How to Read and Understand the Cash Flow Statement

Post on: 11 Апрель, 2015 No Comment

Before investing in a company, it is important to analyze and understand its major financial statements. Along with the Balance Sheet and Income Statement, the Cash Flow Statement is one of the three major financial documents that a company is required to publish. Here’s a quick overview of what it tells you, how it’s laid out, and what you should look for.

Why is it important to understand the cash flow statement? Simply put, the cash flow statement describes how a company is getting and spending its money. In doing so, it gives you information about how a company’s operations are running and if it is spending its money wisely.

The cash flow statement is not quite as straightforward as the balance sheet or the income statement. It combines the information from these other financial documents to show how much cash or cash equivalents a company has generated during a specific time period.

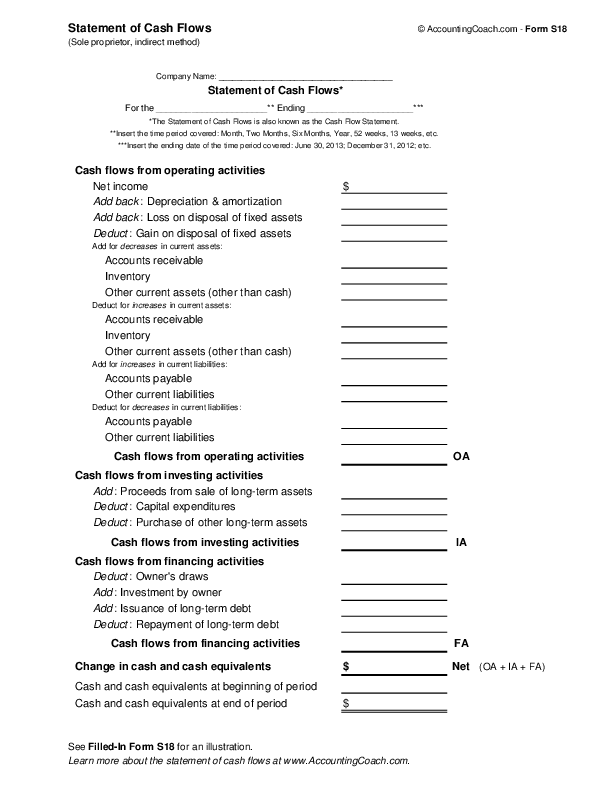

In order to understand how to analyze the cash flow statement, it is first important to understand how it is organized. In short, like the other financial statements, the cash flow statement is organized in a very logical way. The top line is the net income line, which comes from the income statement and shows how much net profit a company generated over a time period.

Underneath the top line, there are three major sections that include items that are either added or subtracted from net income: cash flows from operations, cash flows from investing activities, and cash flows from financing activities.

Cash flows from operations are just what they sound like, changes in cash as a result of a company’s normal business operations. In this section, changes to balance sheet items like accounts receivables and liabilities are recorded as either positive or negative cash flows. For example, if a company pays off debt, its liabilities would decrease, and this would show up as a cash outflow in this section of the cash flow statement.

The next section is cash flows from investing. This includes capital expenditures, which is money that the company pays for things like equipment and buildings. It also includes investments, or money that companies pay out in the hopes of getting a financial return or receive in the form of dividends or capital gains.

The final section is financing activities. This includes things like cash outflows for dividends a company pays out, inflows from the sale of company stock or outflows from the purchase of stock, and net borrowings from other sources.

The bottom line, which is typically regarded as the most important part of the document, shows the overall change in cash and cash equivalents during the specified time period. A positive number here is generally good, but it is also important to study the details of the statement and learn how the company arrived at the positive number.

Although it may seem challenging or even tedious at first, it is important to analyze and understand the cash flow statement because healthy positive cash flow is a crucial indicator of a company’s overall financial health. In conjunction with the other major financial statements, the cash flow statement can shed light on how effective a company has been at generating cash. Understanding this can help you to better gauge its financial trajectory, and thus better understand its investment potential.

Online Investing Guide