized by moderately unfavorable valuations and moderately unfavorable market action, holding the Strategic Total Return Fund to a limited duration of under 2 years (meaning that a 100 basis point change in bond yields would be expected to impact the Fund by about 2% on the basis of bond price fluctuations). Precious metals shares are very oversold, and their decline has been largely responsible for the Total Return Fund’s 3% retreat from its recent new highs.

The weakness in precious metals shares has been more a brief frustration than a significant concern, however. The Market Climate for this group remains favorable (and would become more so if we observe further economic softening), and given the Fund’s exposure of about 15% of assets, even a further decline in the group would probably not produce a significant impact on the Fund. In any event, precious metals continue to be an important factor in our current investment stance, and nothing in our discipline suggests reducing our moderate position in response to the pullback. To the contrary, if we observe sufficient evidence of economic weakness without a retreat of inflation pressures, I would be inclined to increase our investment position in precious metals to a modestly higher percentage of assets. A good rule to remember – don’t sell a perfectly appropriate position in asset that you would, in fact, buy if you didn’t already hold it.

Hedging our portfolio of stocks

The main difference between buying the S&P 500 itself and buying a futures contract is that there is virtually no money down. If you buy a futures contract, you can earn interest on the cash that you would have otherwise spent to buy the stock outright, and after a few months, you’ll own the stock just the same. Of course, the markets are not going to let you keep that interest. As I’ll explain below, the price of the futures contract will include that interest. So the return from holding an S&P 500 futures contract will be the total return on the S&P 500 itself, minus interest. Conversely, if you sell short a futures contract on the S&P 500, it’s like an interest-bearing short sale. The total return on the short position is –1 times the total return on the S&P 500 itself, plus interest.

Suppose that you own a portfolio of stocks and want to hedge the impact of market fluctuations on that portfolio. One way to do this is to continue to hold the stocks, and simultaneously sell short a futures contract on a major index that is reasonably correlated with the risk you want to remove.

Let’s assume first that the portfolio you own is, in fact, the S&P 500. In that case, if you sell short an S&P 500 future against it, the hedged portfolio will be riskless (you’re long and short the same underlying security) and the total return your portfolio will be:

Total return on S&P 500 + Total return on short futures position

which is:

Total return on S&P 500 – Total return on S&P 500 + Interest

Notice, not surprisingly, that the market will reward your riskless portfolio with a total return that is simply the risk-free interest rate.

If the portfolio being hedged is something different from the S&P 500, the total return on the hedged portfolio will be:

(Total return on portfolio — Total return on S&P 500) + Interest

A fully-hedged investment position earns the difference in performance between the actual stocks held and the index used to hedge, plus interest.

We always hold a widely diversified portfolio of stocks, and hedge it during unfavorable market conditions, rather than going to cash. The reason is that our stock selections are intended to outperform the indices we use to hedge. Since the inception of the Strategic Growth Fund, the stocks held in the Fund have outpaced the S&P 500, S&P 100, and Russell 2000 by an average margin of several hundred basis points annually, after expenses. Since the importance of stock selection in the performance of the Fund is difficult for shareholders to observe directly, I’m planning to include considerable detail on this in the upcoming annual report.

When you observe the day-to-day movements of the Strategic Growth Fund, it’s important to remember that despite the strong long-term performance of our stock holdings since inception, our stocks do not and will not outperform the market consistently over excruciatingly short periods. Depending on whether a particular stock or group of stocks is strong or weak, the Fund may advance somewhat on a market decline one day, and decline somewhat on a market decline the next. It may decline two days in a row, even if the market rises one day and falls the next. None of these short-term movements are meaningful in and of themselves. While the annualized difference in performance between our stocks and the market has been significant relative to the annualized variation in that performance, the daily difference in performance between our stocks and the market (a few basis points, on average) is completely swamped by the daily variation. Our stocks will not outperform the market on a daily basis. Similarly, investors searching for patterns by attempting to correlate the returns of the Fund to the returns in the market can expect constant frustration. The point of hedging is typically to remove the impact of market fluctuations on the Fund.

As usual, past performance does not ensure future results. Our stock holdings can and periodically do underperform the market indices we use to hedge, which can result in investment losses even if the Fund is fully hedged. The Fund can also periodically experience losses — even when it is fully hedged — due to time decay on contingent index call options or staggered put options established in response to unusually oversold or overbought market conditions, as detailed below.

Option combinations

As a practical matter, I typically use option combinations rather than futures in order to hedge the Strategic Growth Fund. These positions allow the flexibility to use “directional” and “contingent” positions, are liquid, and reduce the need for day-to-day cash settlement flows. Like futures, the option combinations used by the Fund act as interest-bearing short sales on the underlying indices.

For example, suppose that the S&P 500 is at 1200, and you simultaneously buy a June 1200 put at 15 and write a June 1200 call at 15. So your net outlay per combination is zero. (As with futures, the combo is priced to subtract dividends and include interest, so I’m implicitly assuming that interest rates and dividends are equal. if interest rates are higher than dividend yields, at-the-money calls will be more expensive than at-the-money puts, but we’ll start simple).

Suppose that the S&P 500 is still at 1200 at expiration. Both call and put expire worthless, and your net return on the combination is still zero.

Suppose instead that the S&P 500 rallies by 20 points to 1220. In that case, the short 1200 call is worth 20 at expiration, while the put is worthless. So you have to pay out 20 points, just as you would have if you had been short the index outright.

Finally, suppose that the S&P 500 declines by 20 points to 1180. In this case, the 1200 put is worth 20 at expiration and the call is worthless. So again, your return is just as if you had been short the index.

It turns out that the strike price and expiration you pick doesn’t matter. As long as you buy a put option and sell short the call with the same strike price and expiration, you’ve created a “synthetic” short position that will move essentially one-for-one with the underlying index.

More generally, an option combination is priced as:

Call — Put = Stock price — Strike — Dividends + Interest

This relationship is called put-call parity (where interest and dividends are calculated between the present date and the expiration date) and is enforced by arbitrage (see below). So if you sell the combo short by selling the call and buying the put, your total return is -1 times the change in price of the underlying security, minus dividends, plus interest. A position where you were long the index and short the combo would then have the following total return:

S&P 500 price return + dividends — S&P 500 price return — dividends + interest

Again, a riskless position earns the riskless interest rate. Markets are smart that way.

Calculating the number of contracts for the hedge: Suppose that we hold $600,000 in stock, and the S&P is at 1200. Each option (or in the case of a long put/short call position, each option combination) on the index covers 100 “shares” of the index. So buying a put option and selling short the corresponding call option is like selling short 100 shares of the S&P 500, with a total notional value of 100 x $1200 = $120,000. In this case, buying 5 puts and selling short 5 calls would fully hedge the dollar value of the portfolio. Of course, the position would not be riskless unless the underlying portfolio was actually the S&P 500. In any other case, the potential for the stocks to perform differently than the index would be a source of risk, but also a source of potential return.

Partial hedges and contingent positions

As long-time followers of these comments know, I occasionally hedge using put options only, stagger the strike prices of the option combinations, or establish “contingent” call option positions, or in severely negative conditions. These are more complex, but the basic idea is this:

A put-only position defends against the downside risk of the portfolio without limiting the upside potential, but the cost of this “asymmetry” is that the put option decays in value as time moves toward expiration (even if the market doesn’t move). I use various “gamma scalping” strategies to reduce the impact of this time decay, which are most effective when the actual volatility of the market is greater than the volatility “implied” in the option prices. More often, I use option combinations rather than put-only strategies, because the objective of the hedging is generally to remove the impact of market fluctuations.

In situations where our estimates of market return/risk are extremely negative, we may stagger the strike prices of the index options we use to hedge, by raising the strike price of the index put option closer to the prevailing level of the index (though only one of the options is in the money when the position is initiated). This adds some potential for additional time decay from those higher-strike put options, but can be particularly helpful in the initial phases of a bear market, both because the broad market may decline by a larger amount than the major indices early on, and also because these positions are allow us to better align our investment stance with the prevailing return/risk profile of the market.

Conversely, in situations when the market is very oversold, or the quality of market action appears to be improving, but the overall Market Climate remains unfavorable, I periodically establish “contingent” call positions. These “contingent” positions are useful when there is a reasonable probability that the quality of market action will improve and force us to remove our hedges after a market advance has already occurred. One of the elements of good risk management is to match contingent liabilities (things that you’re forced to pay out if a particular event happens) with contingent assets (things that deliver value if that particular event happens). In March 2003, contingent call positions were an important element of our investment stance, when it became evident that the quality of market action was improving despite fresh lows in a number of market indices.

It’s important to recognize that the options market has operated very well during panics, including October 1987, and in numerous instances since. Still, because I occasionally receive “doomsday” questions about the markets, I’ve included some institutional details and my own views here. All of the options used by the Hussman Funds are exchange traded and backed by the Options Clearing Corporation (OCC). The OCC is in turn backed by the creditworthiness of its Clearing Members (major U.S. financial institutions) and carries a lien on securities, margin deposits and funds maintained in Clearing Members accounts to the extent specified in the OCC’s rules (see www.optionclearing.com for details). The OCC requires margin deposits by its Clearing Members, and carries a separate Clearing Fund. While various financial institutions may, on their own, face risks related to their own option positions or over-the-counter option exposures, I believe that an OCC default is highly improbable, as is a failure relating to exchange-traded options. Even if an OCC default were to occur, and neither the Federal Reserve nor other financial institutions were willing or able to ensure its solvency, the potential loss to the Hussman Funds would be limited to the extent that the Fund’s options were “in-the-money,” which rarely represents more than a few percent of Fund value.

Futures prices and program trading

As a final note, it’s useful to review why options and futures are priced as they are. To simplify the topic, this discussion omits some technical points (differential borrowing and lending rates, daily mark-to-market, etc) without changing the basic results.

Suppose you want to participate in the fluctuations of a particular stock, and want to have the actual stock certificate in your hand three months from today. Clearly, you could just go out and buy the stock at today’s price S. If you do that, you’ll collect dividends over the next three months, and you will, of course, have the stock three months from now as well.

Alternatively, let’s suppose you can buy a “futures contract” that will deliver the stock to you three months from today, at a price F determined here and now but paid later (no need for cash upfront). If you buy the stock this way, you can earn interest on the cash you would have otherwise used to buy the stock outright, and you’ll still have the stock three months from now.

So here are your choices:

Buy the stock: Pay S today. In three months, you have Share + Dividends

Buy the future: Pay F in the future. In three months you have Share + Interest

As you probably guessed, since both methods deliver precisely the same security in the future, the market will equalize the two ways of acquiring it:

Stock price S – Dividends = Futures price F – Interest

Futures price F = Stock price S + Interest – Dividends

Notice that if interest rates are higher than dividend yields, futures prices will sell at a “premium” to the underlying stock price. It turns out that this isn’t just a theoretical relationship. It’s actually enforced by arbitrage.

For example, suppose that the futures price was too expensive, so:

F > S + Interest – Dividends or F + Dividends – S – Interest > 0

Well, even with (virtually) zero money in your pocket, you could borrow money, buy the stock, and sell short the futures contract. Three months from now, you’ll deliver the stock to satisfy the futures contract you sold short, and you’ll receive $F with certainty. You’ll also have received dividends on the stock while you held it, and you’ll have to pay back the money (S + Interest). So your total cash flow three months from now, with certainty, will be F + Dividends – S – Interest. Look at the inequality above. We already knew that quantity was greater than zero when we put the trade on. It’s a riskless profit on (virtually) zero initial capital. The same argument holds true if the futures price is too cheap.

So riskless arbitrage ensures that futures obey their pricing rule (with the possible exception of brief deviations in very fast moving markets). The strategy of enforcing that arbitrage relationship, buying the future and selling short the stocks when the futures price is too cheap, or selling the future and buying the stocks when the futures price is too expensive, is typically executed automatically by computer programs, which is why it’s called “program trading.”

[Geeks note: The main risk in program trading is executing trades on say, 500 stocks at once. Though program traders usually try to get the big stuff done first and then clean up the basis risk later, futures prices can get way out of whack for short periods of time if the market is moving quickly enough, because short sales aren’t allowed on a down-tick in price. Program trading can also feed on itself for short periods. During the ’87 crash, for example, the S&P 500 futures briefly traded more than 20 points below the cash index because institutions were selling futures like mad and the arbs couldn’t translate it into stock sales fast enough. No sooner did they get the trades off than new futures selling came in from “portfolio insurers” reacting to the decline… one reason why it’s always preferable to panic before everyone else does.]