How to Read a MorningStar Mutual Fund Style Box

Post on: 16 Март, 2015 No Comment

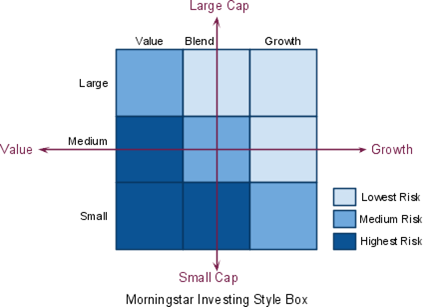

About 20 years ago, MorningStar created a mutual fund style box that helps investors understand what type of mutual fund they were investing in, whether it was a bunch of large cap, mid-cap or small cap stocks & whether those stocks were value and/or growth oriented. The MorningStar style box allows you to understand the importance of diversification across different asset classes & styles of investing. MorningStar was responsible for popularizing this style box by placing it along side its mutual funds’ ranking systems by assigning them 1 to 5 stars.

What Exactly is the MorningStar Style Box?

The MorningStar style box is a graphical way of classifying mutual funds & stocks into asset classes & styles of investing. The box is a grid of 9 squares each representing a different market capitalization of asset class & style. The box divides assets in to small cap, mid cap & large cap across the horizontal axis while dividing investing styles of Value, Blend & Growth across the vertical axis. Wherever the horizontal & vertical axis meet is the type of mutual fund you are investing in.

The 9 combinations are:

- Large value

- Large blend

- Large growth

- Medium value

- Medium blend

- Medium growth

- Small value

- Small blend

- Small growth

Differences between Large, Mid & Small Cap Mutual Funds

i) Large Cap Stocks — They have market capitalizations in excess of $8 billion. These are stocks of large & well established companies with billions of dollars in revenues. Examples are Coca Cola, Microsoft, Caterpillar, Apple, Google, etc.

ii) Mid Cap Stocks — These are companies that have market capitalizations in the range of $1 billion to $8 billion and are quite well established but still have lots of room to grow .

iii) Small Cap Stocks — These are companies with less than $1 billion in market capitalization and they are often young, dynamic & fast growing companies that have small market share but ability to capture more customers quickly. Stocks of small cap companies are generally more volatile than mid cap stocks that carry lesser risk. Small cap stocks offer more growth potential in return for higher risk .

Market Capitalization is the overall outstanding # of shares of a company multiplied by its current stock price. This gives us the fair market worth of a company .

Differentiate Growth v/s Value Stocks

i) Growth Stocks — MorningStar uses a proprietry software to screen for stocks that have long term projected earnings growth. are growing their price/earnings multiple. sales & cash flows, etc. MorningStar classifies growth as speculative, classic, aggressive or slow growth.

ii) Value Stocks — Value stocks are those that are trading below the company’s intrinsic value measured by sales, dividends and earnings. MorningStar classifiies value stocks by looking at their price-to-book & price-to-earnings ratios.

Growth stocks are for those investors seeking fast growing companies that will yield higher future returns while value stocks are bought by bargain hunters who realize how cheap a business is selling for and buy it before the whole market does.

How Important is Diversification?

You want to own stocks in different boxes of the MorningStar fund style box because as the saying goes, Don’t put all your eggs in one basket. If you are heavily concentrated on just one or two boxes, and when those industries take a hit, your stocks will tumble really bad. However if you are diversified across multiple boxes and one takes a hit, you will still be OK with the other boxes.

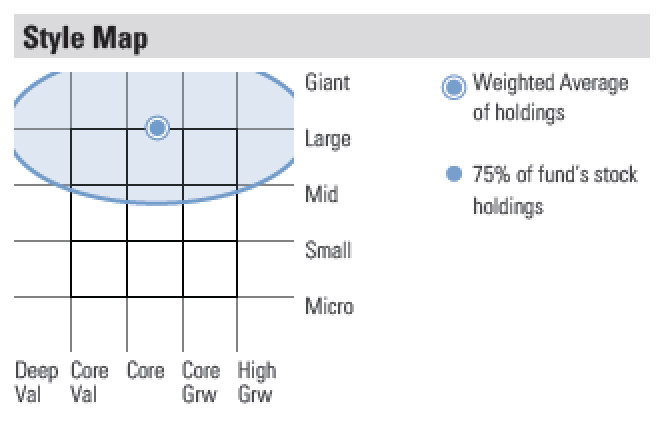

Also by looking at the fund style box, you can compare the dotted boxes that MorningStar fills in for you with the mission statement of the mutual fund and the manager’s goals & objectives. If for instance the objective of the fund is to seek growth of capital in Large Cap value stocks while MorningStar fills in Small Cap growth. you have 2 opposing pieces of information; it is best to verify both and see truly where you are invested in.