How to Roll Over your 401K to an IRA

Post on: 4 Июнь, 2015 No Comment

We just highlighted why you should consolidate your 401Ks into an IRA. Today, well discuss how to actually roll over a 401K into an IRA. It can seem a bit intimidating, but its actually quite simple.

When you leave an employer who has provided a 401K, the choice of what to do with that 401K becomes yours.

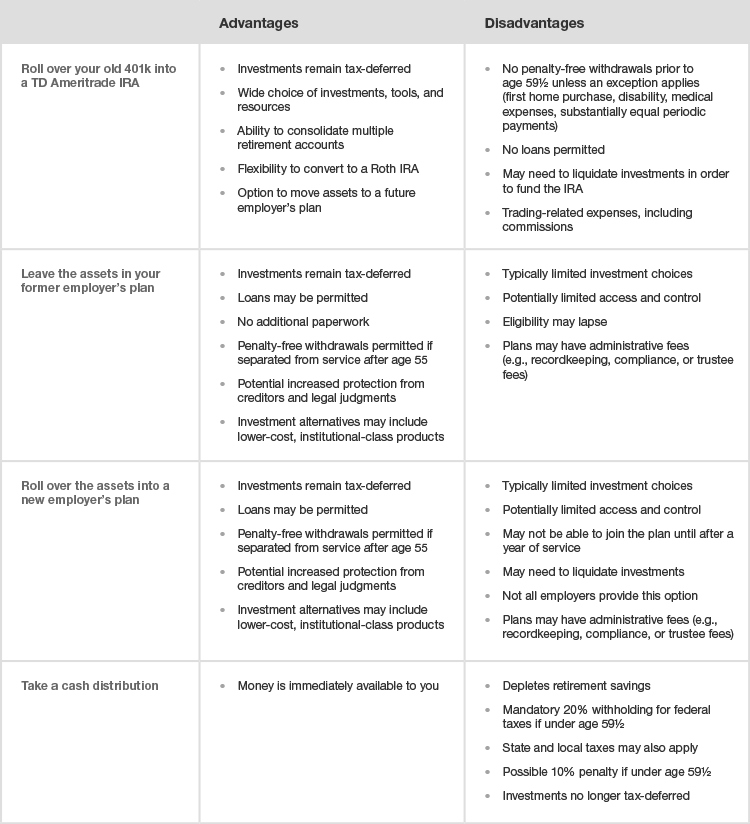

You have four options at this point:

- Withdraw the funds as cash: you do not want to do this as there is a 10% early-withdrawal penalty and other tax implications.

- Let it sit: my previous article highlighted you why you should not do this. A large majority of the time, 401Ks carry higher fees and less investment options than IRAs. And consolidation has its benefits.

- Roll your 401K over to your new employers 401K: again, IRAs are superior, so I cant imagine why you would want to do this, unless you simply didnt know about the IRA alternative.

- Roll your 401K over to an IRA: in most cases, for most people, this is usually the best option.

The Downsides of Rolling a 401K into an IRA:

If you roll a traditional 401K into an IRA, there are no tax implications as both contain pre-tax funds. The exception would be if your plan contains your company stock. Im not going to discuss this in detail here, but you shouldnt be rolling this over.

The same is true from rolling a Roth 401K into a Roth IRA except both contain post-tax funds.

What does that leave us? Rolling a Roth 401K into a traditional IRA you cannot do this. And rolling a traditional 401K into a Roth IRA.

The latter has tax implications. Since traditional 401Ks are pre-tax and Roth IRAs are post tax, you will have to pay taxes on the balance you transfer over. This could be significant and could even push you into a higher tax bracket. Something to definitely be aware of and probably worth consulting with a CPA or certified tax professional beforehand, so you know the tax implications.

The other possible downside is any fees assessed for closing and transferring your 401K. Some 401K administrators may assess this fee, others may not. Its worth noting that the IRA administrator may cover the transfer fees. In the long run, you will probably save money on fees in rolling a 401K into an IRA, but you should at least know they exist.

How to Roll your 401K into an IRA

If you do not yet have an IRA, get one. Starting an IRA is easy. Check out my post with a list of online brokers for a complete list of IRA fees and how to start an account. Personal faves for low cost IRAs are Vanguard and TradeKing .

If you already have an IRA, you can simply keep it. If you want to switch to another, you can do that too.

2. Contact your Old 401K Administrator

Ask your old 401K admin about transfer/close fees and ask them what information your new administrator will need to complete the transfer. Make sure they know you are moving your balance to an IRA. Let them know you want a direct transfer (aka trustee-to-trustee transfer) to your new IRAs provider otherwise, they will send you a check that youll have to send to the new administrator, which can present delays and other hassles.

3. Contact your IRA Administrator

Ask your existing or new IRA administrator to initiate the direct transfer on your behalf (they should be more than happy to). It is helpful to have a statement from your old administrator handy, or be logged in to that account when you do this.

Give them the information or paperwork that your old administrator requires to transfer the funds.

If, for whatever reason, you are left to initiate the transfer, make sure you know what information you need to give to the old 401K administrator.

Once your funds have been transferred and cleared, its time to invest! Note that your rollover does not count towards your IRA contribution limits. so you can still contribute for the year.

Thats it!

401K Rollover Discussion:

- Have you rolled a 401K into an IRA? How much time did it take? Did you find it easy/difficult?

- How many 401Ks have you rolled into an IRA?

- Do you have any other questions about rolling a 401K into an IRA?