Howto calculate annualized rate of return of your portfolio

Post on: 18 Сентябрь, 2015 No Comment

In my previous post, I wrote about the Beardstown Ladies who had to suffer public humiliation because they couldnt tell what their annualized returns were.

In their defense, not many investors do know what their actual returns are!

Why? Because most brokers, dont provide that information, including online portfolio managers like Google Portfolio and Yahoo Finance.

Dont Confuse Return On Investment With Annualized Returns

Let me give you an hypothetical example. If I invested $20000 and sold it all for $30,000 how did I do? Pretty good? Thats a 50% gain!

This 50% is whats called Return On Investment. It simply tells you your overall gain (or loss).

Nice to know, but thats not what you should be looking at when measuring portfolio performance. Why? Because in this example, I never told you how long it took me to make that money. What if I told you that I made this trade in 1999, got spooked, and have been sitting on this profit ever since?

Growth And The Time Factor

That changes everything! My annualized rate of return dwindles to 3.44%. Thats the effective rate.

That is, had I invested in say Treasuries or CDs (bank rates were much higher back then and prime rate was about 8%) that offered 3.44%, I wouldve made the same amount today without the stress and with no risk!

Thats why time value is important and ROI does not take that into account.

The 3.44% is also called the APY that we are all so familiar with. From an investors perspective thats exactly what you should be looking at. If you put in a certain amount of money for certain number of years, what is your return? Thats your annualized return (also called CAGR- Compound Annual Growth Rate).

But when you invest in the stock market, you dont make a single trade and sit on it for a set number of years. The deposits and withdrawals are spread out and at irregular intervals plus you have dividends, dividends reinvested, stock splits, taxes no wonder brokers dont want to do this!

The trick is to find out your APY or your annualized return taking the above into consideration. Thatll tell you how you really are doing.

How To Find The Annualized Rate Of Return (APY) Of Your Portfolio?

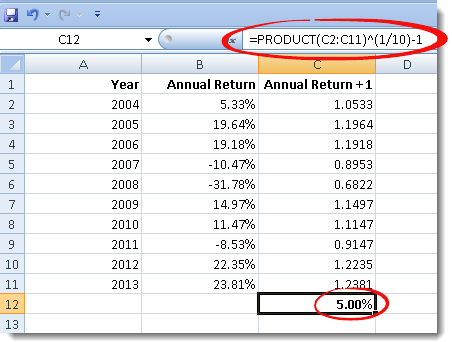

Formula to calculate the annualized rate of return.

Or you could simply use the FREE online tool Ive provided to calculate the APY which looks like the read only view shown below.

What Youll Need

- A copy of the APY spreadsheet. Click on File..Make a copy for an editable version of this tool. (If this menu is greyed out, make sure you are signed in to Google top right Sign In menu)

- Your portfolio value as of the start date from which you wish to calculate APY. You can pick any date

- The current date and the ending value of your portfolio as of this date

- All cash deposits and withdrawals during this period along with their dates

Howto Calculate The Personal Rate of Return or APY

- Enter the beginning date and value of your portfolio in the first row as a negative number. This should include cash plus the market value as of your investments as of that date

- Enter the current date and value of your portfolio in the last row as a positive value

- Fill out any cash deposits(negative) and withdrawals(positive) during this period

- Dont leave blank rows. Delete by right clicking on the row and selecting delete. You can insert additional rows using the same technique

- The APY is automatically displayed in the final cell!

What About Taxes And Dividends?

Glad you asked! Taxes are entered as a negative number. Dont include dividends unless you withdraw them. If left as cash, it is a part of your overall portfolio value. Never include dividends reinvested.

Im Confused With Whats Positive And Whats Negative!

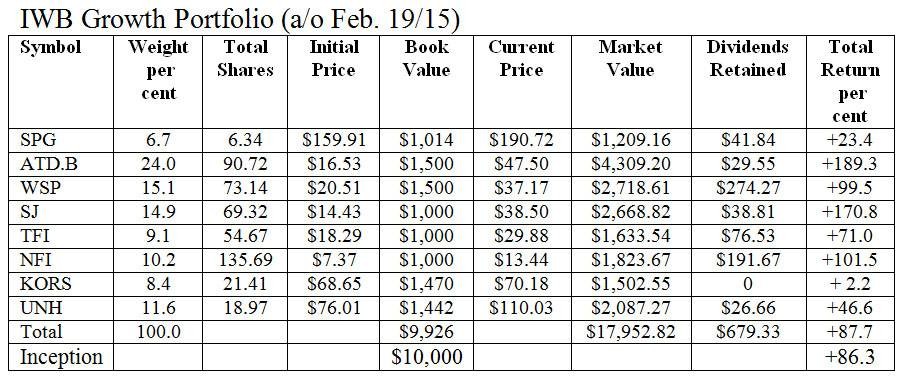

There you have it! Now how did you do compared to the S&P 500?