How to Rollover Your 401k into a Roth IRA READ THIS FIRST

Post on: 31 Март, 2015 No Comment

Typically, most people will initiate a 401k rollover to a traditional IRA.

A common question that Ive been getting lately is,

If you can roll over your 401k into a Roth IRA then how you do it?

Whenever you leave your job, you have a decision to make with your 401k plan.

A variation to that is if you have been contributing to a Roth 401k..then what are your choices?

Lets see if I can help you make cents of the situation. Heres how you roll over 401k into a Roth IRA .

Roth IRA Rollover Rules From 401k

Reminder: You must be separated from your employer to roll your 401k into a Roth IRA. You CANNOT do this if you are still working for the same company and/or employer (unless your over 59 1/2).

Prior to January 1, 2008 you were simply not able to directly rollover your 401k into a Roth IRA. If you wanted to do so you had to complete a two-step process. (Keep in mind that this would also apply to old Simple IRAs, SEP IRAs and 403bs, 457, and qualified pensions, too)

- Open a Traditional IRA.

- Convert the Traditional IRA to a Roth IRA.

Since you were a converting to a Roth IRA you had to follow the Adjusted Gross Income limits (had to be less than $100,000 for 2009). Of course, in 2010 these limits disappeared. I say of course because Ive already written a few posts on the topic.

Just because the law changes made it available to rollover into a Roth IRA doesnt mean that you can do it. Doing so all depends on your plan administrator. For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan (TSP) and the other had a old state retirement plan. Upon helping each of them complete the paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box that you could mark if you wanted to rollover the plan into a Roth IRA (The instructions added to make sure you had a Roth IRA already established). The state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. If that seems like a hassle.it is.

The state retirement plan is not the only one that Ive encountered with this. Many 401ks and 403bs have had the same No-Roth IRA Rollover option. This option is supposed to be mandatory in 2010, but some still do it on a voluntary basis.

Recap on Roth IRA Conversion Rule

Starting in 2010, anybody was able to take all their traditional IRA’s and old retirement plans and convert them to a Roth IRA . The amount you convert will be taxed, but it still can be an attractive move for those that feel that taxes are going nowhere but up.

How Do I Rollover if I Receive the Check?

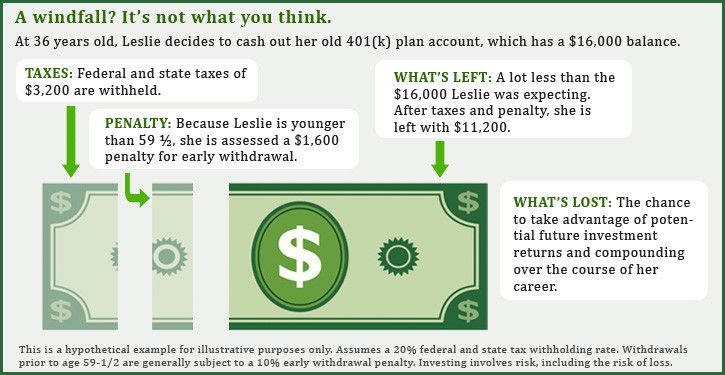

If you receive a distribution check from your 401k rollover to a Roth IRA then chances are they will hold around 20% for taxes. If you want a direct 401k rollover to a Roth IRA, you may want to send that check back to your employer 401k provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account (not as a check, or they will just give you 80% again).

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

What About the Roth 401k?

If you employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover is that much simpler. No need for a conversion here. You would simple just roll the Roth 401k directly into the Roth IRA. Thats what I call simply satisfying.

How You Can Rollover Your 401k by Following These Steps

- You have to have a Roth IRA open/established before you can do any of this..

- Rolling from a traditional 401k to a Roth IRA will be a taxable event

- Enjoy the tax free growth of your Roth IRA!

3 Brokerage Options to Rollover Your 401k Into a Roth IRA

If you plan to rollover your 401k into a Roth IRA you will need to open a brokerage account.

Here are two other great options for you to consider for your 401k rollover:

With over 500 branches across the country, Scottrade is one of the best options for you to rollover your 401k into a Roth IRA. Not only do they have a great brick-and-mortar presence, but you can do everything online as well.

Whether it is $7 trades, no account maintenance fees, or the fact that they wont charge you if you close your account to take your business elsewhere, I absolutely love Scottrade .

I like the company so much I opened an account there myself and made a video walking you through the process of opening a No Fee Roth IRA with Scottrade .

A close second for me is E*TRADE because they also have 30 brick-and-mortar locations while maintaining one of the best online trading platforms available.

Their commission structure is competitive with the industry for stocks and ETFs, and they dont hit you hard on mutual fund fees.

Plus, if you open up an account with E*TRADE you get free trades for 60 days and up to $600 depending on the size of the 401k you are rolling over to the company. Free money for opening an online stock broker account . Ill take it.

We also maintain a full list of the best places to open a Roth IRA .

Brokerage firms are willing to give you cash sign up bonuses (or airline miles) for opening an account with them. If you are looking to get a sign up bonus for opening an online stock broker account . dont miss out on a big sign up bonus.