How to Protect Your Portfolio From Rising Interest Rates

Post on: 6 Июнь, 2015 No Comment

May has been a month of change in the bond market as the CBOE Interest Rate 10-Year T-Note (INDEXCBOE:TNX) has rocketed from a low of 1.6% earlier in the month to a new breakout high of over 2.1%. To put it in percentage terms, the benchmark index has risen over 25% just this month alone. That is a tremendous jump that has been fueled by recent Federal Reserve comments that signal a possible tapering of its bond purchasing program. In addition, we have seen the stock market continue its relentless climb, which has been a catalyst for money coming out of bonds and into hot sectors of the market like financials and health care.

The question on everyone’s mind is: Does this breakout in yields signal a new trend change, or will the cycle reverse so that we see a flight to quality in bonds?

I believe that the overriding factor in this debate will be whether or not the stock market can continue to push to new highs. If stocks remain resilient, then we will most likely continue to see yields climb to the next area of resistance at approximately 2.4%. However, if stocks roll over and we see a return of volatility in equities, then we will most likely see money coming back into the safety of fixed income.

201_TNX.png /%

I am more inclined to favor at least a moderate correction in stocks in the short term, which would be a positive for bond holders. That being said, if you are overweight fixed income in your portfolio, there are still several actions that you can take to reduce your exposure to rising interest rates and cushion your portfolio against inflationary forces.

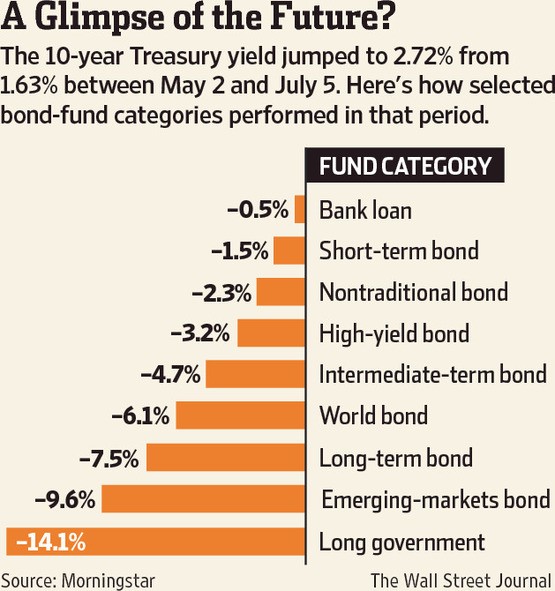

The easiest way to reduce your portfolio’s sensitivity to interest rates is to lower the average duration of your holdings. For example if you are holding the iShares Investment Grade Corporate Bond ETF (NYSEARCA:LQD), you may want to consider switching to the Vanguard Short-Term Corporate Bond Fund ( VCSH ). This switch will not change the overall credit quality of your portfolio, but you will be drastically shortening your average duration from 11.82 to 3.1 years. The drawback is a lower yield. However, that tradeoff can be quickly mitigated by much smaller price fluctuations in a rising interest rate environment.

Another way to combat the effects of rising interest rates is to consider allocating a portion of your portfolio to floating rate notes. Two of the biggest ETFs in this sector of the bond market are the iShares Floating Rate Note ETF (NYSEARCA:FLOT) and the PowerShares Senior Loan Portfolio (NYSEARCA:BKLN). Floating rate notes have historically performed well in a rising interest rate environment because their coupons fluctuate based on the prevailing market rate. This unique feature helps to mitigate the duration risk that is associated with traditional fixed-rate bonds. FLOT invests primarily in investment grade notes centered on the financial sector, while BKLN invests in securities of lower credit quality with higher yields.

202_bkln.png /%

Lastly, investors who are looking to hedge their fixed income portfolio may want to consider a small allocation to a rising rate fund such as the ProShares Short 20+ Year Treasury Bond Fund (NYSEARCA:TBF) or the ProShares Short 7-10 Year Treasury Bond Fund (NYSEARCA:TBX). These ETFs give you inverse exposure to long-term and intermediate-term Treasury bond prices, respectively. In my opinion, inverse ETFs should only be used as short-term trading vehicles in order to hedge a long position or take advantage of a dislocation in the market.

If you have already experienced the brunt of the recent interest rate rise, you may consider looking at reducing your equity exposure or using surplus cash to buy fixed income opportunistically as rates become more attractive. In addition, if you already have a low-duration bond portfolio, you might look to elongate duration at low-risk entry points to take advantage of higher yields and the potential for capital appreciation.

No matter how you decide to adjust your income portfolio to take advantage of the changes in the current interest rate environment, be mindful of the risks. I recommend you develop a game plan to strategically shift your portfolio to benefit from these changes. Making subtle changes now can pay huge dividends down the road when the Fed starts to tighten its purse strings.

Read more from David Fabian, Managing Partner at Fabian Capital Management: