How To Time The Market Like Warren Buffett

Post on: 25 Май, 2016 No Comment

This is the first in a 3-part series on market timing read part 2 here .

“The guy’s just not going to spend the cash to spend it. [He’s] the best market timer I ever saw.” -David Rolfe on Warren Buffett

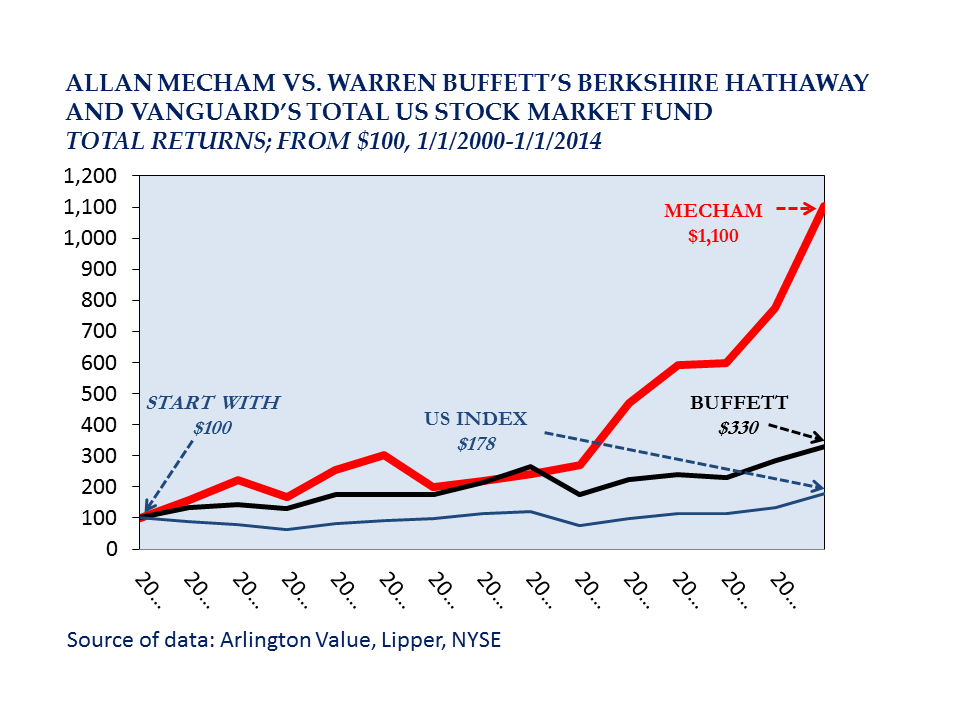

Warren Buffett likes to counsel individual investors to buy-and-hold (specifically, buy an equity index fund and hold it forever ). This is a perfect example of do as I say, not as I do, as Buffett has successfully timed the market for decades. And with Berkshire Hathaway reporting earnings last week it was revealed that Buffett is now carrying his largest cash position ever (in stark contrast to individual investors who now hold their smallest cash positions since the height of the internet bubble ). Clearly, hes timing once again and Im sure a few of you are wondering just how he manages to do this so successfully.

A couple of days ago I wrote Dont Buy The Buy-And-Hold Line of BS arguing that valuations matter and when stocks offer literally zero return over the coming decade its probably not a bad idea to own something else (like bonds). Well, this really gets at the heart of Buffetts investment philosophy:

The investment shown by the discounted-flows-of-cash calculation to be the cheapest is the one that the investor should purchase Moreover, though the value equation has usually shown equities to be cheaper than bonds, that result is not inevitable: When bonds are calculated to be the more attractive investment, they should be bought. -Warren Buffett, 1992 Berkshire Hathaway Chairmans Letter

In other words, when stocks are better value buy them. When bonds are the better value buy them. Couldnt be simpler; could it? But how does Buffett calculate value? In the quote above he references discounted-flows-of-cash, a very complicated valuation model that relies on many assumptions that can cause all sorts of problems. I think theres actually a much easier way to look at it.

Back in 1999, when he decided to market-time the internet bubble (well done, sir), Buffett hinted at his process telling Fortune. I think its very hard to come up with a persuasive case that equities will over the next 17 years perform anything likeanything liketheyve performed in the past 17. So what tool does he use to make a persuasive case? A couple years later, once again via Fortune. he revealed it: the ratio of total stock market capitalization-to-GNP (or GDP), calling it, probably the best single measure of where valuations stand at any given moment.

Okay, but HOW does he use it? Heres my best guess:

John Hussman has done some work with this indicator and found that it is very closely correlated to future returns in the stock market. In other words, this indicator is very good a predicting future returns for stocks over the coming decade.

When Buffett said in 1999 that the next 17 years were very unlikely to look like the prior 17, he meant that the starting valuation in 1982 was so attractive (based on his favorite yardstick, market cap-to-GDP, which stood at 0.333) it virtually guaranteed wonderful returns over the coming decade. Conversely, the starting valuation in 1999 was so unattractive (based on the same yardstick reading of 1.536, or 4.5 times higher than the 1982 reading) it virtually guaranteed horrible returns.

So I believe Buffett very clearly understands the predictive ability of his favorite yardstick. And he uses it to time the market by comparing future stock returns to future bond returns, as he said in the quote from the 1992 letter above. Stay with me here.

I ran the numbers on Buffetts yardstick and its predictive ability myself, using the data from FRED and Robert Shiller covering the years from 1950 to 2013, and found it to be negatively correlated (low values correlate with better 10-year returns and vice versa) by over 80%. I then created a forecasting model based on the data. This tells us what stock market future annualized returns should be over the coming decade based upon the current reading of the yardstick.

We can then take this number and simply compare it to the current yield on the 10-year Treasury note to see which offers the best return over the coming decade, just as Buffett prescribes. When stocks offer a better return, they should be bought. Conversely, when the 10-year treasury offers a better return it should be bought. Simple. As Buffett says, most of the time stocks are more attractive but not always:

So I went back and looked at what would have happened if someone had followed this model, only looking at it once a year at year-end, starting back in 1950. (I know this is cheating; our investor obviously didnt have access to all of this then future data back in 1950. Still, its a fun exercise so get over yourself.)

They would have been fully invested in stocks from 1950 to 1981 at which point they would have switched into treasuries for only a year. They would have owned stocks again from that point until 1996 when bonds offered the greater prospective return. They would have stayed out of stocks for nearly the next decade (through the rise and fall of the internet bubble) and only sold their bonds in January 2003 when they would have bought stocks again. But they only owned stocks for two years before switching into bonds again in 2005. They didnt buy stocks again until January 2009, after the heart of the financial crisis had already passed and stocks were once again attractively valued relative to bonds. Once again they sold their stocks and bought treasuries at the end of 2012 and still hold those treasuries today.

And how did she do? Even after missing the massive gains of the internet bubble and those we saw in stocks last year, this hypothetical Warren Buffett-wannabe-market-timer, was way ahead of the game. Her $1,000 grew to roughly $1.15 million today compared to $720k for the buy-and-hold investor and a mere $32k for the all-bonds guy. And all she did was buy stocks when they were more attractive; otherwise she bought bonds. Simple.

Now this model is merely for educational purposes. It doesnt factor in transaction costs or taxes (which could be huge) so its not in any way a recommendation for you to use with your investments. But its definitely something to consider when evaluating investment opportunities on a broad basis or deciding where to put new money to work.

Ill soon put up a page on this site that regularly updates Buffetts favorite yardstick and compares its prospective return to the yield on the 10-year treasury so we can keep tabs on it. Stay tuned.