How to Spot Quality Growth and Value Stocks

Post on: 7 Июнь, 2015 No Comment

0 Flares Twitter 0 Facebook 0 Google+ 0 LinkedIn 0 0 Flares

The fundamental rule of investing is to buy low and sell high. While the concept is true, the actual implementation of it presents a challenge considering that there are around 15,000 publicly traded companies in the U.S. alone. There needs to be a system for separating stocks into categories to make the investment choices more manageable.

While some overlap exists, most stocks can be broken down into two different types: growth and value. Both categories are defined by unique characteristics that can be attributed to almost every stock listed. While some may fit one definition or the other easily, many more display varying characteristics of both like coloring the label in gray rather than in black and white.

It helps to think of the stock market like a retail store: some products fly off the shelves faster than they can stock them while others get marked down in order to entice customers to buy them. Growth stocks operate a bit like the item that sells fast. Its usually sold at a premium and goes quickly. Value stocks are like the items on the discount rack. It could be there because its out-of-season, or it may be slightly damaged. Both types have their own strengths and weaknesses and play a part in any portfolio.

Growth Stocks

As the name suggests, growth stocks consist of companies on the rise. They range in size from a few hundred million to tens of billions of dollars but generally display some common characteristics.

- High Rate of Earnings Growth – The primary definition of a growth stock is a company that is growing earnings at a greater-than-average rate. A good rule of thumb is to look for growth of at least 10% over the past 5 years for smaller companies and at least 6% for larger ones.

- High Price to Earnings Ratio – A stock that has high earnings growth will come with a premium in the form of its P/E ratio. The higher the number, the greater future growth is expected from investors.

- Does Not Pay Dividends – A company that is growing quickly wont pay out dividends to investors because it will reinvest earnings in the company itself to fuel growth prospects.

Many companies in the technology sector can be classified as growth stocks. They are generally young, fast-growing companies that pay little to no dividends and trade at a high P/E. Companies that are relatively new or in an industry thats on the rise, such as green energy, may also find itself meeting the definition of a growth stock.

A value stock is one whose assets and earnings can be purchased at a discount. As with growth stocks, company sizes may range from small to large and can be identified by analyzing several criteria.

- Low Price to Earnings Ratio – A value stock will trade at a bargain, so the P/E ratio will be lower than the market average.

- Low Price to Earnings to Growth Ratio (PEG) – A stock with a PEG of less than 1 may indicate that it is undervalued based on future growth expectations. A low figure can mean that the intrinsic value of the company may be higher than the price its currently trading at.

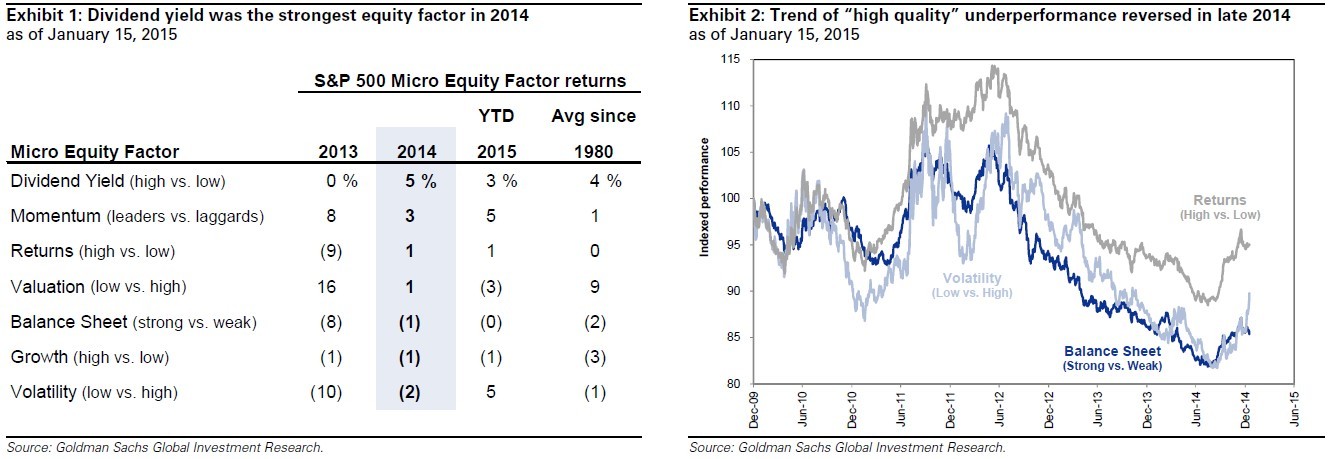

- High Dividend Yield – Value stocks are often associated with high dividend yields because the stock price is low compared to the amount paid out as dividends. This goes hand in hand with the low P/E ratio as well. If a stock is undervalued for what its worth, then the amount of earnings paid out compared to its stock price will be disproportionate.

- Comparable Book to Value Ratio – The book value of a company is calculated by subtracting all liabilities from assets, or the amount the company would be worth if everything were to be liquidated. Because value stocks are discounted, this value may be very close, or even lower than the actual stock price itself.

Value stocks may be discounted for a variety of factors that might not be a reflection of a companys true value. Cyclical stocks wane hot and cold depending on the business cycle. A popular value-based approach is to buy these types of stocks when it’s out of season and sell when it’s in season.

Investors should be careful to avoid value-traps however. These bargain priced stocks masquerade as value buys but are cheaply valued for a good reason. They may be in a struggling industry or show a negative trend of declining valuations year after year.

Seeking Out Quality

Once a stock has been identified as being either growth or value, further due diligence is needed to determine the quality of the underlying company. You will likely come across multiple growth and value stocks so you need a way of figuring out which one to invest in. This analysis consists of careful assessments regarding management, financial statements, competitors, and other criteria.

There are many methods for determining quality and each sector has its own specific factors that need to be taken into account. A gold mining company has to analyzed based on different criteria than a clothing retailer for example, but they all have some commonalities when it comes to research.

An Economic Moat

In order to thrive, a business has to remain competitive. The threat of new entrants, economies of scale, and brand recognition are just a few of the many forces that every business must deal with. To distinguish itself, it must have what Warren Buffet called, an “economic moat.”

The moat is the advantage a company has over its competitors whether it be better brand recognition, lower cost of production, cheaper access to materials, industry outlook, and other such edges. Having a high barrier to entry means that new companies are difficult to start; a protection to existing companies. Offshore oil drillers for example enjoy a high barrier to entry due to the large capital outlay required to build a rig, hire workers, and drill for oil.

Lower operating costs are another major advantage that fits the definition of an economic moat. If a company can make the same product at a lower cost, than they can price their competition out of the market. Basically anything that helps a company stand out among its peers will help raise its quality for investors.

Financial Strength

Business is ultimately a numbers game and a strong balance sheet and income statement is a clear sign of a quality company. Looking at historical financial statements will reveal positive and negative trends that indicate the direction a company is headed. Positive momentum like increasing sales figures, low debt, and improving margins are some of the major indicators investors look for.

Quality companies will have positive operating cash flows, sales growth outpacing inventories and account receivables, and high liquidity. A very popular measurement investors use is free cash flow. Instead of focusing on earnings, which can be affected by accounting changes, free cash flow is much harder to fabricate. A simple way of calculating it is to take operating cash flow and subtract capital expenditures.

No stock analysis is complete without a look at its valuations. This consists of comparing price to earnings, price to book, return on equity, and other ratios to competitors and industry averages. Financial ratios dont mean much in a vacuum; they only hold weight when compared to other similar companies.

Stock valuations break down into four main categories:

- Liquidity – These ratios consist of measuring current assets against current liabilities and inventories to calculate how much cash a company has available for investments or acquisitions.

- Debt – This category takes into account all assets and liabilities to reveal how much debt a company is carrying and how expensive interest payments are compared to earnings and income.

- Profitability – Returns of equity, assets, and investments tell investors how well a company is managing its expenditures and how well management takes advantage of opportunities.

- Efficiency – This measurement analyzes how efficient a company is with asset turnover. In other words, if a company is generating $2.00 in sales per $1.00 of assets, it will have an asset turnover ratio of 2.0. Larger ratios usually indicate better efficiency, but an overly high figure could mean that a company needs to expand its base to take advantage of growth possibilities.

Final Thoughts

As with most investment-related principles, diversification yields the best results. A mix of both growth and value stocks will round out a portfolio and help minimize risk. Neither growth stocks nor value stocks can be considered superior to the other as profits can be generated from a return on capital from future growth or undervaluation.

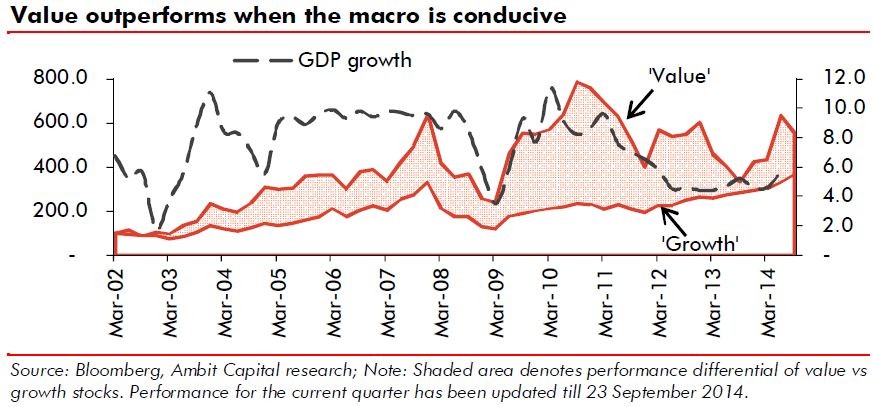

Some fundamental analysts like Benjamin Graham and John Templeton believed that the market engages in extreme viewpoints when it comes to growth and value stocks. Investors tend to overestimate growth prospects and underestimate risks, which gives a growth stock a higher P/E than is warranted. Value stocks on the other hand can be underestimated, so much that P/Es drop to unrealistically low levels. Once the general market realizes the attractiveness of the undervalued stock, the P/E will grow faster than that of a growth stock. This line of thought leads many investors to stick with value stocks only and stay away from growth stocks.

Advocates of growth stocks though, believe that growth is the single most valuable piece of information investors need to find attractive investments. High P/Es, they contend, are justified by future earnings while low P/Es are a reflection of a company’s poor future growth prospects.

Both strategies have paid off over the years with value investing leading the way for most of the 80s and growth investing coming into prominence during the 90s. Investor sentiment aside, the best portfolio is a balanced one that contains a mixture of both growth and value stocks to minimize risks and take advantage of opportunities.

Fariba Ronnasi

CEO, Elite Wealth Management

0 Flares Twitter 0 Facebook 0 Google+ 0 LinkedIn 0 0 Flares