How to Pick Stocks Like Warren Buffett

Post on: 12 Апрель, 2015 No Comment

Circle of Competence

Warren Buffett believes in picking an industry/market in which you knows much more than the average investor about. He calls that industry your circle of competence. Warren Buffett tries to invest in companies that are easy to understand and chooses companies in industries whose fundamentals stay the same in the long-term. Wells Fargo, Goldman Sachs, Geico, and Coca-Cola are some of Warren Buffets most famous investments. The key denominator in all of those investments is that the markets in which those companies operate remain fundamentally the same without major disruptions. To invest like Warren Buffett, you should establish your circle of competence and stick to it. If you know the retail market well, stick to that sector. If you know the construction and real estate market well, stick to that sector. Even technologysomething Warren Buffett avoids (because the fundamentals always changes)if you know more about the sector than most investors, you should definitely choose that as your circle of competence. You can have a circle of competence that spans multiple industries. Thats okay. The key is to not go outside of it.

Be a Contrarian

Warren Buffett is known for being a contrariansomeone who goes against the popular ideas of the market. He calls the popular opinion in the market, Mr. Market. To be a contrarian, you should adopt independent thinking and be able to analyze your investments without factoring in distractions and opinions of the market. An example of Warren Buffetts contrarian thinking was when he decided to invest in Goldman Sachs when all other investors were wary of banks. His investment just a few years ago has now returned more than double its original investment.

Analyze Stocks Based Upon Their Intrinsic Value

Warren Buffett and his mentor, Benjamin Graham, are extremely big on the concept of intrinsic value. To define intrinsic value, we look to John Burr Williams in The Theory Of Investment Value. In the book, intrinsic value is defined as:

The value of any stock, bond or business today is determined by the cash inflows and outflows – discounted at an appropriate interest rate – that can be expected to occur during the remaining life of the asset.

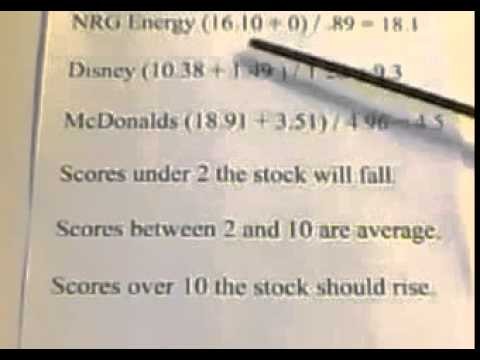

Warren Buffett himself has never quite given away a precise formula for intrinsic value. As a matter of fact, he has admitted that intrinsic value is quite fuzzy (yet vitally important to stock selection). But we can extrapolate a formula by analyzing his thoughts and stock investments. To calculate the intrinsic value of a company ( the Warren Buffett way), go to this MoneyChimp page .

While talking about intrinsic value, we must also talk about the margin of safety as they go hand-in-hand. The margin of safety is the difference between the intrinsic value of the stock and its market price. For instance, if you calculated the intrinsic value of the stock is $70 but it is currently selling for $50, your margin of safety is $20. That gives you a $20 room for error, so that if your analysis is wrong and the stock is really only worth $60, then you are still profiting $10 per share, a 20% profit margin.

Stocks=Part Ownership in a Business

Warren Buffett doesnt buy stocks, he buys businesses. That has always been his investment approach to every stock selection. Granted you dont have billions or even millions to buy a large portion of any business like Warren Buffett does, but your mindset should be the same. If you treat every stock purchase as an investment in a business, your mindset will change on what makes a stock worth buying. Would you invest in a business that is on the brink of bankruptcy? Probably not. Then why would you invest in a stock of a company that is also in the same vicarious position? Even if it is just $1.20 per share. So what does it mean to invest (and become a part owner) of a business? It means that you are in it for the long haul and are not trading in and out of the stock. It also means that you should think long and hard before buying a sinking ship.