How to Read a Balance Sheet

Post on: 20 Июль, 2015 No Comment

Share

Can your business continue to fund its own growth? Your company’s balance sheet can answer that question at a glance.

Whereas an income statement reports sales and expenses during a set period of time, and a cash-flow statement charts the flow of money in and out of your business, your balance sheet summarizes your company’s financial health on a specific date.

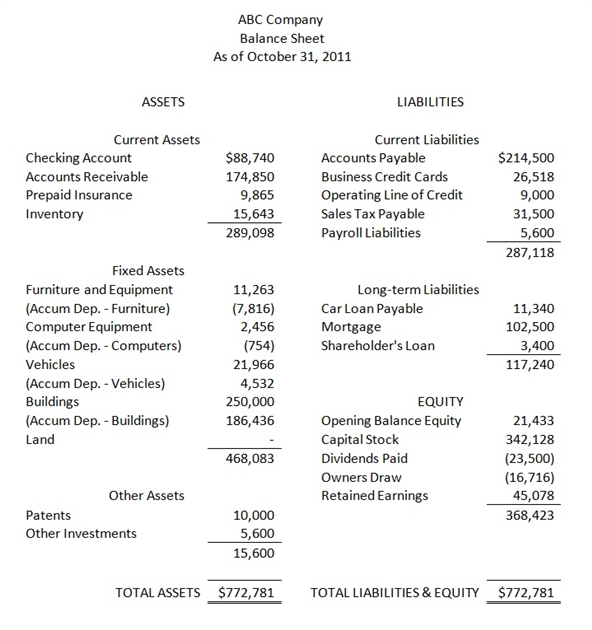

Let’s break down a typical small-business balance sheet and define each section. We’ve provided a sample Balance Sheet [PDF format] for you to use as part of this post. Either print it out or open it in a new window to follow along as we run through the basics.

What a Balance Sheet Tells You: Assets = Liabilities + Owner’s Equity

That includes a measure of:

- What the business owns (assets)

- What the business owes (liabilities)

- The company’s net worth on a specific date

A summary of what your business owns is generally divided into three categories, Current Assets, Fixed Assets, and Other Assets.

- Current (or Liquid) Assets: This is cash and assets that will likely turn into cash during the current business year. It’s what you generally use to pay operating costs.

- Cash: The total amount of money on hand (your most liquid asset).

Less:

Reserve for Bad Debts: This is the total amount you expect to write off when customers default (generally calculated based on bad debts during previous reporting periods).Less:

Accumulated Depreciation: Depreciation is the amount allowed for wear and tear, based on an established formula.- Other Assets: These are things you own that are neither fixed nor current assets that can be converted to cash. Intangible assets, which have no physical manifestation, such as goodwill, patents, copyrights, and trademarks fall into this category.

- Total Assets: This is the total cash value of all the assets that your business owns. This amount should remain higher than your total debts in order for the company to prosper.

Liabilities are debts that the business owes. They fall into two categories: Current and long-term liabilities.

- Current Liabilities: These are amounts due to be paid within a year, such as accounts payable (amounts you owe suppliers and employees), sales and payroll taxes, income taxes, and amounts due on short-term business loans, such as a line of credit.

- Long-Term Liabilities: These are amounts due over a period longer than a year, such as long-term loans, leases or mortgages, deferred taxes, and future employee benefits.

- Total Liabilities: This is the total value of all the company’s debts. A healthy business will usually show a number here that is less than its total assets.

Owner’s Equity

Also known as Capital or Net Worth. this amount represents what would be left for the owner(s) if all the company assets were sold and total liabilities were paid.

- Total Owner’s Equity: The total amount that owners and creditors have invested in the company.

- Net Profit to Date: This is your total sales revenue, after expenses, for the current year. The amount is found on the company’s income statement (bottom line).

Together, your company’s liabilities and owner’s equity must equal your total assets for the balance sheet to be considered “balanced.”

New business owners can benefit from creating quarterly balance sheets to track trends. Comparing results over several quarters (and hopefully years) will help you spot strengths and weaknesses in your business and make smart decisions about how to invest and grow your company.