How to Read and Analyze A Corporate Annual Report

Post on: 30 Май, 2015 No Comment

Without a doubt, annual reports — more formally known as “annual reports to shareholders”, and distinctly different from the 10-K annual reports that the Securities and Exchange Commission (SEC) requires of public companies—are at the pinnacle of corporate communication. With their glowing words, evocative photographs, and lovely, full-color graphs, annual reports can be very compelling reading. The point of the annual report is to provide a summary of exactly how a company has performed in the preceding year, as well as to provide a glimpse of the future. The report is the best source of information for most people to determine the financial health of a company and to learn of any potential problems or opportunities .

Advertisement

Building a compelling annual report is a real art and science affair, and more than a few consulting firms are doing very well, thank you, by hiring themselves out to create reports for all kinds of companies. Unlike my other post in the past which overview and provides tips on how to make a corporate annual report, this post provides light guidelines and tips on how you [as a reader] can read and analyze a corporate annual report [more formally known as “Annual Report to Shareholders”]. At the end of this post, I also provide sound intelligent way to watch 7 deadly warning signs on a corporate annual report. Enjoy!

9 Parts Of The Corporate Annual Report

Reading an annual report can be a daunting prospect if you don’t know exactly what you’re looking for and where to find it. The good news, however, is that most reports are now standardized around a common model of nine key parts; this organization makes it easy to review any company’s annual report after you get the hang of it. Here are the nine parts, generally presented in the following order :

- Part#1. Letter From the Chairman. The letter from the chairman of the board is the traditional place for a company’s top management team to explain what a great job it did during the preceding year and to lay out the company’s goals and strategies for the future. The letter also is a great place to find apologies for problems that occurred during the year, which may or may not have been solved. Oops!

- Part#2. Sales and Marketing. This section contains complete information about a company’s products and services, as well as descriptions of its major divisions and groups and what they do. When reading this section, you should be able to figure out which products are most important to a company and which divisions or groups are most critical to the company’s success.

- Part#3. Ten-year Summary of Financial Results. If the company is at least ten years old, its annual report contains a presentation of financial results during that period of time. This section is a terrific place to look for trends in growth (or non-growth) of revenues and profit and other leading indicators of a company’s financial success.

- Part#4. Management Discussion and Analysis [MDA]. This section is the place where a company’s management team has the opportunity to present a candid discussion of significant financial trends within the company during the past couple years.

- Part#5. Letter of CPA Opinion. To be considered reliable, a company’s financial statements have to be reviewed and audited for accuracy by a Certified Public Accountant (CPA). In this letter, a CPA firm states any qualifications that it has with the company’s financial statements. These statements can have great bearing on the reliability of the data or of management’s assessment of it.

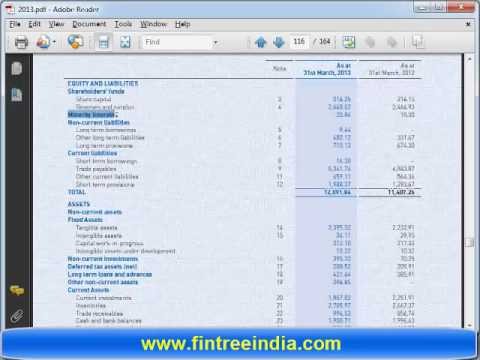

- Part#6. Financial Statements. Financial statements are the bread and butter of the annual report. This section is where a company presents its financial performance data. At a minimum, expect to see an income statement, a balance sheet, and a cash-flow statement. Be sure to watch for footnotes to the financial statements and read them carefully. You often find valuable information about an organization’s structure and financial status that hasn’t been publicized elsewhere in the report. For example, you may notice information on a management reorganization or details on a bad debt that was written off by the company.

- Part#7. Subsidiaries, Brands, and Addresses. Here you find listings of company locations — domestic and foreign — as well as contact information, brand names, and product lines.

- Part#8. List of Directors and Officers. Corporations typically have boards of directors — senior businesspeople from both inside and outside the organizations — to help guide them and to provide a broader view of markets and business environments than what’s seen by internal managers. Officers include the president, chief executive officer (CEO), vice presidents, chief financial officer (CFO), and so forth.

- Part#9. Stock Price History. This section gives a brief history of the company’s stock prices and dividends, showing upward and downward trends over time. Included is information on a company’s stock symbol and the listing stock exchange — for example, the New York Stock Exchange (NYSE) or NASDAQ.

If you want to read a company’s annual report but can’t find it, you can go online. With the help of online search engines, finding a company’s annual report is easier than ever. Many companies also have Investor Relations pages on their Web sites where you can find copies of annual reports and quarterly filings with the Securities and Exchange Commission. For example. in 2006, General Electric created an interactive annual report on its site. You can check it out at [here ]. The site even features a video of the Chairman of the Board and the CEO talking about how they’re going to build a better company.

Analyzing The Annual Report

An annual report is the best tool that the public has to review the performance of a company. Most annual reports contain plenty of useful information. But now that you have all this terrific info. what should you do with it? I thought you’d never ask! You can analyze the information in a report to get a sense of the near- and long-term health of a firm. Here are some definite musts when it comes to reading and analyzing an annual report :

- Review the company’s financial statements and look for trends in profitability, growth, stability, and dividends .

- Read the report thoroughly to pick out hints that the company is poised for explosive growth — or on the brink of disaster. Places to look for such hints include the letter from the chairman, the sales and marketing section, and the management discussion and analysis. Of course, it also pays to keep an eye on the company through the business press and analyst reports. (For some tips on recognizing an impending disaster, see the upcoming sidebar).

- Carefully read the letter of CPA opinion. Be sure that the firm agrees that the company’s financial statements are an accurate portrayal of its financial reality.

- Carefully read any footnotes to the financial statements. These footnotes often contain information about company assumptions that can be critical to a full understanding of the financial statements.

7 Deadly Warning Signs On An Annual Report

Annual reports consist of equal parts marketing glitz, feel-good platitudes, and hard financial data. After you get past all the hype, plenty of interesting data is just waiting to be viewed and analyzed. As you review the data in an annual report, stay on the lookout for the following seven deadly warning signs :

- Sign#1. Revenues Stagnant or Falling. By comparing a company’s revenues across two or more years, you can get a sense of how fast its revenues are growing. You also can see whether revenues are likely to continue to trend upward in the future. When revenues stop growing—or, worse, begin to fall—this is a major warning sign of trouble within the organization. Stagnant or falling revenues can be the result of all kinds of problems: poor product quality, increased market competition, or internal management problems, to name a few. You have to decide whether this change is a one-time aberration or a trend that’s going to get worse before it gets better. To find out more, search for articles in the financial press that discuss the company and its prospects, as well as prospects for the industry as a whole.

- Sign#2. Earnings Per Share Inconsistent With the Company’s Profit . The value of a company’s stock is to some extent based on the firm’s profitability and the number of shares in the hands of investors. So, if profit increases 15 percent from one year to the next, you may expect the earnings per share of stock to also increase by 15 percent. This won’t be the case if the company dilutes (reduces) the value of the stock by issuing more shares during the course of the year. If earnings per share are lagging behind the company’s profitability, raise the red flag because this requires further investigation. Be aware, however, that stock price frequently is affected by things that have nothing to do with the business itself. For example. institutional investors, concerned about a recent announcement from the federal government, may pull their investments out of the sector, driving the price down.

- Sign#3. Indications of Financial Distress. A company can have phenomenal growth in sales and profit but still go out of business. Have you ever heard someone who went out of business lament that he or she was a victim of his or her own success? As odd as it sounds, it can happen. If a company isn’t solvent — in other words, it doesn’t have enough cash in the bank to cover its current liabilities — it’s in trouble. Run some numbers on companies of interest — specifically, a quick ratio and an acid-test ratio — to see whether they’re solvent. If the results are marginal and the trend is downward, the ratio doesn’t bode well for the future.

- Sign#4. Unusual Gains or Losses. Although every company goes through natural and regular business cycles during the course of months or years, unusual gains or losses can be red flags deserving of your attention. Unusual gains or losses are to be expected from time to time, but they should be just that — unusual. Ongoing unusual gains or losses are cause for concern because they indicate a fundamental problem in the company’s ability to manage its operations and finances.

- Sign#5. Profit Ratios Falling. Because profit is the best measure of success for many companies, growing — or, at minimum, maintaining—profit ratios is an important goal of management. If a company’s profit ratios are falling from year to year, the financial health of the firm is in clear jeopardy. Something in the company is broken and needs to be fixed.

- Sign#6. Adverse Auditor Opinion. For the most part, the letter of CPA opinion is a perfunctory exercise that confirms that a company’s financial statements are accurate.

Occasionally (today it happens more often because of Sarbanes-Oxley), however, a CPA firm takes exception to a company’s financial results and issues an adverse opinion. Pay close attention to the letter of CPA opinion. Watch for words such as “fairly present” (good) or “adverse opinion” or “reservations” (bad).