How to Report 401(k) and IRA Rollovers to the IRS

Post on: 21 Май, 2015 No Comment

The key here is reporting the amount moved and the amount that’s taxable. With direct rollovers, these are two dramatically different figures.

- By Kay Bell

Bankrate.com — 09/17/2014

You started a new job, and took your 401(k) plan savings from your former employer with you. You made sure to transfer the funds directly from your old workplace to your new company’s 401(k) plan. And the cash never touched your hands directly.

Wise move. Besides keeping your retirement fund invested, you avoided tax complications.

So what’s with that Form 1099-R you got, the one with the notation that a copy has gone to the Internal Revenue Service? You thought you followed all the rules to avoid any taxes on your retirement plan transfer.

Don’t panic, you did. But the IRS still wants to keep track of any so-called trustee-to-trustee transfers that you make with tax-deferred retirement accounts. The key here is reporting the amount moved and the amount that’s taxable. With direct rollovers, these are two dramatically different figures.

The 1099-R you received will help you differentiate — and properly report — these amounts.

What the 1099-R tells you

Box 1 of the form shows the total amount of your retirement fund that was distributed. The more important amount to you right now is in box 2a, the taxable amount. For direct rollovers from one qualified plan to another, that amount is generally zero.

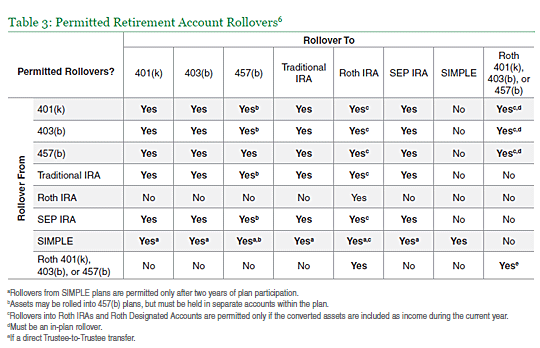

Also check box 7, the distribution code. A letter or number should be here, explaining to the IRS exactly why your retirement money was taken out and just what was done with it. Direct rollovers to another qualified plan are coded with the letter G. This includes transfers to another company’s 401(k) plan, a tax-sheltered 403(b) annuity, a government 457(b) plan or an IRA.

The code lets the IRS know that the money was never in your hands, an important point when it comes to taxes on transferred retirement funds. If you had taken the money out yourself, taxes would have been withheld.

What you tell the IRS

Now that you’re sure that your retirement plan transfer is reported correctly on your 1099, you must tell the IRS the same thing on your tax return. If you got a retirement distribution, you can’t file a Form 1040EZ. You must file either a 1040A or 1040 return.

Your full company retirement plan distribution goes on line 12a if you file Form 1040A, on line 16a if you use the long Form 1040. The taxable amount — zero for direct rollovers since you are not taking out the money — then goes on line 12b or line 16b. Be sure to write rollover next to the amount.

The same process is used if you move IRA accounts, say, to consolidate multiple accounts or get a better return on your retirement investment. For reporting purposes on your tax return, an IRA includes a traditional retirement account; a Roth IRA; a simplified employee pension, or SEP, IRA; or a savings incentive match plan for employees, or SIMPLE, account.

You’ll get a 1099-R for your IRA transfer and will report the transaction on lines 11a and 11b of the 1040A or 15a and 15b of the 1040. Again, write rollover on your tax return.

Don’t touch the money

Because you transferred your retirement account from one plan manager to another, reporting the move to the IRS is simple. Trustee-to-trustee transfers, noted by the G code on the 1099-R, are generally nontaxable events. The money goes from one account manager to another, never in your hands to be viewed by the IRS as taxable income.

However, if you had opted to take the money yourself, 20 percent of your account would have been withheld. For example, if you had $10,000 in your 401(k), $2,000 would have been withheld when you took the distribution, meaning you actually only got $8,000.

The IRS gives you 60 days to redeposit your distribution into another retirement account and maintain tax-deferred status. But even if you do that, it will cost you upfront cash.

To ensure that your entire account meets IRS regulations, you must come up with the withheld $2,000 from some other source to make your rollover contribution equal to the original $10,000 distribution.

You’ll get that $2,000 back when you file your taxes. It will show up in box 4 of the 1099-R you, and the IRS, will get detailing your withdrawal. You’ll count that withheld amount on your return and, depending on your other tax payments, it will come back to you as a refund or be applied toward the overall tax bill that you owe.

In the meantime, however, by taking out the money yourself, you’ve given Uncle Sam free use of your two grand.

If you directly transferred your pension money last year between trustees, you’re in good tax shape. The details on Form 1099-R will help prove you continually maintained your account’s tax-deferred status.

And if you move your retirement money this year, make sure it’s a trustee-to-trustee transfer — and look for that supporting 1099 next year.

The statements and opinions expressed in this article are those of the author. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Bankrate and Fidelity Investments are independent entities and not legally affiliated.