How To Profit From VIX ETNs And Futures Contracts iPath S&P 500 VIX ShortTerm Futures ETN

Post on: 23 Ноябрь, 2015 No Comment

In recent years, VIX ETF, ETN, and Futures contracts have paradoxically been one of the greatest trading opportunities for individual investors, as well as one of the great money losers of all time. The reason for this paradox is simple: Unlike a stock, bond, or even a standard commodity futures contract, volatility products have no underlying cash flows that derive from the real economy. VIX trading products are entirely a financial product, and as such, they are zero-sum between individual market participants.

What has separated the winners from the losers? I believe it is simple. On one side of the trade have been those who bought into the notion of buying volatility or hedging with volatility or even selling volatility because it is overpriced, yet have implemented these things with little understanding of how these markets work. On the other side have been those who analyzed underlying economics of these unusual products and successfully acted upon that knowledge. This second group is where the winners can be found.

In my first article on VIX ETF and Futures products, we looked at two factors that have proven very valuable for extracting trading profits: Trend following principles and forward curve dynamics.

In this article, we are going to delve deeper into these concepts in a way that should enhance both our conceptual understanding of these products, and also how the two factors set up to create investing opportunities.

Let’s start by reviewing a chart of the performance of the VIX index and VIX ETN (NYSEARCA:VXX ) since inception:

The chart above is of the underlying VIX index between January 2007 and February 2013. Notice that while the index value does decline over the time period, the majority of the period is spent in a multi-year trading range defined by the two horizontal blue lines. Next, let’s examine the performance of the VIX ETN over the same time horizon:

It should be immediately clear that the performance of the VIX ETN is radically at odds with the performance of the underlying VIX index. As we discussed in our first VIX article. the massive downtrend in the VIX ETN is directly related to the steep contango, which has predominated for majority of the time that the VIX ETN has been trading.

Let’s delve deeper into this concept. Theoretically and intuitively, it would seem reasonable to think that large divergences between a spot or index price and futures prices would be due to the futures markets anticipating a higher level of index volatility in the future. If this was true, the contango/backwardation relationship would not provide meaningful trading information, as it would suggest that the systematic or predicted effect would be on the underlying index, which is itself not a tradable security.

Yet this has not been the case. Research has found that futures prices are not a reliable predictor of changes in the index or spot price. In fact, it turns out to be just the opposite: Under conditions of steep contango or backwardation, the current spot price is a powerful predictive factor for futures contract prices and hence, VIX ETN and ETF products. In fact, this is true for futures contracts in general, which I outline in this article .

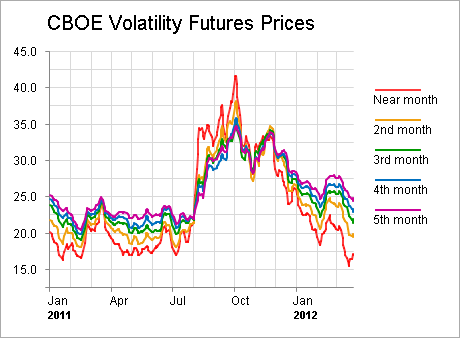

As a result, the successful VIX product trader must factor in more than changes in the underlying index, as a large portion of the systematic return of VIX securities is caused by the futures market effects of contango and backwardation. Please study the following example:

The above data table documents a three-month period (starting at the bottom and working up) where the underlying VIX index rose moderately, yet the forward contracts declined in value do to the steep contango of the forward curve. Let’s examine the performance of the October 2012 contract (highlighted with red, starting at the bottom) through this period. On the right side of the data tables I have included the historic forward curve for each of the three dates we are looking at.

As each month passes, you can visually see that the October contract rolls down the curve and declines in price, even as the underlying VIX index rises each month. In essence, the moderate rise in the VIX index (1.03 points) is absorbed by the losses created by the forward curve effect. The October contract loses 3.15 points during this period, or $3,150 per contract. This understanding is critical to VIX ETN or ETF traders, because the market exposure of these products is created in the futures markets.

The opposite holds true when this market is in steep backwardation (Index and close to expiration contracts are higher in price than more distant contracts). Under these conditions, contract prices on average have rolled up the curve and increased in value as they approach expiration.

An investor looking to take advantage of forward curve effects needs to understand that as strong as this edge has been, this idea is very far from risk free. When volatility does increase, it can spike sharply, which can quickly change the shape of the forward curve from steep contango (short bias called for) to steep backwardation (long bias called for).

I have posted a supplemental study here that examines one of these transition periods. The study also includes a slide deck that documents how the VIX futures forward curve has changed over time. It is critical that active investors looking to trade these products study these transition periods and have a sound risk management protocol for managing them. In essence, the goal is to profit from the forward curve effects, while mitigating or sidestepping losses that occur when conditions change.

In my original VIX article, I highlighted that very simple trend models have been useful tools for managing positions in VIX index related markets. Within the article, I used a 10ma — 20ma (moving average) cross system as an example. The rule was simply to go short when the 10ma crossed below the 20ma, and to exit (get flat) when the 10ma crossed above the 20ma. Within the comment area of that same article, I noted that every moving average combination I tested proved to be useful over the life of the VIX futures contract. A number of people contacted me and asked if this idea was directly applicable to the VIX ETN and similar products. Here are the results:

Using VIX ETN data and the same 10ma — 20ma system, the average trade yielded a 13% gain and winning percentage was 74%. Below is a graphical representation of the system’s performance during this period. Note that the blue line invests a flat $10,000 per signal, and the red line reinvests the full amount of equity including any accumulated profit or loss:

The above chart is presented for two reasons. First, it documents the power of simple trading ideas when applied to a situation with favorable economics (which the VIX ETN has had on the short side due to the forward curve decay effect). Second, it documents how powerful the compounding effect can be when applied to a good investment idea or strategy. Please note, the above is not presented as a complete trading system, and I would never suggest that using it as such would be a good idea.

Active investors who are interested in profiting in VIX products need to track the factors that influence these markets so that they can align their positions with current market conditions.

In summary, critical components of this plan include:

- The current shape of the forward curve — Steep contango benefits short positions, steep backwardation benefits long positions.

- The current price level of the relevant futures contract — The ideal short setup is when the curve is in steep contango, but the current price is still relatively high relative to long term price averages. This often occurs when volatility begins to decline or normalize after a period of high volatility. I develop this idea further in the supplemental report linked to above.

- Momentum tools such as moving averages — These tools have been useful for the life of both the VIX futures contract as well as the VIX ETN.

- Use of hedging and spread techniques — Because the VIX index has a very strong negative correlation with stock indexes, the SPY ETF or S&P 500 futures contract can be used to hedge some of the market risk while still allowing for the capture of the forward curve premium effects. Futures traders can also use spreads between different contract months to alter the risk and reward characteristics of the trade.

Before wrapping things up, I want to highlight a more general concept regarding how to profit from investing ideas. The analogy I like is the world of fashion and retail.

An academic studying the field might spend years studying the how’s and whys of a particular trend or fad with analysis of ever more detailed minutia utilizing the latest academic techniques. The fashion merchant, on the other hand, wants only the minimum analysis required to make a successful judgment about what inventory to purchase for the coming season(s). He then focuses on how to manage that inventory for maximum profit — including when to mark down the merchandise and move it out the door. Successful active investing is much closer to the merchant’s approach. I document my general approach to analyzing trading ideas in this article .

I bring up this topic because I think there is a general tendency to over-intellectualize the world of finance and investing. Analysis might be important, but so is the gut instinct or intuition that tells the trader it is time to move from analysis to action. I believe understanding why and how individual traders can get an edge is critical to gaining this confidence. I outline my thoughts on the subject here.

The bottom line is that in the field of investing, profits accrue to those who are able to pick up the $20 dollar bills before they become completely obvious to the majority of participants. Stopping to analyze all angles and fine points of why (or even if) the situation exists (as the joke goes about economists) usually means that someone else will get to the money first.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I actively trade VIX futures, and might initiate or liquidate a position at any time.