How to Rebalance Your Portfolio

Post on: 16 Март, 2015 No Comment

Rebalancing Your Portfolio Forces You to Buy Low and Sell High

Most people do a good job creating a portfolio with the right asset allocation strategy . but they often stop there. They set and forget. If youve been through any of the recent bear markets you probably know that this can lead to some major problems when it comes to your investment performance. What good is it to take the time to create a carefully planned portfolio if youre going to ignore it for a few years and let the market dictate how your investment mix shapes up?

Thats where rebalancing your portfolio comes in. In essence, all rebalancing does is regularly readjust your investment holdings so they once again match your target investment mix. You may be wondering how a portfolio can stray from its target mix, but it happens much quicker than you might imagine. Especially in strong bull markets like we saw in 2009.

Why You Need to Rebalance

Your portfolio is a living and breathing creature and its constantly changing. Thats because youre invested in the market which changes every single day. If the market is moving, your portfolio is moving. The problem is that over time some of your investments are going to outperform others. When this happens, the outperforming investments grow and take up a greater percentage of your portfolio. When one investment does well and another does equally as bad this occurs at double the pace.

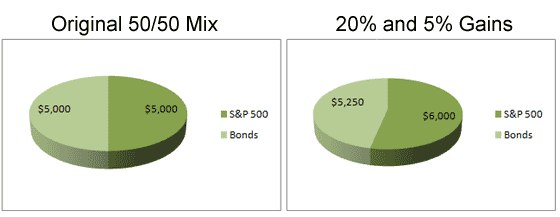

For example, lets take a simple portfolio thats made up of just two investments. A $10,000 portfolio with 50% in a bond fund and 50% in an S&P 500 index fund. For the sake of the illustration lets say that over the past year the S&P has gone up 20% and your bond fund has only returned 5%. Most investors would still be thrilled as they made a lot of money, but theres one problem. The portfolio is significantly overweight in stocks compared to your target mix which exposes you to greater risk and potentially great losses if stocks fall again.

As you can see, without doing anything to your underlying investments your portfolio has changed just because of how the two investments have performed. With a 20% gain in stocks and a 5% gain in bonds you realized a total gain of 12.5% leaving you with a balance of $11,250. This also means that your portfolio is now made up of 53.5% stocks and 46.7% bonds. But thats not a big deal, right? What is a few percentage points one way or the other?

Well, lets say the market suddenly reverses course. What would happen to your performance then? To see what happens well take the same portfolio with the new balance of $11,250 and subject it to a bear market that saw a 20% decline in stocks and a 5% gain in bonds.

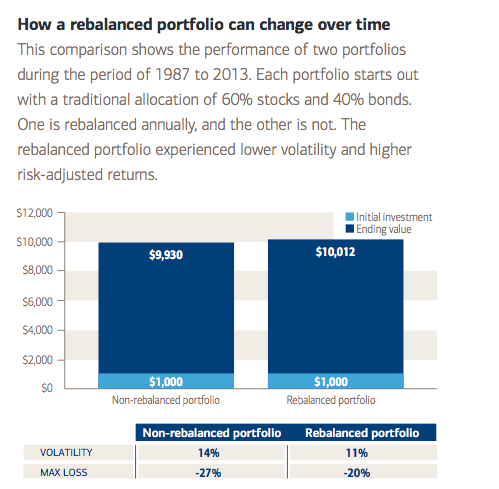

Here, the rebalanced portfolio fared a little better than the unbalanced portfolio and did not lose quite as much money. It works out to about 1% better performance. That seems insignificant, but remember, were looking at a small portfolio and 1% can add up. If you can squeeze 1% out of your returns on a $100,000 portfolio that saves you $1,000. Also keep in mind that this example just used one quick snapshot in time where the market went up, threw off your allocation by just a couple percentage points, and then went back down. In the real world you will be still making contributions into the account which also has an effect on the allocation and over time the compounded returns or losses on each asset class can throw your allocation off by far more than the 3% I used here, which means the total difference in outcome could be far more than 1%. And keep in mind we were just using two very simple investments. The more complex your portfolio, the greater the chances that one of your assets will become out of whack.

But why did the rebalanced portfolio fare better? Its pretty simple. When you rebalance, you are forcing yourself to take profits off the table and sell high and buy low. In this example the S&P significantly outperformed the bonds, so in order to rebalance you took some of the gains you realized in stocks and sold them (selling high) so that you could then put that money back into bonds (buying low). So, you locked in some of your profit and then when the market reversed you had less money than you otherwise would have had invested in stocks and more invested in bonds. That means you see less of a loss in stocks and a greater gain in bonds, therefore a better overall performance.

When and How to Rebalance Your Portfolio

So, the question remains. How and when should you rebalance? The first thing you need to do is be able to easily track your investment portfolio. Unfortunately, many 401(k) and brokerage statements are lacking in this department. You may have 10 different investments while the little pie chart they show you just breaks it down into a few broad categories. So, you need to find a better way to track your holdings.

The best thing I can recommend is tracking your portfolio in Morningstar . You can create an account for free and input your investments into the portfolio tracker or instant x-ray and it will give you a wealth of information that youll never get on your investment statements. Once youre able to easily track and get a visual snapshot of your portfolio you can then easily make the changes necessary.

The other big debate is how often should you rebalance. Well, there are two common methods when it comes to rebalance frequency. First, you can use a time-based interval. What this means is you rebalance on a regular schedule, regardless of what the market has done. Some people do this quarterly, while others semi-annually or annually. Basically, you set a date and a frequency and rebalance like clockwork.

While that will work, it is still fairly arbitrary and a lot can happen in the markets between your rebalance intervals. In my opinion, a better way is to set thresholds for your investment mix and rebalance based on when an investment crosses the threshold. For instance, if you set a threshold of 5% that would mean that any time one of your asset classes exceeds 5% of your target one way or the other, its time to rebalance back to your target. The key with this method is to set a threshold that isnt so low that youre rebalancing every month, but not so high that it takes five years before you exceed a threshold. Either way, the benefit of this method is that youre rebalancing based on actual market conditions, not just an arbitrary timeline you set.

Portfolio Rebalancing Guidelines

1. Be mindful of taxes. Keep in mind that rebalancing involves buying and selling of investments. When you do this within a taxable account it can trigger capital gains and losses. So, take a little extra time to examine the tax implications before pulling the trigger on any rebalancing. You dont need to worry about this within retirement accounts, which is where most people have the bulk of their investments anyway, but its something to be aware of.

2. Rebalance enough, but not too much. You need to be able to strike a balance so that you arent shuffling your investments with every little market move while not leaving your portfolio overexposed to market risk because of a recent move. 2009 was a great example of this. In many cases people saw their stock holdings within their portfolio rise 30-50% in about a year. If a major market correction were to occur without someone rebalancing and taking some of those gains off the table they may face much greater losses. So, try to rebalance once a year on average, or if you have a threshold set be sure to monitor it and try to keep it so that youre rebalancing regularly, but not more than once a quarter.

3. If you have to rebalance just one thing, rebalance your stock and bond split. Our portfolios can be complicated and hold a variety of domestic and international stocks, small or large-cap stocks, cash accounts and bonds, or even specialty sectors. It can be overwhelming when you try to keep everything in-check, so at the very minimum you should focus on your stock and bond mix. This is where the bulk of your diversification and downside protection comes from so that should be your primary concern. Its true that different asset classes have varying levels of correlation . but dont get hung up on the details and focus on the big picture to start.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D80&r=R /%

My name is Jeremy Vohwinkle, and I’ve spent a number of years working in the finance industry providing financial advice to regular investors and those participating in employer-sponsored retirement plans.