How to Use the CAN SLIM Approach to Screen for Growth Stocks

Post on: 27 Май, 2015 No Comment

Introduction

C =Current Quarterly Earnings

A =Annual Earnings Increases

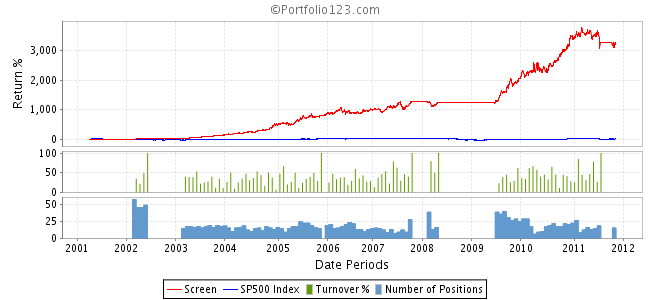

- AAII has been testing the performance of a wide range of screening systems for over five years, and our interpretation of the CAN SLIM approach has been one of the most consistent and strongest-performing screens during both bull and bear markets.

CONTINUE

Related Articles:

- Stock Strategy Performance: Winners and Losers in 2002

O’Neil’s C-A-N-S-L-I-M System

Take an attention-grabbing book title, toss in an easy-to-remember acronym, and top it off with a daily business newspaper that supplies information required for preliminary analysis: Youve got the recipe for a popular investment strategy. The CAN SLIM approach is presented by William ONeil, publisher of Investors Business Daily, in his book titled How to Make Money in Stocks: A Winning System in Good Times or Bad .

The second edition of How to Make Money in Stocks presented a stock selection approach developed by studying 500 of the biggest stock market winners from 1953 to 1993. The CAN SLIM approach presented in the book was based upon the characteristics that these winning stocks possessed prior to their big price run-ups. Recently, ONeil extended his analysis of past market winners to 600 companies that performed strongly from 1953 to 2001 and revised a number of CAN SLIM criteria. The third edition of How to Make Money in Stocks was published last year and presents the revised CAN SLIM rules (see Table 1 ). This article presents the CAN SLIM approach with an eye toward the recent changes and its application using AAIIs stock screening systemStock Investor Pro . Additionally, the March/April 2003 issue of Computerized Investing presents how to apply the CAN SLIM stock screen using Internet stock screening systems.

CAN SLIM OVERVIEW

The CAN SLIM approach seeks companies with a proven record of quarterly and annual earnings and sales growth showing strong relative price strength and support from leading institutions. ONeil does not mind paying rich premiums for stocks with good prospects. He feels that most strategies seeking stocks with low price-earnings are flawed because they ignore the price trend determining the price-earnings ratio, as well as the quality of the underlying earnings within the ratio. ONeil believes that stocks generally sell for what they are worth and most stocks with low price-earnings ratios are probably priced correctly by the market. ONeil also asserts that it is important to follow the market closely and try to lighten up your stock exposure when going into a bear market.

C = CURRENT QUARTERLY EARNINGS

The CAN SLIM approach focuses on companies with proven records of earnings growth that are still in a stage of earnings acceleration. ONeils study of winning stocks revealed that these securities generally had strong quarterly earnings per share performance prior to their significant price run ups.

ONeil recommends looking for stocks with a minimum increase in quarterly earnings of 18% to 20% over the same quarterly period one year ago. When screening for quarterly earnings increases, it is important to compare a quarter to the equivalent quarter last yearin other words, this years second quarter compared to last years second quarter. Many firms have seasonal patterns to their earnings, and comparing similar quarters helps to take this into account.

Another item to watch for when screening for percentage changes is a meaningless figure created by having a very small base number. For example, an increase from one penny to 10 cents translates into a 900% earnings increase. It is always advisable to look at the raw numbers of the company passing the screen. This allows you to gauge the overall trend and stability in earnings and other items such as sales and cash flow.

Whenever you are working with earnings, the issue of how to handle extraordinary earnings comes into play. One-time events can distort the actual trend in earnings and make the company performance look better or worse than a comparison against a firm without special charges. ONeil recommends excluding these non-recurring items from the analysis.

The first two screens require quarterly earnings growth greater than or equal to 20% and positive earnings per share from continuing operations for the current quarter. We used Stock Investor Pro. with data as of March 14, 2003, for the screen. Only 2,343 stocks out of an initial universe of 8,428 met these two criteria. Beyond looking for strong quarterly growth, ONeil likes to see an increasing rate of growth. An increasing rate of growth in quarterly earnings per share is so important in the CAN SLIM system that ONeil warns shareholders to consider selling holdings of companies that show a slowing rate of growth for two quarters in row. The next screen specified that the earnings growth rate from the quarter one year ago compared to the latest quarter be higher than a similar quarter one year earlier. This reduced the number of passing companies to 1,556.

As a confirmation of the quarterly earnings screen, ONeil likes to see same-quarter growth in sales greater than 25% or at least accelerating over the last three quarters. This new screening requirement was added to the third edition of ONeils book and seeks to help confirm the quality of a firms earnings. Independently, 3,647 stocks have a current quarterly sales growth greater than or equal to 25%, but combined with the other filters the number of passing companies was reduced to 393.

The CAN SLIM system is not purely mechanical and ONeil also likes to find at least one other stock in the same industry group that shows strong quarterly earnings growth as confirmation that the industry is strong.